409a Valuation The Impact On Employee Equity Capboard

409a Valuation The Impact On Employee Equity Capboard A 409a valuation is a crucial step for startups offering equity compensation to us based employees. it ensures compliance with the irs. if you have employee equity compensation or planning to begin doing so, you must get a 409a valuation. learn what precisely a 409a valuation is and its impact on employee equity. what is 409a valuation?. Section 409a of the internal revenue code (section 409a) imposes a 20% penalty tax (in addition to any ordinary income tax!) on nonqualified deferred compensation that fails to satisfy certain.

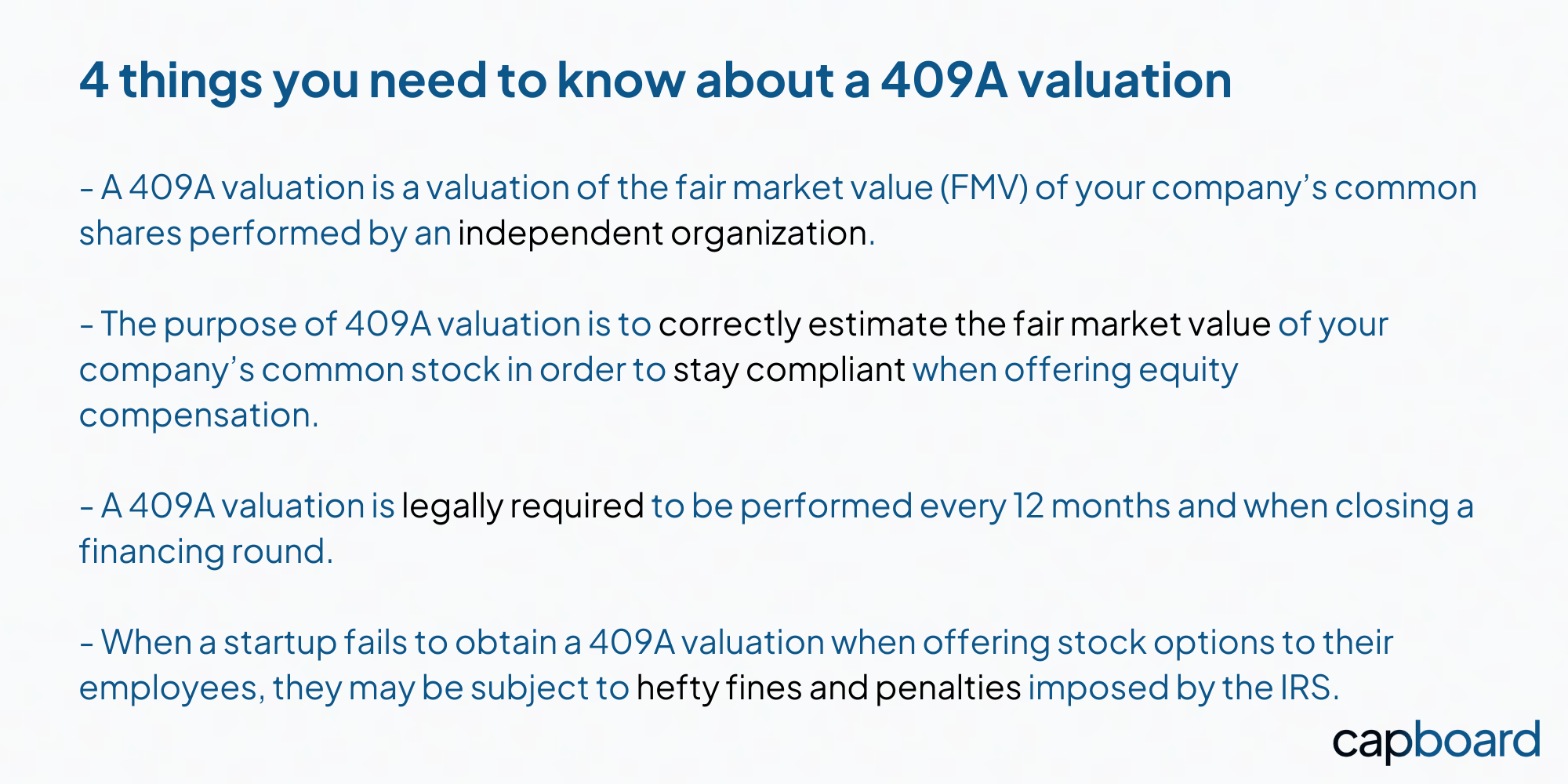

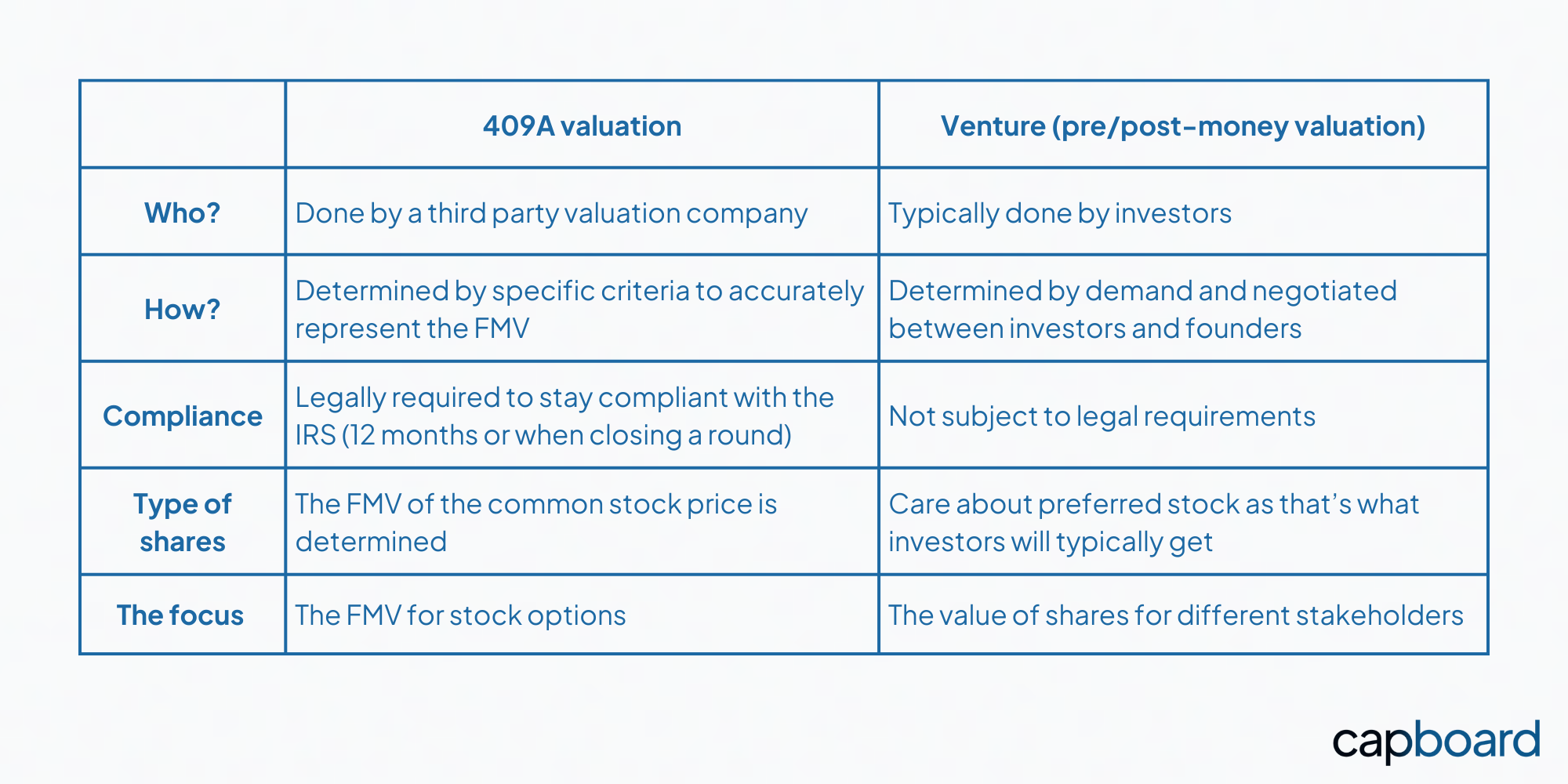

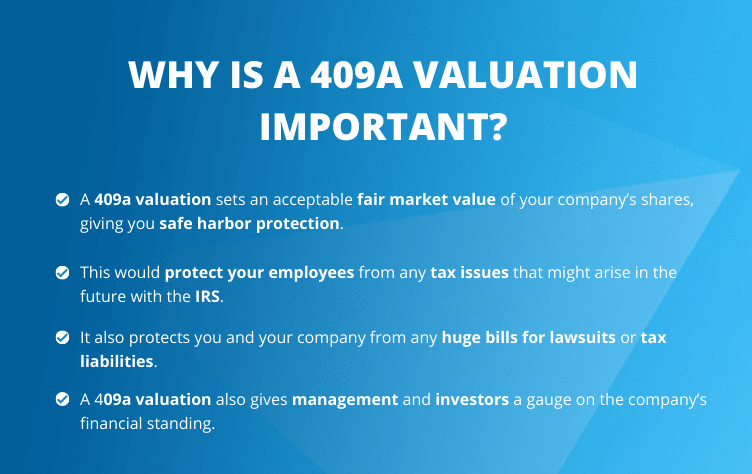

409a Valuation The Impact On Employee Equity Capboard 3) apply a discount for lack of marketability. 7. calculate enterprise value. while there are many ways financial experts (e.g. m&a experts, equity research analysts, vc firms) can determine enterprise value, in 409a valuation work, there are three main methodologies: market, income, and asset based. A 409a valuation is an appraisal of value for a private company’s stock. this valuation is recommended before issuing any stock equity to employees. an effective way to conduct a 409a valuation is with an outside advisor to establish safe harbor. failure to obtain a 409a valuation can result in tax