2024 Tax Rate Schedule Inge Regine

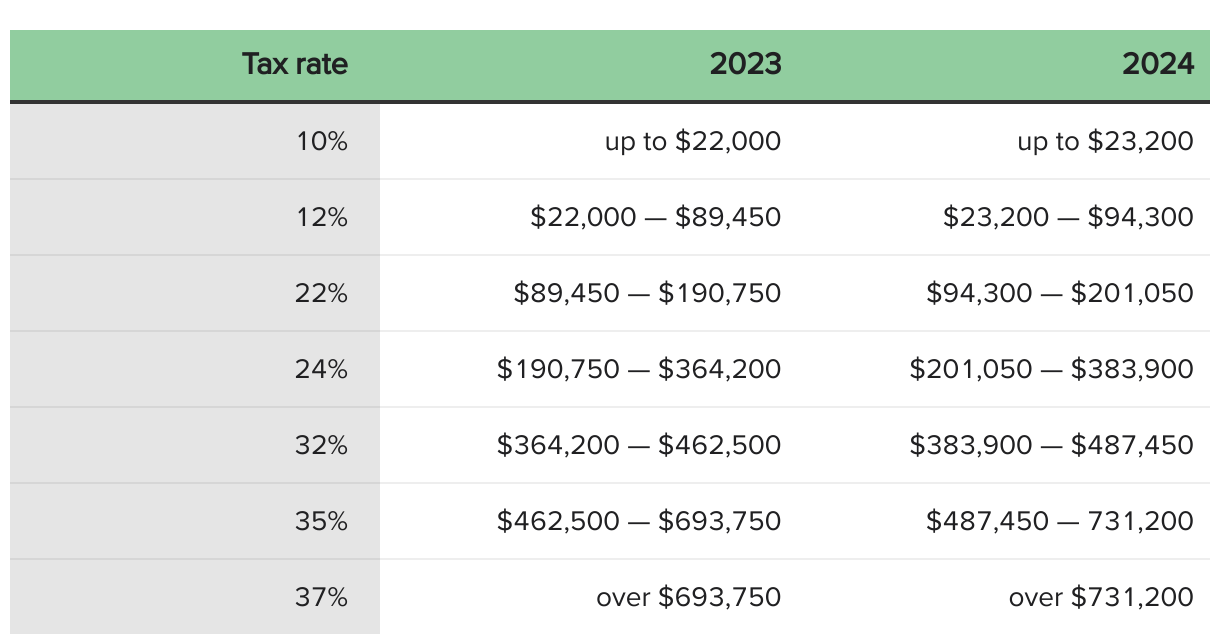

2024 Tax Rate Schedule Inge Regine 2024 federal income tax brackets and rates. in 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. for a single taxpayer, the rates are:.

2024 Tax Rate Schedule Inge Regine 2024 tax rate schedule. tax rates on long term capital gains and qualified dividends. for individuals, 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. (3) page 2 of 21. Ir 2023 208, nov. 9, 2023. washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate schedules and other tax changes. revenue procedure 2023 34 provides detailed information about these annual adjustments. The amt exemption rate is also subject to inflation. the amt exemption amount for tax year 2024 for single filers is $85,700 and begins to phase out at $609,350 (in 2023, the exemption amount for. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2024. california provides a standard personal exemption tax deduction of $ 144.00 in 2024 per qualifying filer and $ 446.00 per qualifying dependent (s), this is used to reduce the amount of income that is subject to tax in 2024.

Comments are closed.