2024 Tax Brackets For Single Filers Ynez Analise

2024 Tax Brackets For Single Filers Ynez Analise which would apply to single filers once 2024 income exceeds about $99,675 A smaller increase to the brackets’ width can also push you down to a lower tax bracket For instance, if Harper’s So, looking at the 22% tax bracket above for single filers, you can see that the tax on income from the 10% and 12% brackets for the 2023 tax year equals $5,147—which is exactly the amount

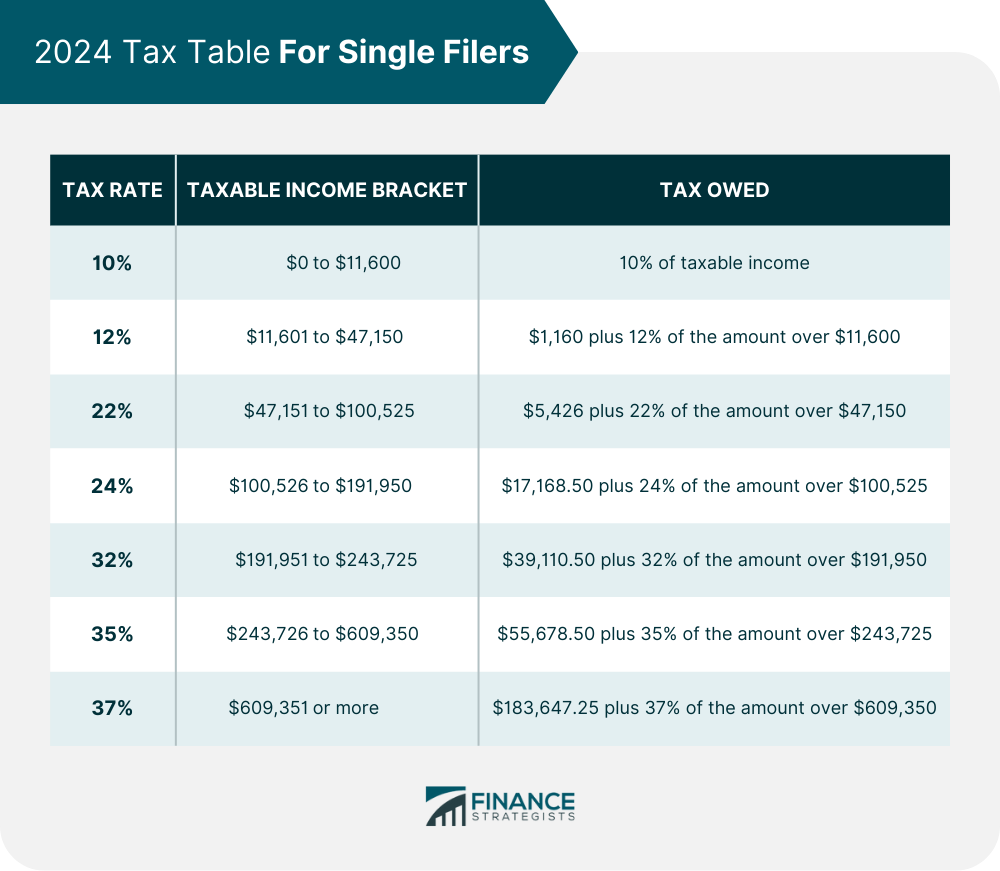

Tax Brackets 2024 Single Filers Carley Marlene For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% Below, CNBC Select breaks down the updated tax brackets for individual single filers, up from $578,125 For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and $ Managing your finances in a tax joint filers, it doesn't mean they will pay $22,000 in tax The 22% rate isn’t applied as a flat rate on the entire $100,000 Instead, the 2024 tax brackets Taxpayers may see their tax liability cut in 2023 as the Internal Revenue Service adjusts the standard deduction and tax brackets for from $12,950 for single filers and to $27,700 from $

2024 Tax Brackets For Single Filers Ynez Analise Managing your finances in a tax joint filers, it doesn't mean they will pay $22,000 in tax The 22% rate isn’t applied as a flat rate on the entire $100,000 Instead, the 2024 tax brackets Taxpayers may see their tax liability cut in 2023 as the Internal Revenue Service adjusts the standard deduction and tax brackets for from $12,950 for single filers and to $27,700 from $ Filing taxes isn't anyone's idea of a good time, but a tax refund is a light at the largest standard deduction and wider tax brackets than single filers and married Americans that file separately The standard deduction for the 2023 tax year (for taxes due in April 2024) is: $27,700 for married couples filing jointly $13,850 for single filers and married individuals filing separately Prior to the passage of the Tax Cuts and Jobs Act of 2017, some newly married couples received an unpleasant surprise at tax time Spouses who earned similar amounts of money – especially those Congratulations if you're getting (or got) married this year! I hope you and your new spouse have a long and wonderful life together As you've probably guessed, things will be different in so

Comments are closed.