Bad Faith Insurance Lawsuit In 2024

Bad Faith Insurance Lawsuit In 2024 Thursday, september 19, 2024. the insured filed a lawsuit against the insurer alleging causes of action for breach of contract, breach of the implied covenant of good faith and fair dealing. Los angeles, sept. 9, 2024 prnewswire parris law firm attorneys filed an insurance bad faith lawsuit in los angeles superior court against geico insurance following a $20 million wrongful.

Filing A Bad Faith Insurance Lawsuit Haffner Law On may 29, 2024, the northern district of new york upheld insurance policyholders’ right to pursue bad faith claims and consequential damages when an insurance company unreasonably delays and. Cvn screenshot of plaintiff attorney kimball jones delivering his closing argument . las vegas, nv a nevada state court jury hit progressive corp. with a $100 million punitive damages verdict on friday in a bad faith lawsuit stemming from the insurer’s alleged unnecessary delays in reimbursing medical bills for a man who sustained severe injuries after being struck by a car in a crosswalk. These two cases come on the heels of a similar bad faith class action complaint filed in california in july 2023 challenging the alleged use of an algorithm to administer benefit claims. with the increased use of these technologies in the health insurance industry, similar lawsuits are likely on the horizon. On april 18, 2024, oklahoma lawyer rich toon of toon law firm obtained the largest jury verdict in oklahoma history in an insurance company bad faith case brought by an individual. the record setting $92,426,640 jury verdict found great lakes insurance se liable for insurance company bad faith. the verdict of more than $92m includes $65,000,000.

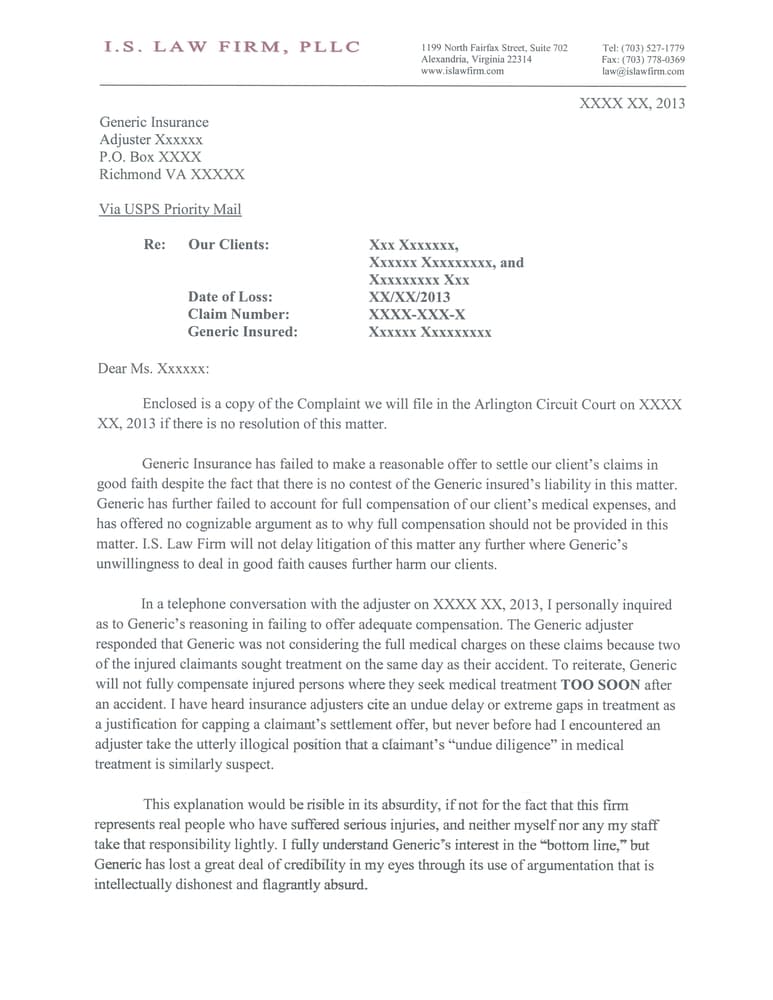

Insurance Bad Faith Negotiations I S Law Firm Pllc These two cases come on the heels of a similar bad faith class action complaint filed in california in july 2023 challenging the alleged use of an algorithm to administer benefit claims. with the increased use of these technologies in the health insurance industry, similar lawsuits are likely on the horizon. On april 18, 2024, oklahoma lawyer rich toon of toon law firm obtained the largest jury verdict in oklahoma history in an insurance company bad faith case brought by an individual. the record setting $92,426,640 jury verdict found great lakes insurance se liable for insurance company bad faith. the verdict of more than $92m includes $65,000,000. Insurance bad faith report, april 2024. five star cars llc v. graphic arts mut. ins. co., no. 3:22 cv 00915 mps, 2024 u.s. dist. lexis 3435 (d. conn. jan. 8, 2024). after a used car dealership suffered fire damage, its property insurer allegedly undervalued the loss. the insured brought suit alleging breach of contract, bad faith, and. Effective july 1, 2024, claimants will no longer be able to file a bad faith suit for penalties and attorney fees for claims arising from a catastrophic loss to immovable property without first complying with the “cure period notice” set forth in §1892.2. this is new and changes the law. the steps are as follows:.

Sample Complaint Against Insurance Company For Bad Faith In California Insurance bad faith report, april 2024. five star cars llc v. graphic arts mut. ins. co., no. 3:22 cv 00915 mps, 2024 u.s. dist. lexis 3435 (d. conn. jan. 8, 2024). after a used car dealership suffered fire damage, its property insurer allegedly undervalued the loss. the insured brought suit alleging breach of contract, bad faith, and. Effective july 1, 2024, claimants will no longer be able to file a bad faith suit for penalties and attorney fees for claims arising from a catastrophic loss to immovable property without first complying with the “cure period notice” set forth in §1892.2. this is new and changes the law. the steps are as follows:.

Bad Faith Insurance Claims Stoy Law Group Pllc

Comments are closed.