25 Mortgage Rates July 2022 Umayzakimarley

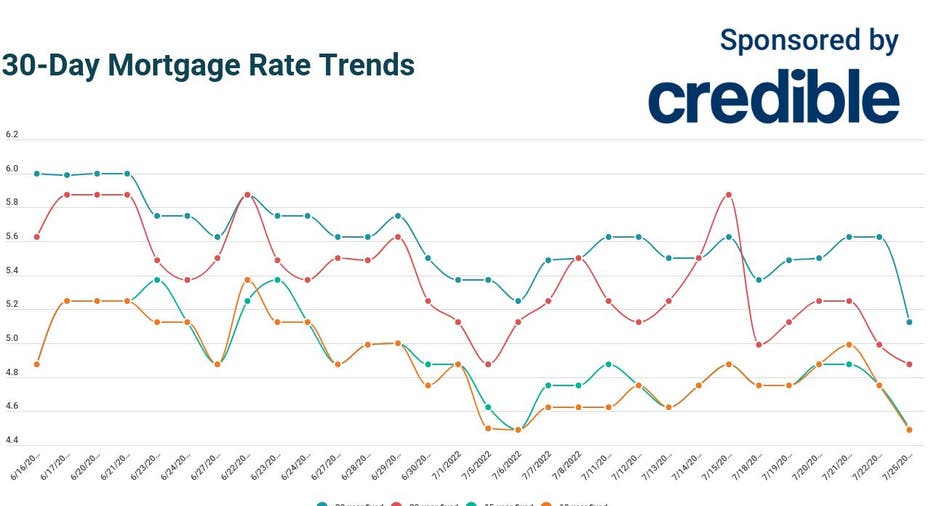

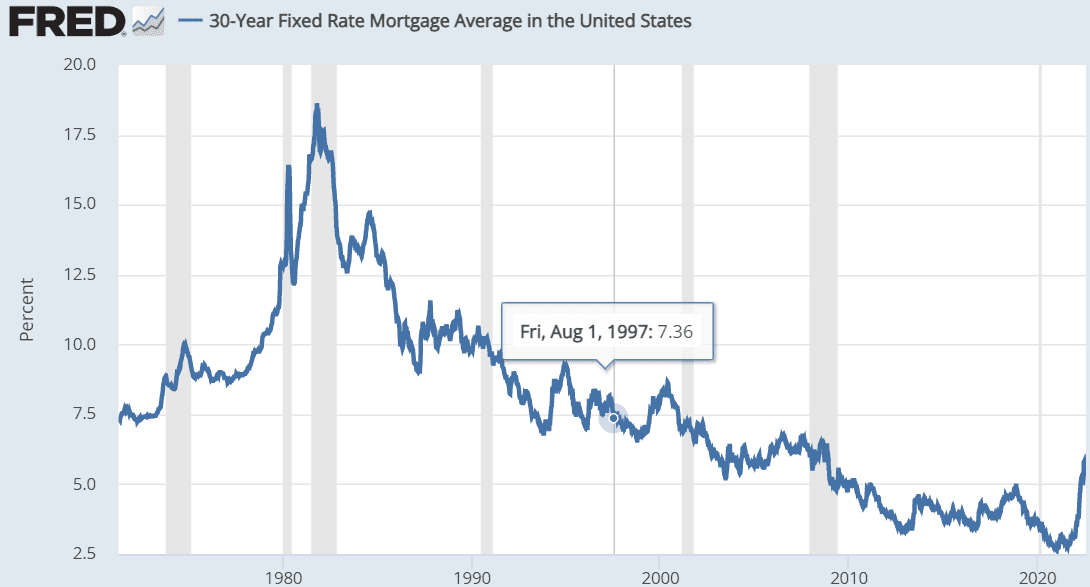

25 Mortgage Rates July 2022 Umayzakimarley Ten year rate history report for mortgages of several mortgage terms. 1 year rate: 1.25%: 1985: 10.00%: 11.25%: 11.75% 1 year rate: 2.00%: 2022: 4.74%: 5.39%. 6.31. 12 22 2022. 6.27. 12 29 2022. 6.42. what were mortgage rates in 2022? we've compiled a history of mortgage rates over time provided by freddie mac. find the chart above to view historical 30 year fixed rate mortgages in 2022. return to the historical rates homepage to view a complete rate history.

Mortgage Rate Predictions For The Rest Of The Year 2022 The Truth Finally, the national average home price in canada is predicted to rise by a total of 2.5% in 2024 to reach $694,393, before rising by a further 5% in 2025 to reach $729,319. crea had earlier projected growth of 4.9% in 2024 to reach $710,120, followed by 7% growth in 2025 to reach $760,120. That means on a 25 year mortgage, your $100,000 mortgage’s monthly payment would jump from $436 to $716. the big difference between 2024 and 1982 is that we no longer have 35 year prime mortgages with average house prices near $72,800 and average mortgage balance hovering around $41,200. The downside of locking in a rate for such a long period is the rate premium. that long term price stability comes at a steep price. the posted interest rate on rbc's 25 year fixed mortgage was 8.75% as of october 2020. See today's best mortgage rates. compare current mortgage rates across the big 5 banks and top canadian lenders. take 2 minutes to answer a few questions and discover the lowest rates available to you. 4.19%. best fixed rate in canada. see my rates.

Todayтащs 30 Year юааmortgageюаб юааratesюаб Plunge Half A Point To 34 Day Low юааjulyюаб The downside of locking in a rate for such a long period is the rate premium. that long term price stability comes at a steep price. the posted interest rate on rbc's 25 year fixed mortgage was 8.75% as of october 2020. See today's best mortgage rates. compare current mortgage rates across the big 5 banks and top canadian lenders. take 2 minutes to answer a few questions and discover the lowest rates available to you. 4.19%. best fixed rate in canada. see my rates. Best mortgage rates vs. today's average mortgage rates. according to money.ca’s latest survey on canada’s mortgage lenders, today's average mortgage rates are: 5.03% for a 3 year fixed. Real estate data is sourced from the canadian real estate association (crea) and regional boards' websites and documents. as of september 6, 2024, the best mortgage rates in canada are: 5 year fixed at 4.19%, 3 year fixed at 4.39%, and 5 year variable at 5.15%. compare today’s lowest rates from 40 lenders in canada.

Mortgage Rates 2022 Graph Best mortgage rates vs. today's average mortgage rates. according to money.ca’s latest survey on canada’s mortgage lenders, today's average mortgage rates are: 5.03% for a 3 year fixed. Real estate data is sourced from the canadian real estate association (crea) and regional boards' websites and documents. as of september 6, 2024, the best mortgage rates in canada are: 5 year fixed at 4.19%, 3 year fixed at 4.39%, and 5 year variable at 5.15%. compare today’s lowest rates from 40 lenders in canada.

Comments are closed.