Access To Capital

How To Access Capital For Your Business An unprecedented $6.3 million – from the cooperative assistance fund (caf) ace | access to capital for entrepreneurs celebrated its annual awards reception last fall in atlanta, highlighting the power, strength and resilience of small businesses in georgia…. press release. The report analyzes the capital ecosystem for entrepreneurs in the u.s. and the kansas city metropolitan area, and highlights the challenges and opportunities for marginalized founders. it also provides data on the impact of covid 19, the role of alternative lenders, and the call to action for policymakers and stakeholders.

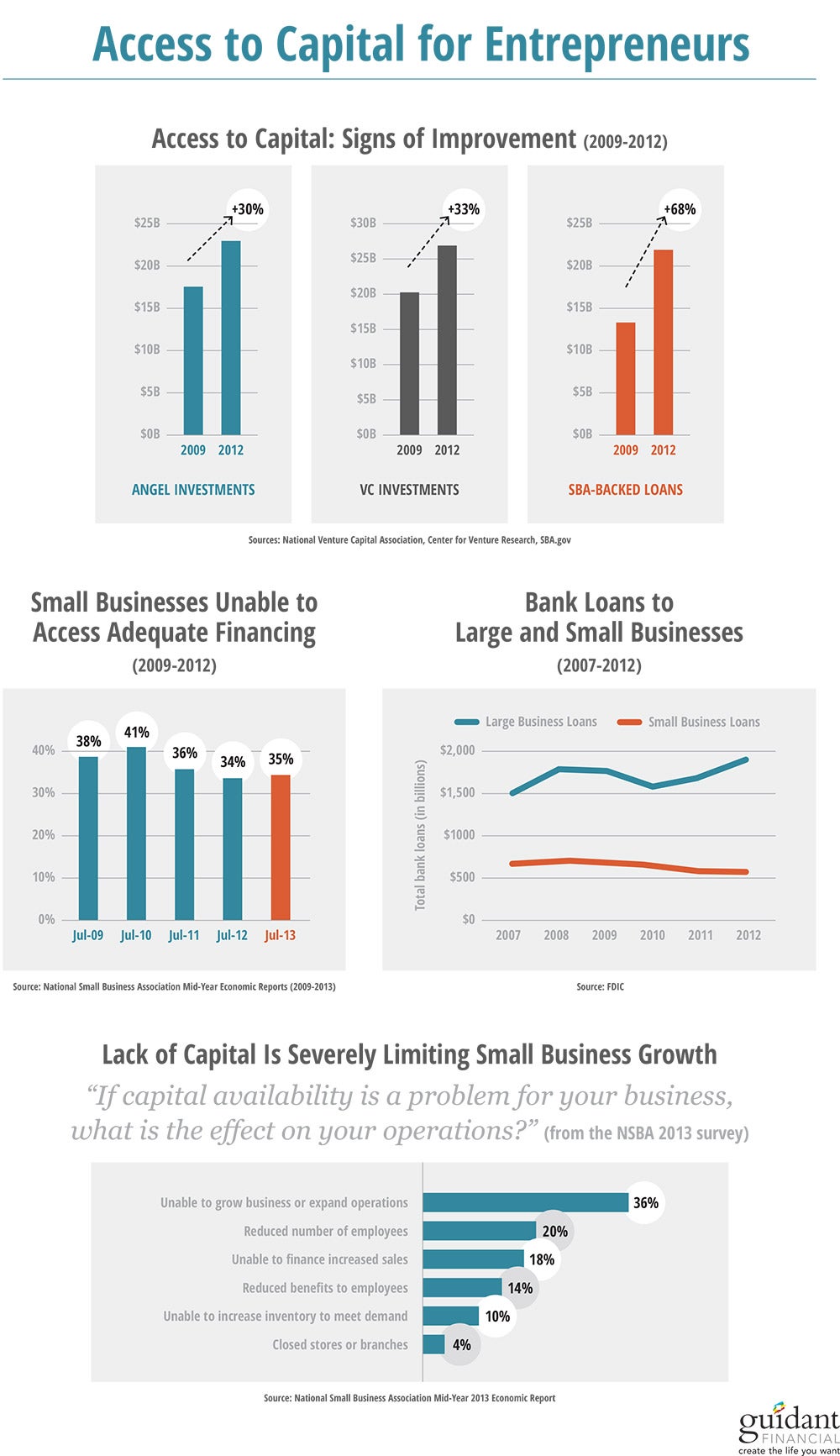

Has Access To Capital Really Improved For Entrepreneurs Infographic The u.s. small business administration (sba) announced on august 1, 2023, new policies and procedures for its 7 (a) and 504 loan programs to increase funding for small businesses and lenders. the changes include flexibility in credit criteria, clarification of affiliation standards, data analytics for fraud review, and permanency for mission driven lenders. Access to capital plays an important role in entrepreneurship, both in direct and indirect ways. external private institutional capital – in other words, bank lending and venture capital – dominates the research and public discourse. yet, at least 83 percent of entrepreneurs do not access bank loans or venture capital at the time of startup. This report explores the challenges and opportunities for entrepreneurs to access capital in the us, and highlights innovative strategies and solutions from capital entrepreneurs. it covers the knowledge landscape, the gaps and barriers, and the emerging solutions for improving capital access systems. The white house fact sheet highlights the administration's actions to support small businesses with capital, technical assistance, and equity. it includes proposed rules, funding programs, and support services for underserved communities and entrepreneurs.

Inurban Strategies Llc This report explores the challenges and opportunities for entrepreneurs to access capital in the us, and highlights innovative strategies and solutions from capital entrepreneurs. it covers the knowledge landscape, the gaps and barriers, and the emerging solutions for improving capital access systems. The white house fact sheet highlights the administration's actions to support small businesses with capital, technical assistance, and equity. it includes proposed rules, funding programs, and support services for underserved communities and entrepreneurs. The sba has made permanent its mission lending community advantage program and launched 143 new lenders to serve small businesses in underserved markets. the program aims to close the capital gaps for entrepreneurs who face systemic barriers and benefit from the president's invest in america agenda. Addressing capital access market gaps in underserved communities: sba is modernizing the lending criteria and conditions for sba’s business loan programs and reducing red tape for sba lenders, which will expand the number of credit worthy business owners who can access sba loans, particularly among underserved communities like women, minority.

Comments are closed.