Business Tax Deadlines 2024 Corporations And Llcs Carta

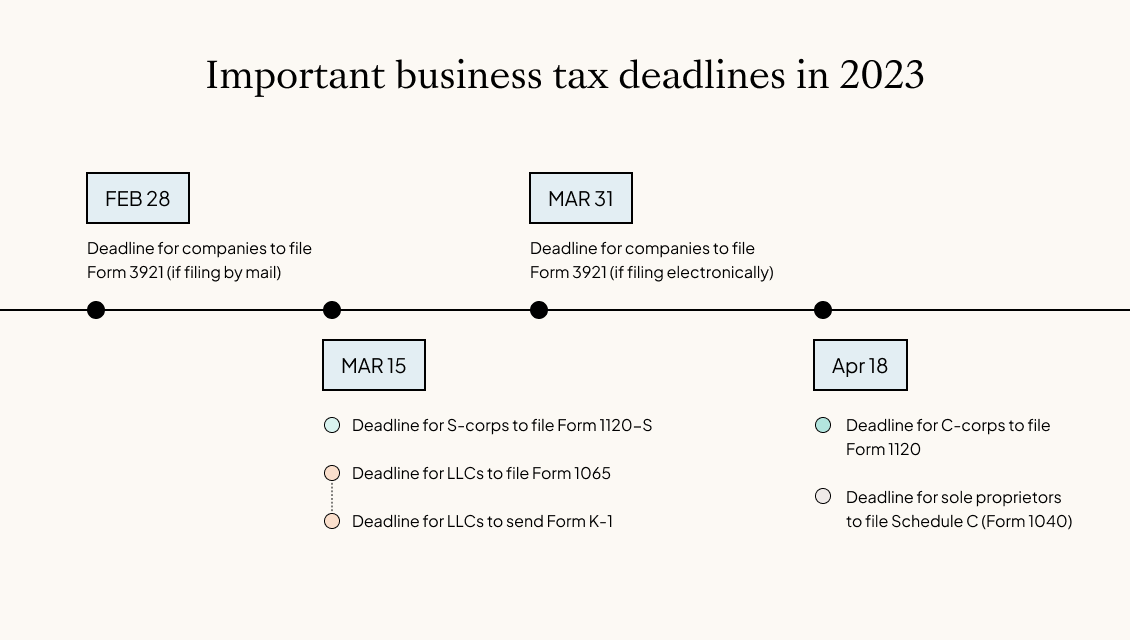

Business Tax Deadlines 2024 Corporations And Llcs Carta Published date: october 5, 2023. key tax deadlines are coming up in 2024 for llc and corporation businesses. here are the dates and irs forms you need to know. the 2024 deadline to file individual income tax returns for 2023 is april 15, 2024. tax deadlines vary for startups and other businesses classified as corporations and limited liability. The due date for your business’s federal income tax return for the 2023 tax year depends on the type of business you’re operating. for example, calendar year partnerships must file form 1065 by march 15, 2024, but calendar year corporations have until april 15, 2024, file form 1120. other business tax deadlines exist for estimated tax.

Business Tax Deadlines 2023 Corporations And Llcs Carta The first major deadline to note is january 31, 2024, when businesses must file form w 2 for employees and form 1099 nec for non employee compensation. this early deadline ensures that employees and contractors receive their tax documents promptly, allowing them to file their personal taxes without delay. march 15, 2024, is another significant. In addition, state corporate income taxes range from 1% to 12% (although some states impose no income tax) and are deductible expenses for federal income tax purposes. for 2024, llcs filing as a c corporation must file form 1120 by april 15 without an extension. with an extension, the deadline for filing is october 15. Key business tax deadlines in 2024. january 31st: deadline to send w 2 forms to employees, 1099 k and 1099 nec forms to non employee contractors. february 28 th: deadline for paper filings for 1099’s and 1099 div. march 1 st: delaware franchise annual report & tax payments are due. march 15th: deadline for partnerships, multi member llcs, and. The filing deadline for form 1120 is typically on the 15th day of the fourth month after the end of a corporation’s fiscal tax year. for example, if a corporation operates on a calendar year, the due date for its form 1120 would be april 15, 2024, for the 2023 tax year. for corporations with a fiscal year that ends on june 30th, a special.

Business Tax Deadlines 2024 Corporations And Llcs Key business tax deadlines in 2024. january 31st: deadline to send w 2 forms to employees, 1099 k and 1099 nec forms to non employee contractors. february 28 th: deadline for paper filings for 1099’s and 1099 div. march 1 st: delaware franchise annual report & tax payments are due. march 15th: deadline for partnerships, multi member llcs, and. The filing deadline for form 1120 is typically on the 15th day of the fourth month after the end of a corporation’s fiscal tax year. for example, if a corporation operates on a calendar year, the due date for its form 1120 would be april 15, 2024, for the 2023 tax year. for corporations with a fiscal year that ends on june 30th, a special. If all estimated taxes were paid by january 16, 2024, the due date for filing your return is april 15 (with some exceptions). friday, march 15, 2024. s corporation and partnership tax return due date for calendar year businesses are due. this is also the deadline to file an s corporation and partnership tax extension (using irs form 7004). From w 2s to 1099s for contractors, these documents confirm that everyone’s getting paid by the books. january 31st is your deadline for sending w 2s and or copy b of form 3921 to your employees. digital payroll services like adp, aside from simplifying payday tasks month to month can also help ensure everything lines up at year end.

Comments are closed.