penalties for both the company and the employee. A 409a valuation is an independent appraisal of a private company’s fair market value (fmv) that is used to set the strike price for employee stock options. it’s one of the primary methods used to value a private company. 409a valuations are necessary if your company plans to issue equity to employees or other service providers. Summary. step 1: find a 409a valuation firm. it’s crucial to select a 409a valuation firm with the right mix of experience, communication skills, and methodology expertise, as well as a history of working with clients similar to your business. step 2: provide 409a details to valuation firm. once you select a 409a valuation firm, you’ll need.

409a Valuation The Complete Guide For Your Business Eqvista A 409a valuation is an independent appraisal of a private company’s fair market value (fmv) that is used to set the strike price for employee stock options. it’s one of the primary methods used to value a private company. 409a valuations are necessary if your company plans to issue equity to employees or other service providers. Summary. step 1: find a 409a valuation firm. it’s crucial to select a 409a valuation firm with the right mix of experience, communication skills, and methodology expertise, as well as a history of working with clients similar to your business. step 2: provide 409a details to valuation firm. once you select a 409a valuation firm, you’ll need. A 409a valuation is required before you offer equity—including stock options—in your company. startups need to update their 409a valuation annually or sooner if there is a material change that may impact the value of the business. other circumstances may trigger the need for a new 409a valuation, including: a new round of funding: this is. This valuation is a critical tool for startups, informing the price at which employees can purchase shares of the company's common stock, often a valuable recruiting tool. the term '409a' originates from section 409a of the u.s. tax code, which governs non qualified deferred compensation plans, such as stock options.

409a Valuation The Impact On Employee Equity Capboard A 409a valuation is required before you offer equity—including stock options—in your company. startups need to update their 409a valuation annually or sooner if there is a material change that may impact the value of the business. other circumstances may trigger the need for a new 409a valuation, including: a new round of funding: this is. This valuation is a critical tool for startups, informing the price at which employees can purchase shares of the company's common stock, often a valuable recruiting tool. the term '409a' originates from section 409a of the u.s. tax code, which governs non qualified deferred compensation plans, such as stock options.

Comments are closed.