3 Golden Rules Of Accounting With Explanation

3 Golden Rules Of Accounting Explained Concepts Behind It Debit the asset account when you spend $5,000 on an asset to improve its efficiency. debit the creditor when you repay the money borrowed from them. credit the asset account when you sell said asset. credit the line of credit account when you borrow money using your line of credit. Easy interpretation of 3 golden rules of accounting. real account. if the item (real account) is coming into the business then – debit. if the item (real account) is going out of business then – credit. personal account. if the person (or) legal body (or) group is receiving something – debit.

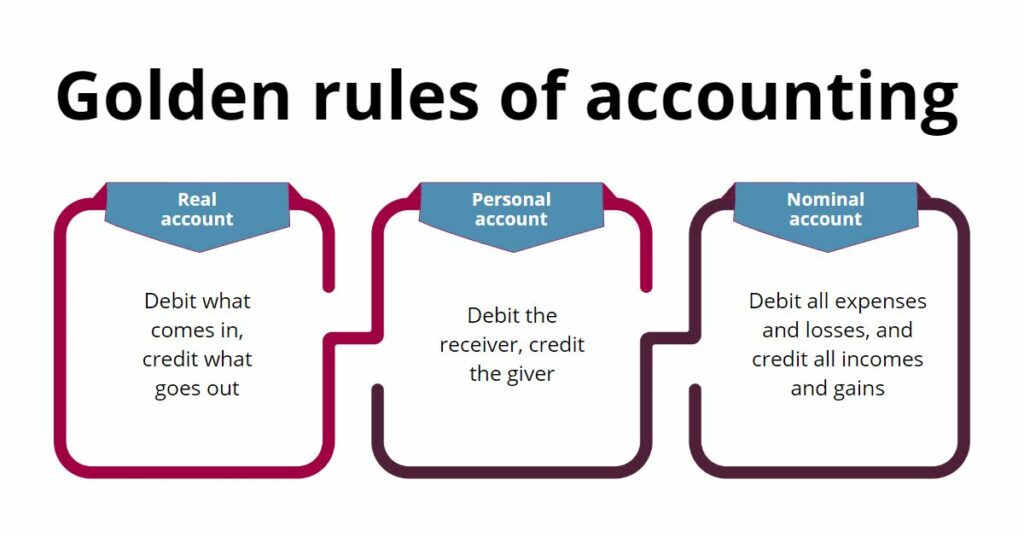

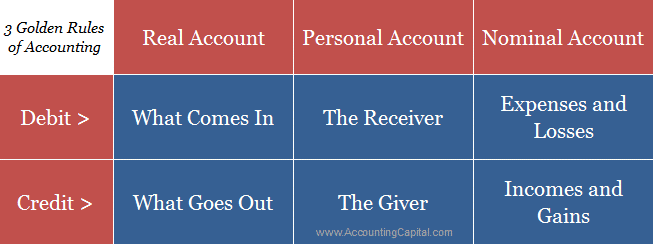

3 Golden Rules Of Accounting With Explanation Youtube The three golden rules of accounting. these three golden rules of accounting: debit the receiver and credit the giver; debit what comes in and credit what goes out; and debit expenses and losses credit income and gains, form the bedrock of double entry bookkeeping. they regulate the entry of financial transactions with precision and consistency. Here is an explanation of the three types of accounts: 1. real account. also known as permanent accounts. real accounts record assets, liabilities, and capital. the balances in real accounts are carried forward to the next accounting period. examples include accounts for land, buildings, equipment, loans, capital, etc. The golden rules of accounting provide fundamental principles, with three key technical rules ensuring accuracy in the process. 1. credit the provider and debit the recipient: in personal accounts associated with specific individuals or entities, the guideline is to record a debit for the receiver and a credit for the giver. Learn the 3 golden rules of accounting with detailed examples. understand real, personal, and nominal accounts, and how to apply these rules effectively. to record transactions every entity must pass journal entries which will then summarize into ledgers. read on here to know the different types of accounts.

Top 3 Golden Rules Of Accounting Sage Software The golden rules of accounting provide fundamental principles, with three key technical rules ensuring accuracy in the process. 1. credit the provider and debit the recipient: in personal accounts associated with specific individuals or entities, the guideline is to record a debit for the receiver and a credit for the giver. Learn the 3 golden rules of accounting with detailed examples. understand real, personal, and nominal accounts, and how to apply these rules effectively. to record transactions every entity must pass journal entries which will then summarize into ledgers. read on here to know the different types of accounts. The golden rules of accounting also revolve around debits and credits. take a look at the three main rules of accounting: debit the receiver and credit the giver. debit what comes in and credit what goes out. debit expenses and losses, credit income and gains. 1. debit the receiver and credit the giver. the rule of debiting the receiver and. The golden rule for personal accounts is straightforward: “debit the receiver, credit the giver.”. in simple terms, when you receive something, debit the account, and when you give, credit the account. example: consider a scenario where your friend lends you £500. to record this transaction, you would debit your cash account (increasing.

Three Golden Rules Of Accounting Examples Pdf Quiz More The golden rules of accounting also revolve around debits and credits. take a look at the three main rules of accounting: debit the receiver and credit the giver. debit what comes in and credit what goes out. debit expenses and losses, credit income and gains. 1. debit the receiver and credit the giver. the rule of debiting the receiver and. The golden rule for personal accounts is straightforward: “debit the receiver, credit the giver.”. in simple terms, when you receive something, debit the account, and when you give, credit the account. example: consider a scenario where your friend lends you £500. to record this transaction, you would debit your cash account (increasing.

Comments are closed.