Acbc Qld Fintech Insights вђ Outcomes Of The Ey Fintech Australia

Acbc Qld Fintech Insights вђ Outcomes Of The Ey Fintech ођ In person & online event date: thu, 10 november 2022 time: 3:45pm registration for 4:00pm – 6:30pm aest venue: ernst and young (level 51, 111 eagle st, brisbane city qld 4000) cost: free financial technology (fintech) is part of the worldwide innovation boom and is the future of financial services. australia has one of the world’s […]. Fintech australia has continued its successful collaboration with ey australia to deliver this important piece of research. the census remains the only detailed, industry backed analysis of the australian fintech industry, offering fine grain detail about the industry’s increased maturity, with an impressive eight year history of australian fintech data and trends.

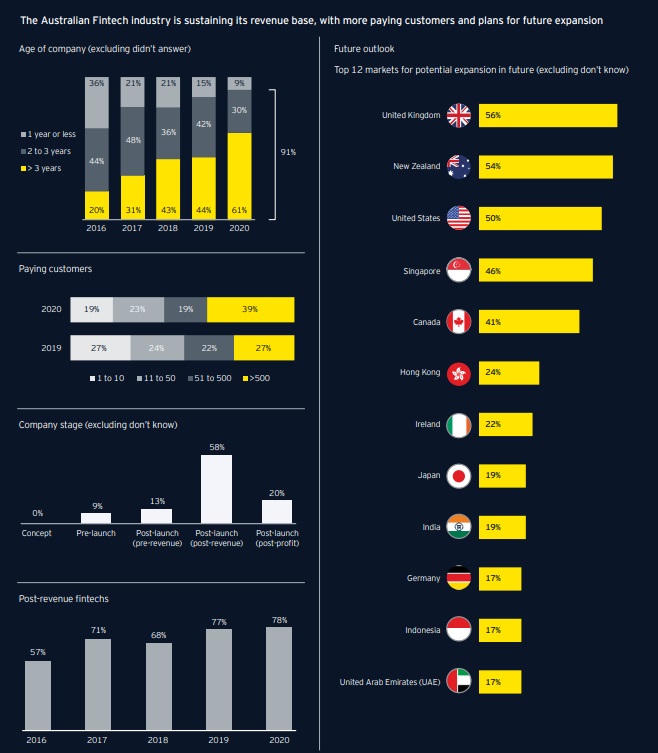

Australia Saw Over 100 New Fintechs In 2020 As The Sector Matures Collaboration essential to maintain fintech growth momentum. australia’s vibrant fintech ecosystem has demonstrated rapid growth and achieved international success. in the last funding round, the majority (64%) of local fintechs were valued at $50 million or less, 29% between $50.1 million to $1 billion and 7% at more than $1 billion. Thank you for attending acbc qld's fintech insights – outcomes of the ey fintech australia census 2022 event. we would like to acknowledge may lam 林希文, partner, ernst & young global. High performing fintech ecosystems are built on four core attributes: talent: technical, functional, sector and entrepreneurial skills, knowledge and experience. capital: sufficient financial resources for startups and scale ups. policy: policy and regulation that promotes innovation, including tax and growth incentives and digital public. Your acbc team and executive committee. this is your queensland branch team. we are here to support you and your organisation. call 61 7 3835 4765 email acbc.qld@acbc .au address gpo box 1923 brisbane qld 4001.

Ey Australia S Fintechs Are Booming But Concerns About Access To High performing fintech ecosystems are built on four core attributes: talent: technical, functional, sector and entrepreneurial skills, knowledge and experience. capital: sufficient financial resources for startups and scale ups. policy: policy and regulation that promotes innovation, including tax and growth incentives and digital public. Your acbc team and executive committee. this is your queensland branch team. we are here to support you and your organisation. call 61 7 3835 4765 email acbc.qld@acbc .au address gpo box 1923 brisbane qld 4001. Australia’s efforts to foster a thriving fintech ecosystem. australia’s fintech industry has emerged as being among the important fintech ecosystems globally. the census gives us hard data and credible insights to back our advocacy work to drive the industry’s ongoing expansion. this report is also, arguably, the best source document to. Australia’s largest segment within the fintech sector was recorded to be within digital payments, with e wallets and the supply chain part of the most common type of fintech (43%), followed by lending (30%).the sector’s total transaction value is forecasted to be us$92 billion (au$135 billion) in 2022, with the number of users in this.

Ey And Fintech Australia Present The Findings Of The Inaugural Fintech Australia’s efforts to foster a thriving fintech ecosystem. australia’s fintech industry has emerged as being among the important fintech ecosystems globally. the census gives us hard data and credible insights to back our advocacy work to drive the industry’s ongoing expansion. this report is also, arguably, the best source document to. Australia’s largest segment within the fintech sector was recorded to be within digital payments, with e wallets and the supply chain part of the most common type of fintech (43%), followed by lending (30%).the sector’s total transaction value is forecasted to be us$92 billion (au$135 billion) in 2022, with the number of users in this.

Comments are closed.