18 Itemized Deductions Worksheet Printable Worksheeto

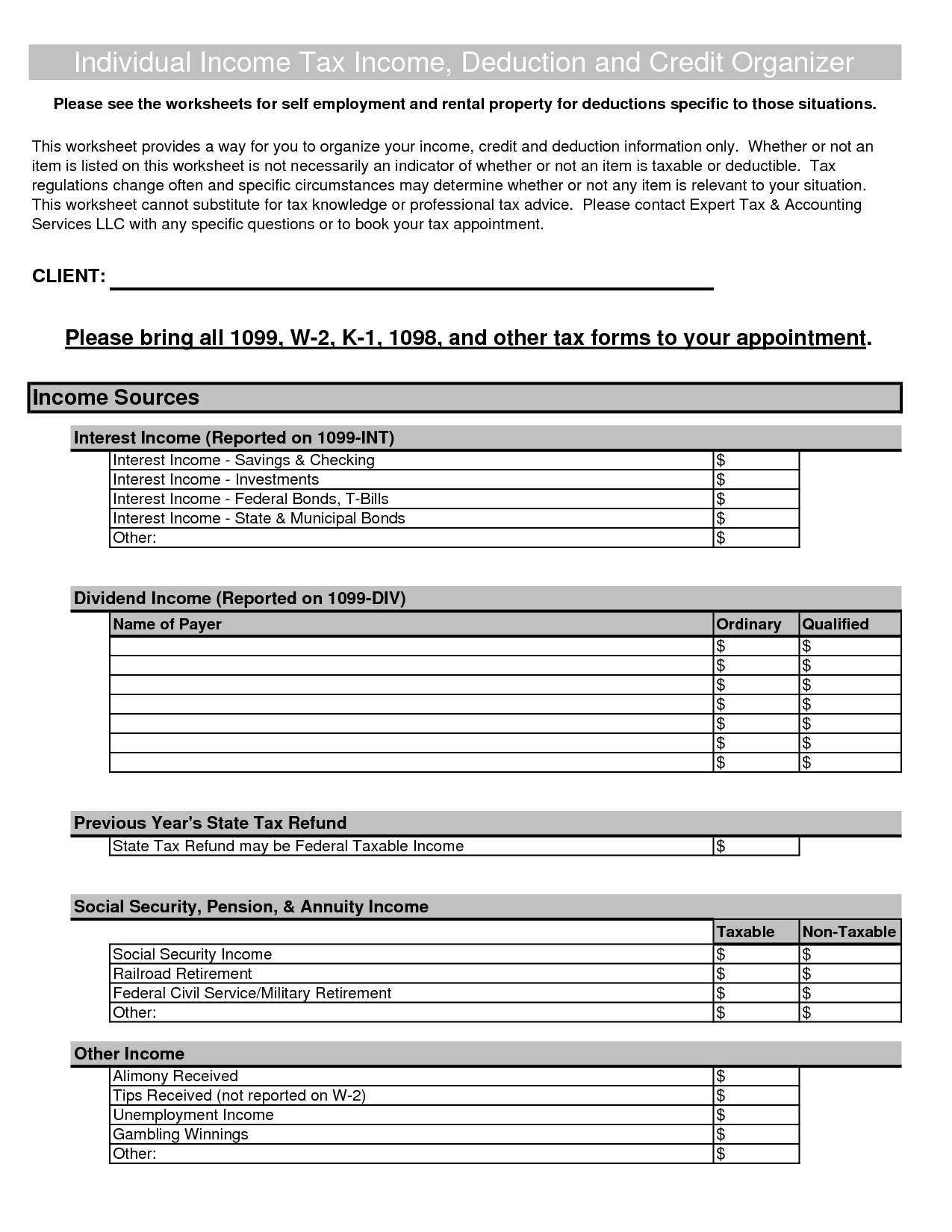

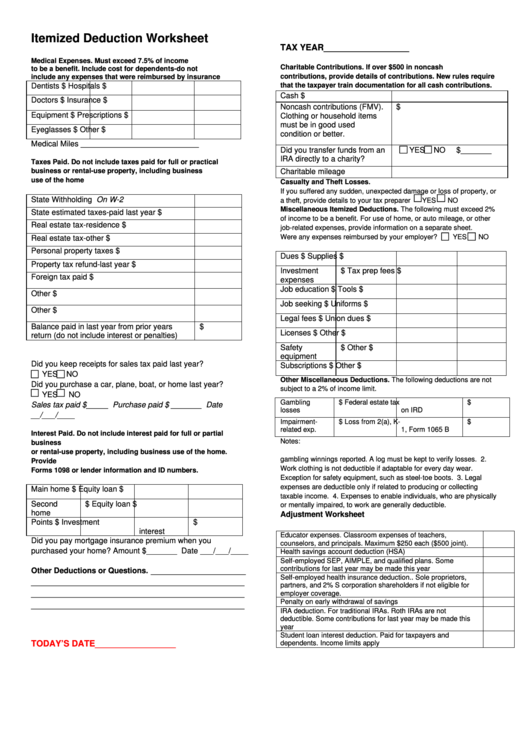

18 Itemized Deductions Worksheet Printable Worksheeto This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security, unemployment, other income). don't forget to attach w 2's and 1099 forms to you worksheets. this file contains worksheets for self employed business, employee business expenses and. About schedule a (form 1040), itemized deductions. use schedule a (form 1040 or 1040 sr) to figure your itemized deductions. in most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

Itemized Deductions Worksheet Printable 2023. attachment. if you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. sequence no. 07. name(s) shown on form 1040 or 1040 sr. your social security number. medical and dental expenses. taxes you paid. Gambling losses expenses. $. other (specify): $. we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): single $12,950 married $25,900 single (65 ) $14,700 married (one 65 ) $27,300 married (both 65 ) $28,700. hoh. Enter your state and local general sales taxes paid on specified items, if any. see the instructions for line 7 of the worksheet: 7. 8. deduction for general sales taxes. add lines 1, 6, and 7. enter the result here and the total from all your state and local general sales tax deduction worksheets, if you completed more than one, on. Standard mileage rate for medical purposes is 16 cents per mile. qualified long term care premiums up to the amounts shown below can be included as medi cal expenses on sched ule a, or in calculating the self employed health insurance deduction. age 40 or under: $450. age 41 to 50: $850. age 51 to 60: $1,690.

