An Inverted Yield Curve Predicts Recessions In The Usa At Curious Cat

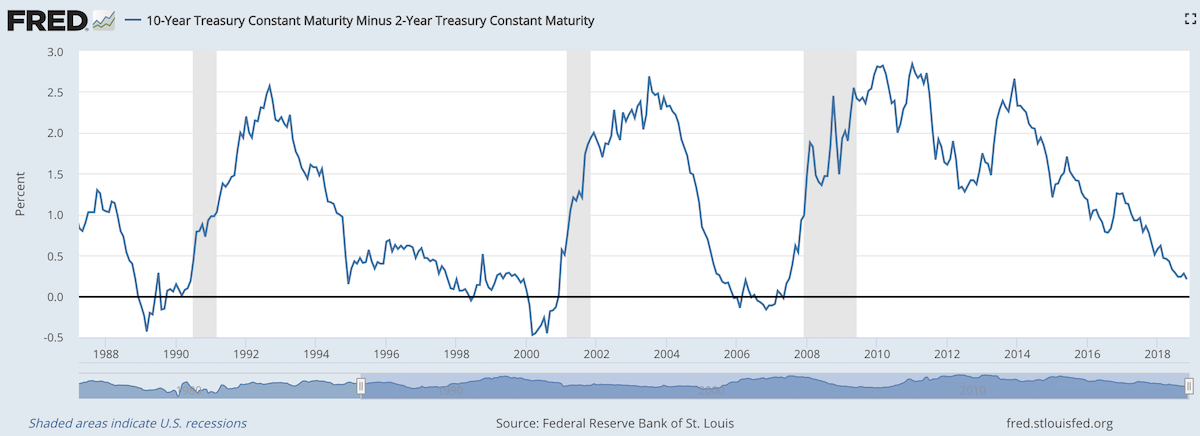

An Inverted Yield Curve Predicts Recessions In The Usa At Curious Cat When 2 year us government bonds yield more than the 10 year us government bonds a recession is likely to appear soon. this chart shows why this is seen as such a reliable predictor. the chart shows the 10 year yield minus the 2 year yield. so when the value falls below 0 that means the 2 year yield is higher. For much of the last two years, the 2 year us treasury yield has traded above the 10 year yield. when that happens, it historically has meant a recession is looming. so you’d think that.

How The Inverted Yield Curve Reliably Predicts Recessions Youtube The yield curve hasn't lost its potency, the effects are just delayed," ludtka says, adding that an inverted curve helps cause recessions because it is harder for financial institutions to make. The inverted yield curve indicator, which occurs when the yield on three month treasury bills exceeds the yield on 10 year notes, is a perfect 8 for 8 in preceding every recession since world war ii. An inverted yield curve predicts recessions in the usa; curious cat kivans. usa corporate debt has increased from a bit over $2 trillion in 2005 to over $7. The 2 10 year yield curve has inverted six to 24 months before each recession since 1955, a 2018 report by researchers at the san francisco fed showed. it offered a false signal just once in that.

Inverted Yield Curve Predicts Recessions Business Insider An inverted yield curve predicts recessions in the usa; curious cat kivans. usa corporate debt has increased from a bit over $2 trillion in 2005 to over $7. The 2 10 year yield curve has inverted six to 24 months before each recession since 1955, a 2018 report by researchers at the san francisco fed showed. it offered a false signal just once in that. Many studies document the predictive power of the slope of the treasury yield curve for forecasting recessions. 2 this work is motivated, for example, by the empirical evidence in figure 1, which shows the term structure slope, measured by the spread between the yields on ten year and two year u.s. treasury securities, and shading that denotes u.s. recessions (dated by the national bureau of. Numerous studies document the ability of the slope of the yield curve (often measured as the difference between the yields on a long term us treasury bond and a short term us treasury bill) to predict future recessions. 1 importantly, the predictive power of the yield curve seems to endure across many studies, even if the specific measure of the yield curve and other conditioning variables differ.

Comments are closed.