2024 Tax Credits For Solar Genni Josepha

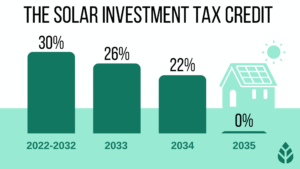

2024 Tax Credits For Solar Genni Josepha The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. the credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. you may be able to take the credit if you. The installation of the system must be complete during the tax year. solar pv systems installed in 2020 and 2021 are eligible for a 26% tax credit. in august 2022, congress passed an extension of the itc, raising it to 30% for the installation of which was between 2022 2032. (systems installed on or before december 31, 2019 were also eligible.

Federal Solar Tax Credit What It Is How To Claim It For 2024 For example, if you installed solar panels on your home in 2024 and paid $10,000, you could claim 30% or $3,000. so, if you owe $2,000 in taxes, you can apply $2,000 of your solar tax credit to. The 2024 federal solar tax credit, also known as the residential clean energy credit, is worth 30% of your total solar system cost for all installations in the u.s. completed through 2032. the. Solar tax credit 2024. the solar panel tax credit allows filers to take a tax credit equal to up to 30% of eligible costs. there is no income limit to qualify, and you can claim the credit each. Here’s an example of how the solar tax credit works: if you installed a home solar power system for $20,000, you could claim a tax credit of $6,000. $20,000 solar installation costs x 30% = $6,000 tax credit value. so, if your tax liability was $15,000, the $6,000 tax credit would reduce what you owe to just $9,000.

Federal Solar Tax Credits For Businesses Department Of Energy Solar tax credit 2024. the solar panel tax credit allows filers to take a tax credit equal to up to 30% of eligible costs. there is no income limit to qualify, and you can claim the credit each. Here’s an example of how the solar tax credit works: if you installed a home solar power system for $20,000, you could claim a tax credit of $6,000. $20,000 solar installation costs x 30% = $6,000 tax credit value. so, if your tax liability was $15,000, the $6,000 tax credit would reduce what you owe to just $9,000. Taxpayers who invest in energy improvements for their main home, including solar, wind, geothermal, fuel cells or battery storage, may qualify for an annual residential clean energy tax credit. the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for a home in the united states installed anytime. Guide to the 2024 federal solar tax credit solar america. america is racing against global warming to reach its solar goals. the biden administration is hoping to attain 80% renewable energy throughout the country by 2030 and achieve 100% carbon electricity by 2035. but with about 68% of energy consumption still derived from petroleum or.

2024 Tax Credits For Solar Panels Sayre Courtnay Taxpayers who invest in energy improvements for their main home, including solar, wind, geothermal, fuel cells or battery storage, may qualify for an annual residential clean energy tax credit. the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for a home in the united states installed anytime. Guide to the 2024 federal solar tax credit solar america. america is racing against global warming to reach its solar goals. the biden administration is hoping to attain 80% renewable energy throughout the country by 2030 and achieve 100% carbon electricity by 2035. but with about 68% of energy consumption still derived from petroleum or.

Comments are closed.