2019 Tax Forms 1040ez

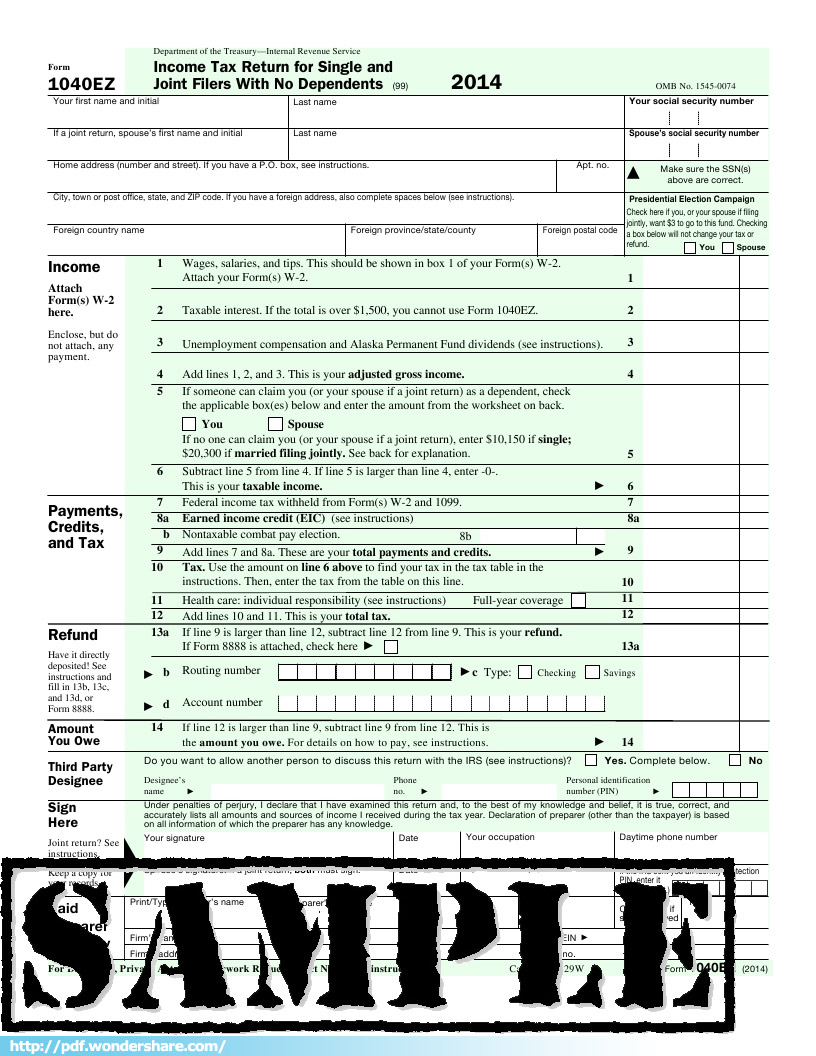

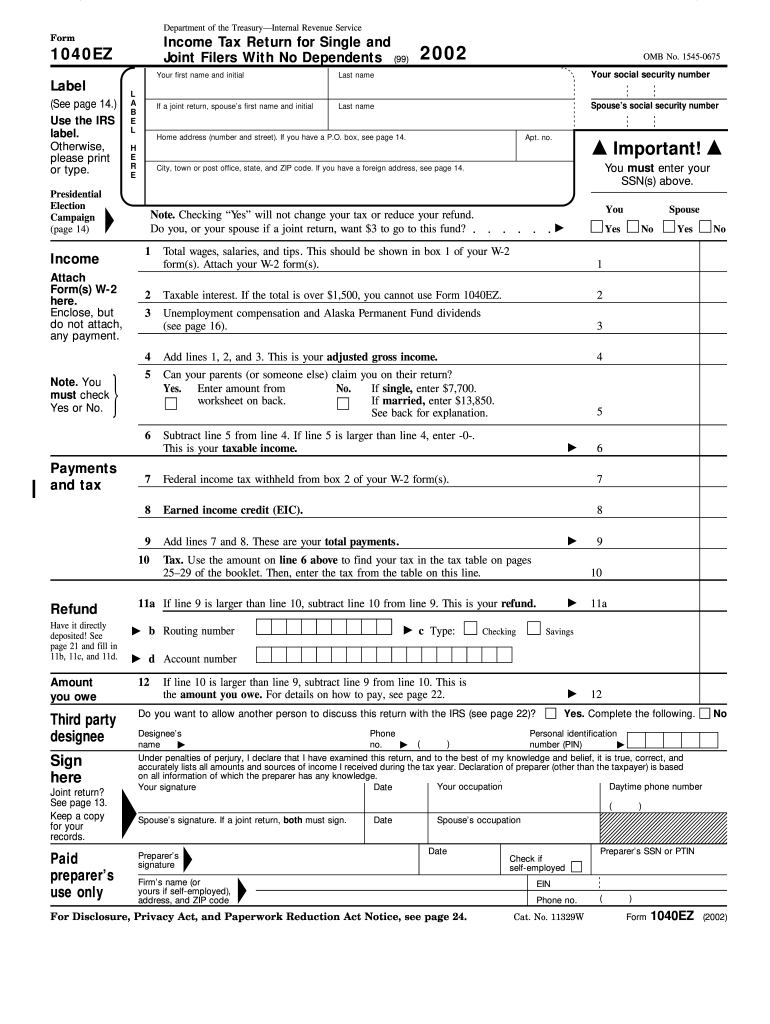

1040ez Free Download Create Edit Fill And Print Pdf For tax year 2019, an excess deduction for irc section 67(e) expenses is reported as a write in on schedule 1 (form 1040 or 1040 sr), part ii, line 22, or form 1040 nr, line 34. on the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ed67(e)”. Form 1040 (2022) us individual income tax return for tax year 2022. annual income tax return filed by citizens or residents of the united states. form 1040 (2022) pdf. related: instructions for form 1040 (2022) pdf. form 1040 schedule 1 (2022) pdf. form 1040 schedule 2 (2022) pdf. form 1040 schedule 3 (2022) pdf.

Printable 1040ez Form Complete With Ease Airslate Signnow Check the status of your income tax refund for the three most recent tax years. irs2go app. check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. your online account. access your individual account information to view your balance, make and view payments, and view or create. Key takeaways. form 1040ez is no longer used, and has been replaced by form 1040 and form 1040 sr. form 1040ez was used for taxpayers with a simple tax return, filing status of single or married filing jointly, taxable income of less than $100,000 with less than $1,500 of interest income, and no dependents. form 1040 is used to report income. Line 11 if you filed a form 1040; your agi is calculated before you take your standard or itemized deduction, on form 1040. see image below. important reminder: if you are using the irs free file guided tax software and you are filing using the married filing jointly filing status, the $79,000 agi eligibility amount applies to your combined agi. Prior year. after you file. file previous year tax returns on freetaxusa. online software uses irs and state 2019 tax rates and forms. 2019 tax deductions and write offs are included to help you get a bigger refund.

