Bir Personal Income Tax Calculator Philippines 2024

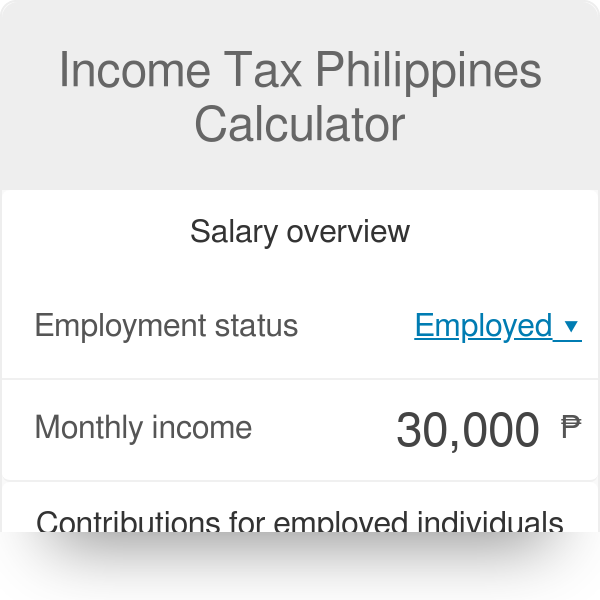

Bir Personal Income Tax Calculator Philippines 2024 Bir income tax calculator philippines 2024. use the latest tax calculator to manage your 2024 tax obligations in the philippines. just enter your gross income and the tool quickly calculates your net pay after taxes and deductions. it uses the 2024 bir income tax table for precise results, making sure you follow the latest tax laws. This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income. the tax caculator philipines 2024 is using the latest bir income tax table as well as sss, philhealth and pag ibig monthy contribution tables for the computation. how to use bir tax calculator 2024.

Bir Personal Income Tax Calculator Philippines 2024 Vrogue Co The bureau of internal revenue (bir) website ( bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the philippine tax laws and their implementing regulations and revenue issuances, including information on bir programs and projects. it also contains copy of the tax code, bir forms, zonal values of real properties, and. With respect to the updated withholding tax table of bir, since this taxable income ₱32,150 is in the compensation range of ₱20,833 – ₱33,332, the prescribed withholding tax as per the bir table is 0.00 15% over ₱20,833. income tax = ( ₱32150 – ₱20833 ) x 15%. income tax = ₱11317 x15%. income tax = ₱1697.55. From the new tax table 2024 above, we got a sample following income computations. if taxable income for the year for example resulted to 1,000,000, tax due will be 152,500. 1,000,000 falls under the 800,000 lower limit bracket. basic amount will be 102,500. the excess 200,000 should be multiplied by 25%. Just enter your gross monthly income using the latest bir, sss, hdmf, and philhealth tables. also, start saving today with our pag ibig mp2 calculator. try it now! monthly income. tax computation. income tax. net pay after tax. monthly contributions. sss.

Comments are closed.