Ach Payment What It Is How It Works How Much It Costs

Ach Payment What It Is How It Works How Much It Costs Nacha doesn’t set the fees associated with ach payments, so the cost depends on the bank or payment processor you use. some processors charge a flat fee, which typically ranges from $0.20 to $1.50 per transaction. others may charge a percentage of the transaction amount, and this generally falls between 0.5% to 1.5%. Ach transfers cost a few bucks at most, but sending a bank wire transfer within the u.s. tends to cost from $20 to $30, and there’s usually a fee to receive one. the wire network, however.

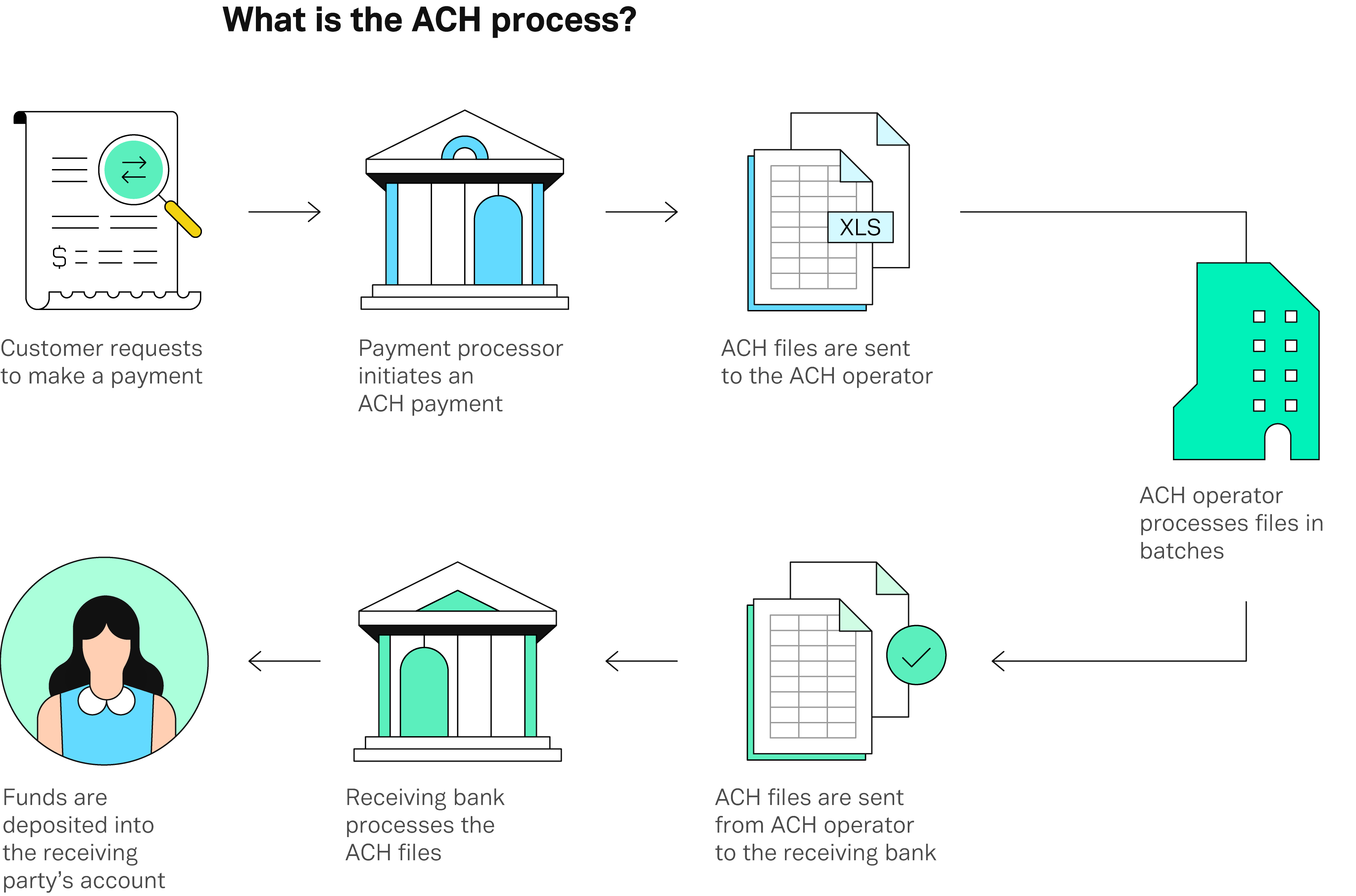

What Is An Ach Payment How Does It Work The ach network is a payments system organized and administered by nacha, formerly the national automated clearing house association, which was founded in 1974 to improve the u.s. payments system. However, some ach payments may qualify for expedited processing for an additional fee. another key difference is the associated fees, with wire transfers typically costing around $25 per transaction, compared to the average ach fee of $0.29. how does ach payment work? an ach payment begins with a request from a business to a bank or payment. An ach payment is a method of electronic payment that takes place between two banks within the automated clearing house network. it’s an alternative to other digital payments, such as wire transfers or card payments. it has gained in popularity over the years, even as the use of checks and cash between businesses and consumers has declined [1]. Nacha estimates that 80% of ach payments settle in one banking day or less. however, the two types of ach payments — ach debits and ach credits — often have different processing times. ach credits make up a little less than 50% of ach payments, according to nacha, and most settle in one business day.

A Complete Guide To Ach How It Works How Long It Takes An ach payment is a method of electronic payment that takes place between two banks within the automated clearing house network. it’s an alternative to other digital payments, such as wire transfers or card payments. it has gained in popularity over the years, even as the use of checks and cash between businesses and consumers has declined [1]. Nacha estimates that 80% of ach payments settle in one banking day or less. however, the two types of ach payments — ach debits and ach credits — often have different processing times. ach credits make up a little less than 50% of ach payments, according to nacha, and most settle in one business day. Ach payment faqs how much do ach payments cost to process? it typically costs less to process ach payments than efts, since the sender of the payment is responsible for initiating the transaction. fees vary depending on the banks involved in the transfer and which services are used, but most ach payments cost between $0.20 – $1.50 per transfer. Ach payments apply to checking and savings accounts and include direct deposits and recurring payments. nacha, originally the national automated clearinghouse association, oversees and governs the ach network. ach payments work by “pushing” and “pulling” money between bank accounts. ach transactions can be secure, quick, reliable and.

What Is Ach The Ultimate Guide To Ach Payments Plaid Ach payment faqs how much do ach payments cost to process? it typically costs less to process ach payments than efts, since the sender of the payment is responsible for initiating the transaction. fees vary depending on the banks involved in the transfer and which services are used, but most ach payments cost between $0.20 – $1.50 per transfer. Ach payments apply to checking and savings accounts and include direct deposits and recurring payments. nacha, originally the national automated clearinghouse association, oversees and governs the ach network. ach payments work by “pushing” and “pulling” money between bank accounts. ach transactions can be secure, quick, reliable and.

Comments are closed.