2019 1040ez Form And Instructions 1040 Ez Easy Form Tax Forms Line 11 if you filed a form 1040; your agi is calculated before you take your standard or itemized deduction, on form 1040. see image below. important reminder: if you are using the irs free file guided tax software and you are filing using the married filing jointly filing status, the $79,000 agi eligibility amount applies to your combined agi. Prior year. after you file. file previous year tax returns on freetaxusa. online software uses irs and state 2019 tax rates and forms. 2019 tax deductions and write offs are included to help you get a bigger refund. Instructions for form 1040. form w 9. request for taxpayer identification number (tin) and certification you or your spouse must have a 2023 form w2, wage and tax. Form 1040 schedule 1 pdf. form 1040 schedule 2 pdf. form 1040 schedule 3 pdf. tax table from instructions for form 1040 pdf. schedules for form 1040. form 1040 sr pdf. form w 4. employee's withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

2019 Tax Form 1040ez Printable Jasfetish Instructions for form 1040. form w 9. request for taxpayer identification number (tin) and certification you or your spouse must have a 2023 form w2, wage and tax. Form 1040 schedule 1 pdf. form 1040 schedule 2 pdf. form 1040 schedule 3 pdf. tax table from instructions for form 1040 pdf. schedules for form 1040. form 1040 sr pdf. form w 4. employee's withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

Comments are closed.