2024 Tax Brackets Single Berte Celisse

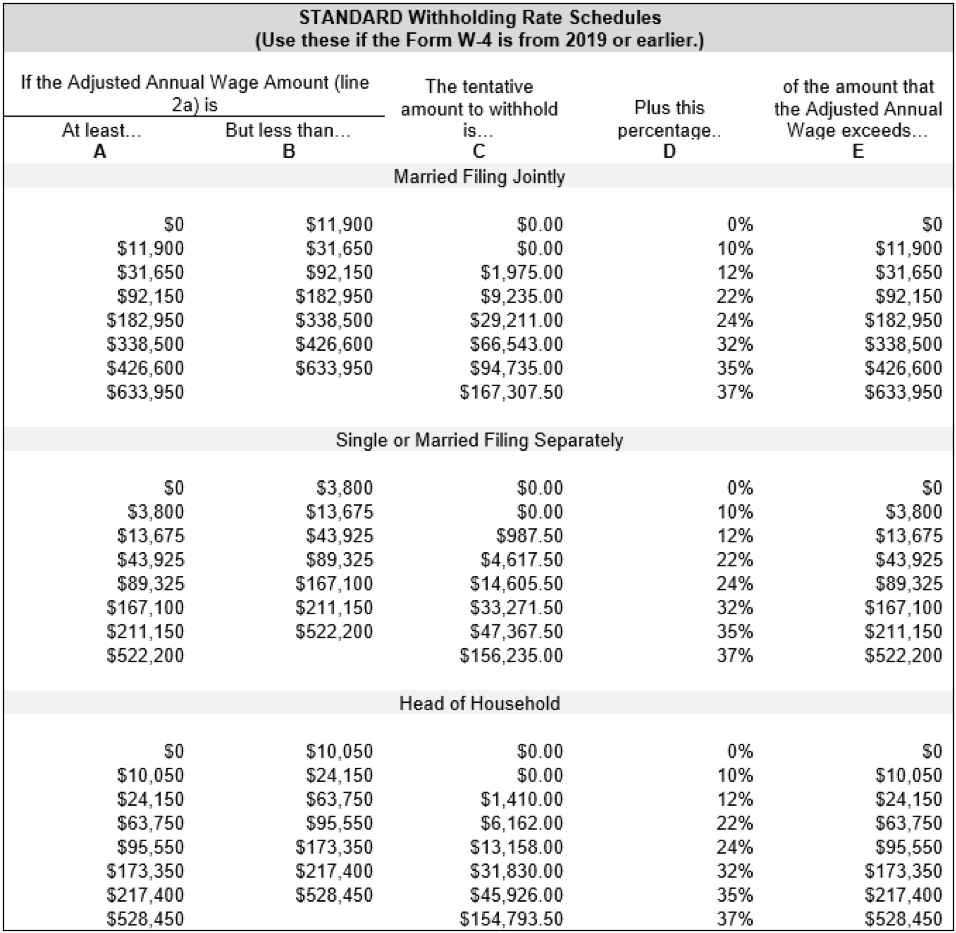

2024 Tax Brackets Single Berte Celisse After scorching-hot inflation pushed income-tax brackets and a widely used tax deduction to their largest single-year increase in decades for the 2023 tax year, another round of sizable For example, let's say you earned $45,000 in taxable income as a single filer in 2023 How your income is taxed gets broken down into three tax brackets: 10% for the first $11,000 of your income

2024 Tax Brackets Single Filer Nikki Analiese Thankfully, the IRS released the income tax brackets for 2024 last year, allowing you to strategize for the upcoming tax year (returns filed in early 2025) Here are the inflation-adjusted tax Your tax bill is largely determined by tax brackets These are really just ranges of taxable income As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates Specifically, the pre-2018 tax brackets meant spouses were often in a higher tax bracket than if they were single with the same income "After the tax (reform) passed, the marriage penalty shrunk Taxpayers may see their tax liability cut in 2023 as the Internal Revenue Service adjusts the standard deduction and tax brackets for $13,850 from $12,950 for single filers and to $27,700

Tax Calculator 2024 Philippines Semi Monthly Berte Celisse Specifically, the pre-2018 tax brackets meant spouses were often in a higher tax bracket than if they were single with the same income "After the tax (reform) passed, the marriage penalty shrunk Taxpayers may see their tax liability cut in 2023 as the Internal Revenue Service adjusts the standard deduction and tax brackets for $13,850 from $12,950 for single filers and to $27,700 It's not entirely unexpected: To adjust for inflation, the IRS raised both the standard deduction and tax brackets by about 7% That put some people into lower brackets and let taxpayers who weren Enter how many dependents you will claim on your 2022 tax return This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income Some California has nine state income tax rates, ranging from 1% to 123% The state also levies a 1% mental health services tax on income exceeding $1 million The tax rates and brackets below apply Congratulations if you're getting (or got) married this year! I hope you and your new spouse have a long and wonderful life together As you've probably guessed, things will be different in so

Comments are closed.