Buyers Take Control Of Housing Market As Asking Prices Drop Interest

Buyers Take Control Of Housing Market As Asking Prices Drop Interest In forest hill, mr. kutyan was keeping an eye on one house listed with an asking price just below the $9 million mark in the spring of 2023. mr. kutyan watched the property’s asking price drop. For the first time in over a decade, prospective buyers are making conditional offers, asking for home inspections and pulling out if they don’t get the price they want. updated oct. 5, 2023 at.

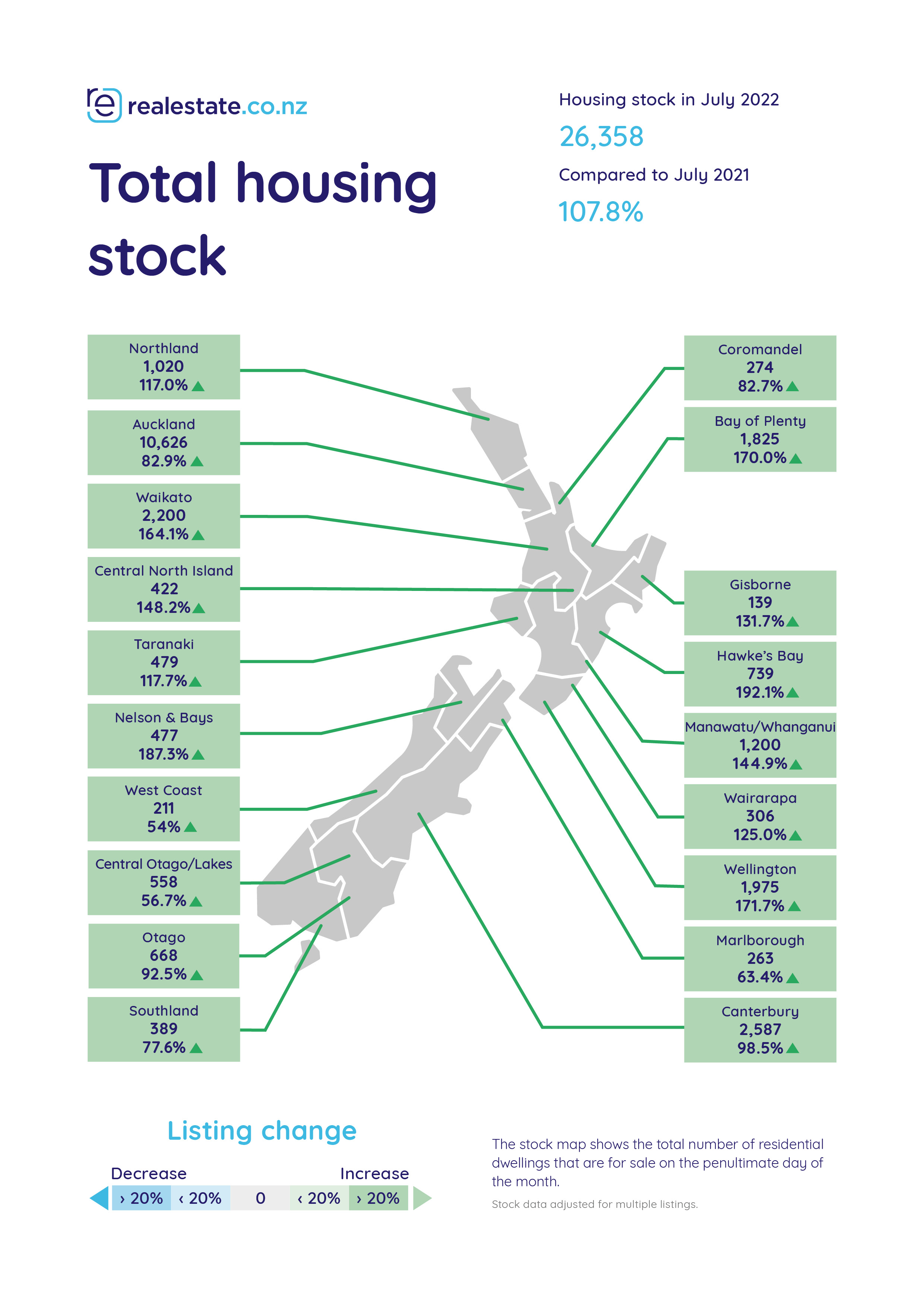

Buyers Take Control Of Housing Market As Asking Prices Drop Interest Detached homes had an average price of $1,468,651, down 13.5 per cent from a year ago, while semi detached properties dropped more than 17 per cent to $1,087,924. townhouses cost an average of. Inevitably there has been downward pressure on asking prices, with the national average asking price of properties listed for sale on realestate.co.nz declining from its january 2022 peak of $994,885 to $907,411 in july, down by $87,474 ( 8.8%). the auckland the average asking price has declined from its january 2022 peak of $1,279,330 to. Canadian home prices fell by the most on record in 2022, as rapidly rising interest rates forced a market adjustment that may have further to go. the country’s benchmark home price fell 1.6% in. With a national median asking price of $425,000 and a 10 percent down payment, that works out to an additional $1,117 every month. home prices are going to drop, just not to the extent some.

How The Mortgage Rate Drop Will Affect The Housing Market Infographic Canadian home prices fell by the most on record in 2022, as rapidly rising interest rates forced a market adjustment that may have further to go. the country’s benchmark home price fell 1.6% in. With a national median asking price of $425,000 and a 10 percent down payment, that works out to an additional $1,117 every month. home prices are going to drop, just not to the extent some. Penelope graham, mortgage expert at ratehub.ca, said in a statement to bnnbloomberg.ca wednesday that it “remains to be seen” if the bank of canada’s most recent rate cut will incentivize home buyers to re enter the market amid still elevated borrowing costs. “however, we did see a slight uptick in sales as a result of the june rate cut. Overall, canada's housing market is adapting to a new normal, one characterized by moderate growth and a focus on affordability. current market trends suggest strong potential for continued home price appreciation in 2024. factors like stable interest rates and a controlled bank of canada (boc) approach can further fuel this momentum.

Comments are closed.