Itemized Deduction Worksheet Printable Pdf Download Enter your state and local general sales taxes paid on specified items, if any. see the instructions for line 7 of the worksheet: 7. 8. deduction for general sales taxes. add lines 1, 6, and 7. enter the result here and the total from all your state and local general sales tax deduction worksheets, if you completed more than one, on. Standard mileage rate for medical purposes is 16 cents per mile. qualified long term care premiums up to the amounts shown below can be included as medi cal expenses on sched ule a, or in calculating the self employed health insurance deduction. age 40 or under: $450. age 41 to 50: $850. age 51 to 60: $1,690. Taxpayers name(s): note: this worksheet is provided as a convenience and aid in calculating most common non cash charitable donations. the source information used is from a salvation army "valuation guide" published several years ago and updated for assumed inflation. although the values are believed to be reasonable, there are no guarantees or. 2023 itemized deductions (sch a) worksheet (fillable) donated a vehicle worth more than $500 i made more than $5,000 of noncash donations. paid interest on borrowings for investments i repaid income (taxed in prior year) over $3,000. if you checked any of the above, please stop here and speak with one of our counselors.

Printable Itemized Deductions Worksheet Customize And Print Taxpayers name(s): note: this worksheet is provided as a convenience and aid in calculating most common non cash charitable donations. the source information used is from a salvation army "valuation guide" published several years ago and updated for assumed inflation. although the values are believed to be reasonable, there are no guarantees or. 2023 itemized deductions (sch a) worksheet (fillable) donated a vehicle worth more than $500 i made more than $5,000 of noncash donations. paid interest on borrowings for investments i repaid income (taxed in prior year) over $3,000. if you checked any of the above, please stop here and speak with one of our counselors.

Comments are closed.