Arbitrage Meaning Conditions For Arbitrage Risks

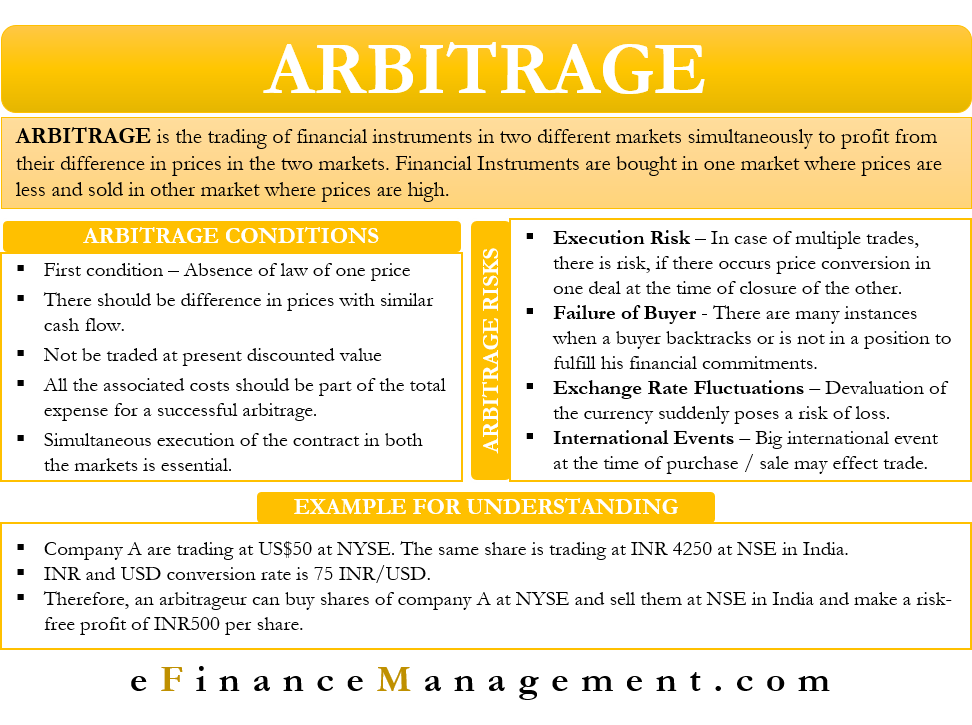

Arbitrage Meaning Conditions For Arbitrage Risks Meaning of arbitrage. arbitrage is the trading of financial instruments in two different markets simultaneously to profit from their difference in prices in the two markets. these financial instruments may include shares, bonds, derivatives, currencies, and commodities. the idea is to earn profits by buying an instrument in one market where. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from a difference in its price. types of arbitrage include risk, retail, convertible.

Arbitrage Definition And Examples A Common Trading Strategy Arbitrage is when an asset (stocks, currencies, etc.) is bought in one market and sold in another for a higher price. the types of arbitrage are spatial, statistical, and merger arbitrage. the. Riskless arbitrage, also known as pure arbitrage, is a strategy that involves exploiting price differentials for the same asset in different markets, with the aim of making risk free profits. the. Another risk of arbitrage is the possibility of liquidity drying up in one or both markets, making it difficult to execute the trade. this can happen if there is a sudden change in market conditions, such as a financial crisis or a political event, which can cause market participants to withdraw their investments. Arbitrage is a financial or economic strategy that involves exploiting price differences for the same asset, security, or commodity in different markets or locations. the goal of arbitrage is to make a risk free profit by taking advantage of price disparities. arbitrage opportunities arise when there are temporary or permanent price.

Understanding Risk Arbitrage Meaning And Strategy Another risk of arbitrage is the possibility of liquidity drying up in one or both markets, making it difficult to execute the trade. this can happen if there is a sudden change in market conditions, such as a financial crisis or a political event, which can cause market participants to withdraw their investments. Arbitrage is a financial or economic strategy that involves exploiting price differences for the same asset, security, or commodity in different markets or locations. the goal of arbitrage is to make a risk free profit by taking advantage of price disparities. arbitrage opportunities arise when there are temporary or permanent price. Risk arbitrage, also known as merger arbitrage, is an investment strategy to profit from the narrowing of a gap of the trading price of a target's stock and the acquirer's valuation of that stock. Arbitrage is an investing strategy in which people aim to profit from varying prices for the same asset in different markets. quick thinking traders have always taken advantage of arbitrage.

:max_bytes(150000):strip_icc()/arbitrage-4201467-1-705aa79c9d6f4128b8eb7b9588403849.jpg)

Arbitrage How Arbitraging Works In Investing With Examples Risk arbitrage, also known as merger arbitrage, is an investment strategy to profit from the narrowing of a gap of the trading price of a target's stock and the acquirer's valuation of that stock. Arbitrage is an investing strategy in which people aim to profit from varying prices for the same asset in different markets. quick thinking traders have always taken advantage of arbitrage.

Comments are closed.