Advantages And Disadvantages Of Whole Life Insurance

Term Life Insurance Advantages And Disadvantages в Effortless Insuranceођ Learn the advantages and disadvantages of whole life insurance, a type of permanent policy that combines death benefit and cash value. compare whole life with other forms of permanent insurance and term life insurance. Pros and cons of using whole life insurance as an investment. whole life insurance can offer both advantages and disadvantages. here’s a quick rundown of the main pros and cons. pros: whole life.

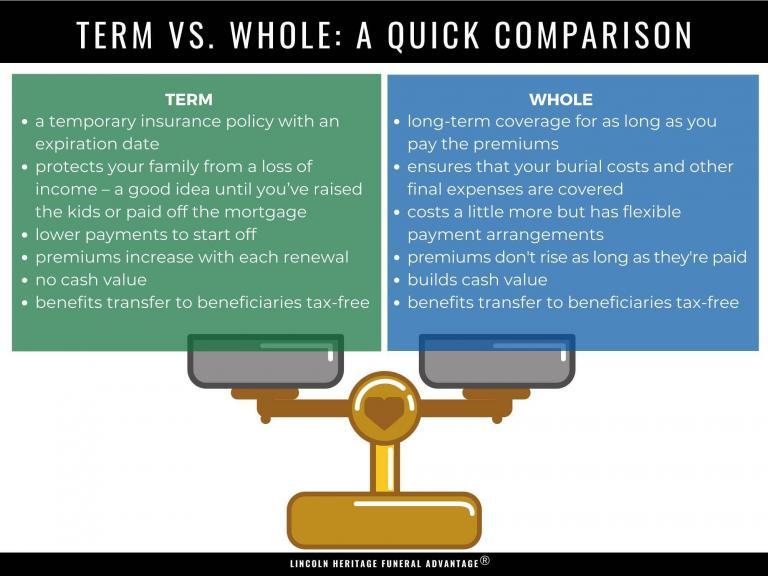

Whole Life Insurance Pros And Cons 18 Advantages And Disadvan Disadvantages of whole life insurance. like all insurance products, whole life insurance has its downsides: it’s expensive. since permanent policies offer lifelong coverage, they come with a significantly higher price tag. whole life typically costs 5 to 10 times more than term life insurance. it’s not as flexible as other permanent policies. Term life vs. whole life: cost comparison. whole life policies are much more expensive than term life policies. in fact, rates for whole life policies are typically between five and 15 times more. Whole life insurance is one option for a buy sell agreement. disadvantages of a whole life insurance policy. expensive: whole life insurance policy tends to be an expensive way to buy coverage. Whole life insurance, by definition, covers you for your entire life, as long as you pay the premiums. it is sometimes referred to as "guaranteed whole life insurance," because companies promise to keep premiums the same the whole time you have the policy. if you die, and the policy hasn't lapsed, your beneficiaries will receive a payout.

Advantages And Disadvantages Of Whole Life Insurance Whole life insurance is one option for a buy sell agreement. disadvantages of a whole life insurance policy. expensive: whole life insurance policy tends to be an expensive way to buy coverage. Whole life insurance, by definition, covers you for your entire life, as long as you pay the premiums. it is sometimes referred to as "guaranteed whole life insurance," because companies promise to keep premiums the same the whole time you have the policy. if you die, and the policy hasn't lapsed, your beneficiaries will receive a payout. While the premium is more expensive than for term life insurance, the list of whole life insurance advantages is significant: your whole life premium stays the same for life. the fixed premium of a term insurance policy typically ends after 10, 20, or 30 years. and with some other types of permanent coverage, the premium cost can go up later. Whole life insurance is permanent life insurance that pays a benefit upon the death of the insured and is characterized by level premiums and a savings component. advantages and disadvantages.

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons While the premium is more expensive than for term life insurance, the list of whole life insurance advantages is significant: your whole life premium stays the same for life. the fixed premium of a term insurance policy typically ends after 10, 20, or 30 years. and with some other types of permanent coverage, the premium cost can go up later. Whole life insurance is permanent life insurance that pays a benefit upon the death of the insured and is characterized by level premiums and a savings component. advantages and disadvantages.

Comments are closed.