Ai For Portfolio Management Bitdeal

Ai For Portfolio Management Bitdeal Bitdeal as a leading ai development company explores the transformative impact of ai in this blog, delving into how it enhances decision making, improves portfolio diversification, and adapts to market trends, revolutionizing the traditional approach to wealth management. With a skilled team proficient in ai and asset management, bitdeal provides customizable genai offerings to meet unique needs. in conclusion, generative ai represents a groundbreaking advancement in the field of asset management, offering unparalleled opportunities for innovation and optimization.

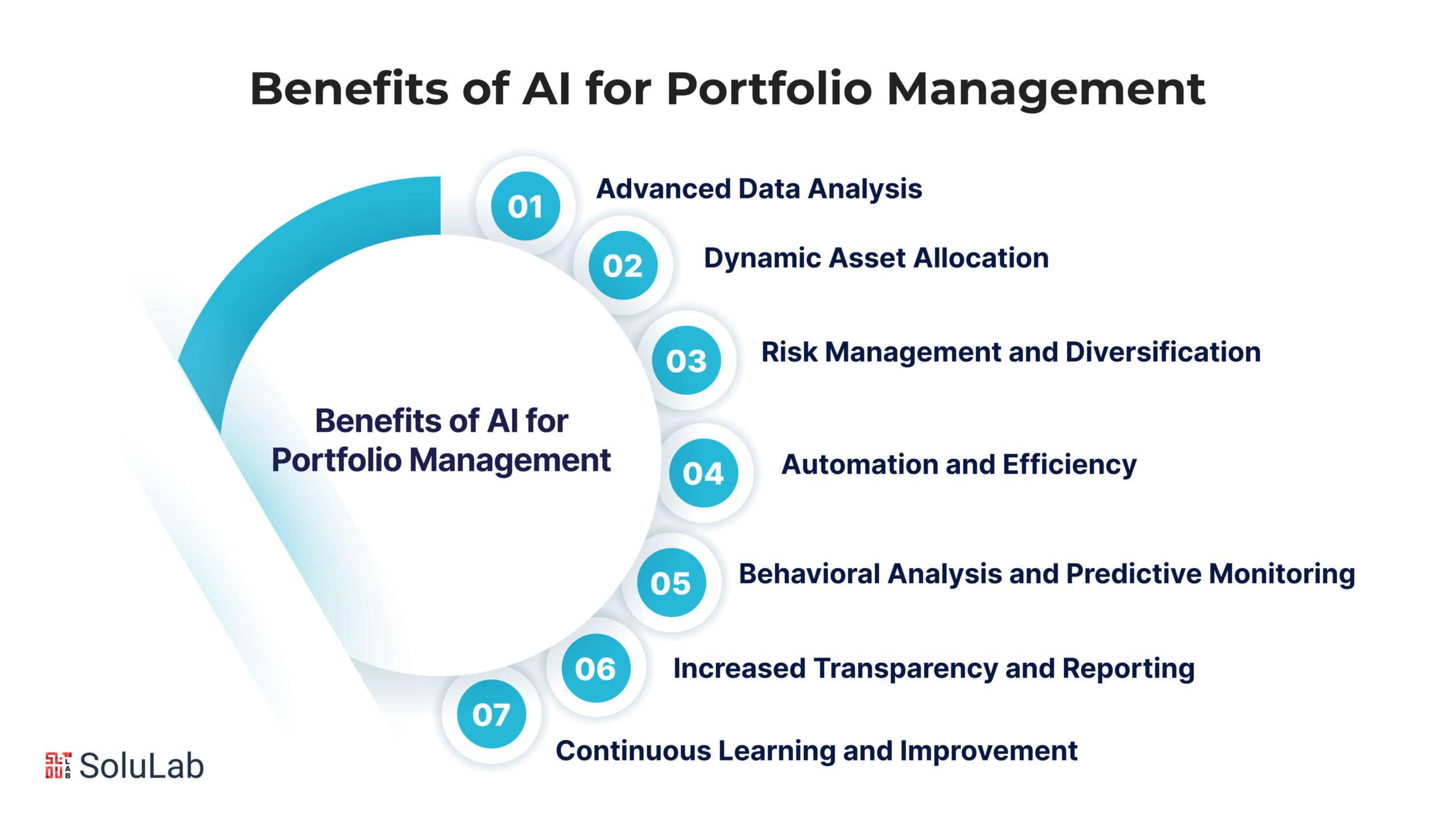

Bitdeal Pioneers Next Generation Ai Solutions To Revolutionize The It Personalized portfolio: ai automatically detects the user's needs and customizes their investment portfolios with necessary alerts and data. all time risk management: ai investment software excels in assessing and managing risks by analyzing historical data, market behavior, and economic indicators. Eight years later, wealthfront has expanded its ai based asset management services, adding more features to its personalized investment portfolio services platform, such as automatic portfolio. Explore how #ai in portfolio management is transforming the financial landscape, offering sophisticated tools and strategies that go beyond traditional approaches. this innovative integration of #. Xavier de laforcade partner head of portfolio management rothschild martin maurel. experiencing strong growth over recent years, both in academic research and in the world of business, interest in artificial intelligence (ai) has grown exponentially since the launch of chatgpt 3.5 at the end of last year. with a record adoption rate of 100.

A Brief Guide To Ai In Portfolio Management Explore how #ai in portfolio management is transforming the financial landscape, offering sophisticated tools and strategies that go beyond traditional approaches. this innovative integration of #. Xavier de laforcade partner head of portfolio management rothschild martin maurel. experiencing strong growth over recent years, both in academic research and in the world of business, interest in artificial intelligence (ai) has grown exponentially since the launch of chatgpt 3.5 at the end of last year. with a record adoption rate of 100. Artificial intelligence (ai) is fundamentally transforming portfolio management, moving from traditional, human centric methods to a more advanced, data driven approach. in today’s fast paced financial environment, where timely and precise decision making is essential, ai has become a vital tool. a recent pwc report highlights this shift. An overview of trends in ai and of the most common ai techniques used in asset management. ai applications in portfolio management, trading, and portfolio risk management are discussed in sections 3, 4, and 5, respectively. section 6 covers the use of ai in robo advising, and section 7 discusses some of the risks and concerns associated with ai.

Comments are closed.