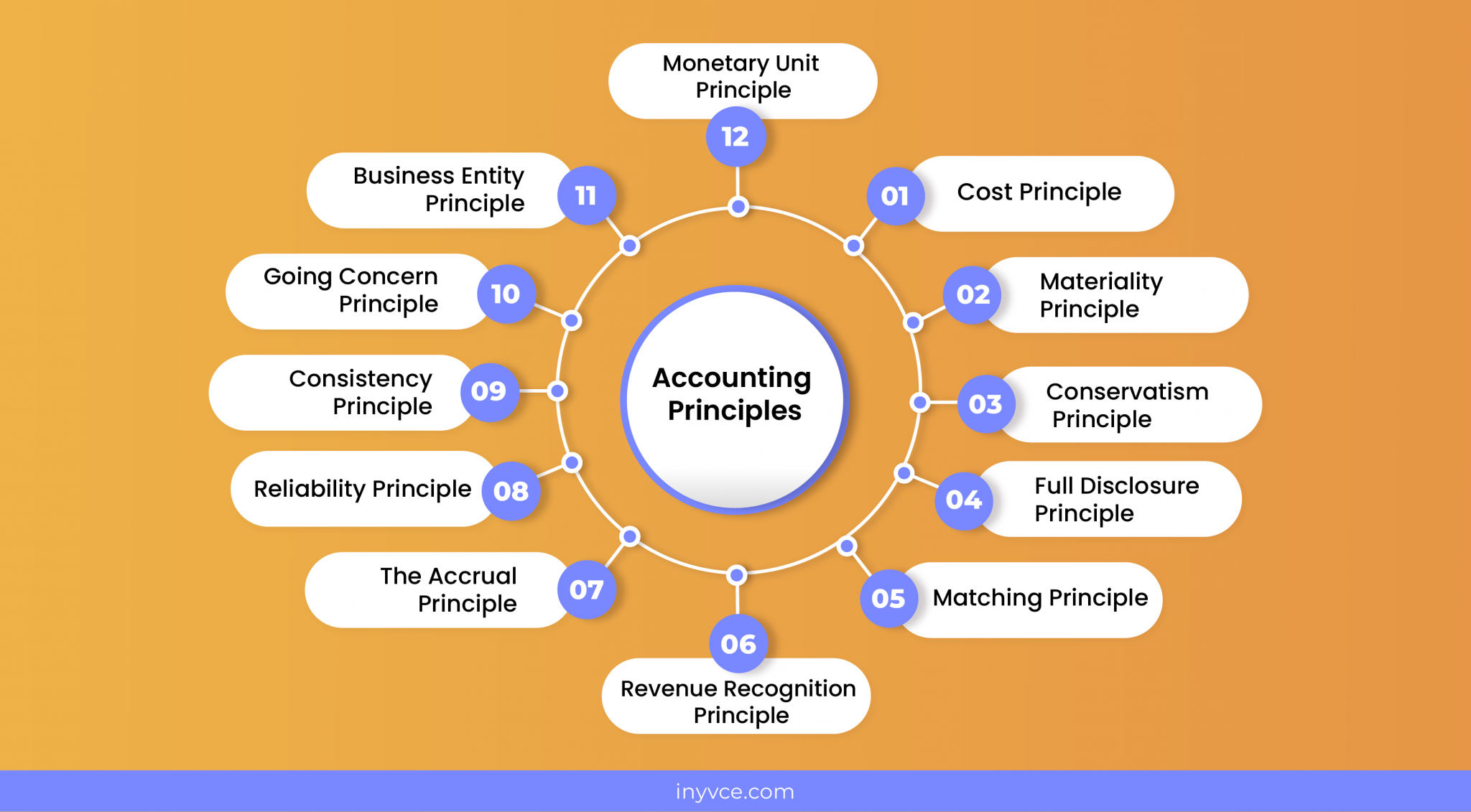

12 Basic Accounting Principles

12 Basic Accounting Principles The bottom line. accounting principles are rules and guidelines that companies must abide by when reporting financial data. which method a company chooses at the outset—or changes to at a later. Here is an explanation of twelve of the fundamental accounting principles the business owners need to know. 1. prudence. prudence, or conservatism, is the accounting principle that drives your accountant sometimes to appear to be a bit of a pessimist! but the principle comes down to taking a conservative, cautious view of the financial affairs.

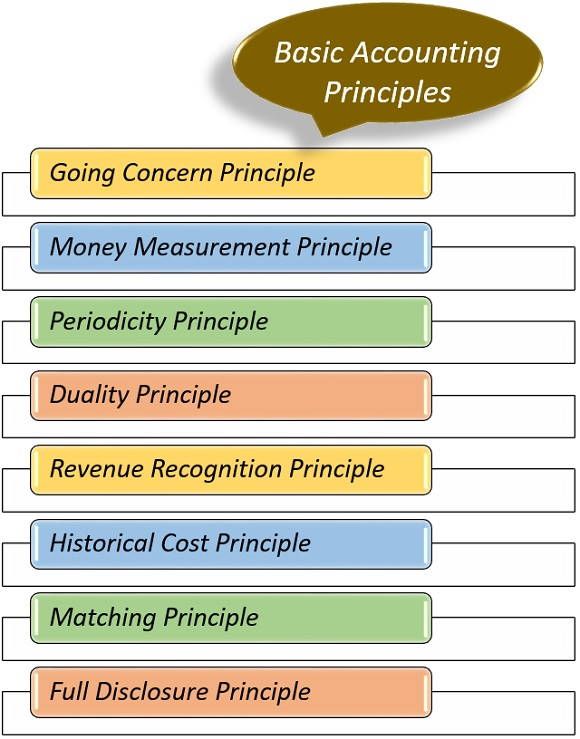

Basic Accounting Principles Gulfpics The best known of these principles are as follows: accrual principle. this is the concept that accounting transactions should be recorded in the accounting periods when they actually occur, rather than in the periods when there are cash flows associated with them. this is the foundation of the accrual basis of accounting. Here’s a list of more than 5 basic accounting principles that make up gaap in the united states. i wrote a short description for each as well as an explanation on how they relate to financial accounting. historical cost principle. revenue recognition principle. matching principle. 8. accounting equation. this basic accounting equation will help you understand how your accounting software records transactions: assets = liabilities owner’s equity. as the formula indicates. The cost principle states that any asset acquired by a company must be recorded in financial records at its original cash value rather than its market value. the assets recorded value will not fluctuate along with inflation or changes in market value. example: a company purchased a land in 2018 worth pkr 200,000.

Comments are closed.