2019 Tax Brackets Formdop

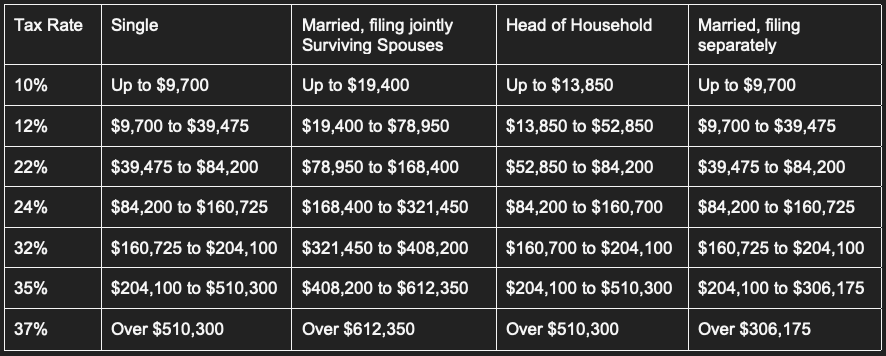

2019 Tax Brackets Formdop Unmarried individuals. $71,700. married filing jointly. $111,700. in 2019, the 28 percent amt rate applies to excess amti of $194,800 for all taxpayers ($97,400 for married couples filing separate returns). amt exemptions phase out at 25 cents per dollar earned once taxpayer amti hits a certain threshold. Find out your 2019 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts. 1 . married individuals filing joint returns, & surviving spouses.

Tax Brackets 2019 Winningsilope In general, 2019 personal income tax returns are due by monday, april 15, 2020. the federal tax brackets are broken down into seven taxable incomes and filing status. the percentages are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. it is good to remember that moving up into a higher tax bracket does not mean that all of your income will be taxes at. #2019 tax brackets plus; your effective tax rate would still be 11.5%. that makes sense, because the 22% rate applies only to that extra $100 you brought in. but if you run the numbers again, you'll see that your tax would now be $6,087 or $22 higher. You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Recent legislation. three tax laws were enacted on december 20, 2019. the taxpayer certainty and disaster tax relief act of 2019 ex tended certain previously expired tax benefits to 2018 and 2019, and provided tax relief for certain inci dents federally declared as disas ters in 2018 and 2019. the exten ded benefits and the disaster relief.

2019 Tax Brackets Priortax Blog You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Recent legislation. three tax laws were enacted on december 20, 2019. the taxpayer certainty and disaster tax relief act of 2019 ex tended certain previously expired tax benefits to 2018 and 2019, and provided tax relief for certain inci dents federally declared as disas ters in 2018 and 2019. the exten ded benefits and the disaster relief. For example, in 2019, single individuals pay 37% only on income above $510,300 (above $612,350 for married filing jointly); the lower tax rates are levied at the income brackets below that amount. Federal income tax brackets and rates for 2019 are shown below. indexing has increased the income brackets by roughly 2% across the board. tax bracket filing status. single. married filing.

Comments are closed.