🔥 Citizens Bank Auto Loan Review Pros And Cons

Citizens Bank Auto Loan Finance Your Ride Citizens bank's auto loan program is designed to provide customers with the means to finance their vehicle purchases. to offer a thorough understanding of th. Here are the standard and extended overdraft fees at citizens bank. type. fee. overdraft fee. $35 per item, up to a maximum of five fees per day. sustained overdraft fee. $30, charged on the 5th.

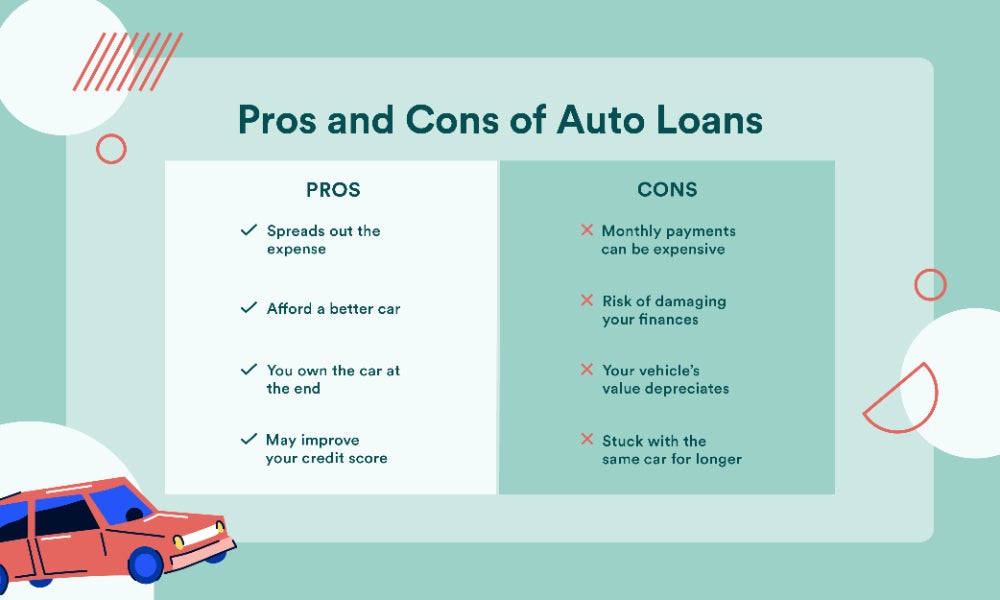

Pros And Cons Of Financing A Car Bankrate 1. monthly payments can be expensive. even if you finance a vehicle that fits your budget, your monthly payment can be steep. on average, drivers pay $735 per month for new vehicles, according to. Citizens bank is a prominent financial institution known for providing a diverse range of loan products to address the unique financial needs of its clientel. If you need cash, you may be able to borrow with a cash out auto refinance loan using your car’s equity (the value of your car minus the amount you owe on it). so if your car is worth $20,000. Higher interest rates and fees: for the convenience and accessibility they offer, online lenders often charge higher interest rates compared to traditional banks. this can mean a more expensive loan in the long run. security risks: sharing personal and financial information online always carries a risk.

Citizens Bank Auto Loans Promotion 2021 Youtube If you need cash, you may be able to borrow with a cash out auto refinance loan using your car’s equity (the value of your car minus the amount you owe on it). so if your car is worth $20,000. Higher interest rates and fees: for the convenience and accessibility they offer, online lenders often charge higher interest rates compared to traditional banks. this can mean a more expensive loan in the long run. security risks: sharing personal and financial information online always carries a risk. When you pay off your car loan early, your debt will become smaller. this is positive for your credit history but might lower your credit score slightly because you're no longer logging on time. Just over half of car buyers with auto loans obtain their financing in person at dealerships, according to a 2023 marketwatch survey. while financing your car purchase at the dealership is convenient, you may get a better deal by finding your own auto loan at a credit union, bank or other financial institution.

How To Get A Car Loan Citizens Bank When you pay off your car loan early, your debt will become smaller. this is positive for your credit history but might lower your credit score slightly because you're no longer logging on time. Just over half of car buyers with auto loans obtain their financing in person at dealerships, according to a 2023 marketwatch survey. while financing your car purchase at the dealership is convenient, you may get a better deal by finding your own auto loan at a credit union, bank or other financial institution.

Comments are closed.