Calculate 2023 Taxable Income

How To Calculate Your Taxable Income 2023 The income tax calculator estimates the refund or potential owed amount on a federal tax return. it is mainly intended for residents of the u.s. and is based on the tax brackets of 2023 and 2024. the 2024 tax values can be used for 1040 es estimation, planning ahead, or comparison. file status. Use this free income tax calculator to project your 2023 2024 federal tax bill or refund based on earnings, age, deductions and credits. editor's note: tax returns for 2023 were due by april 15, 2024.

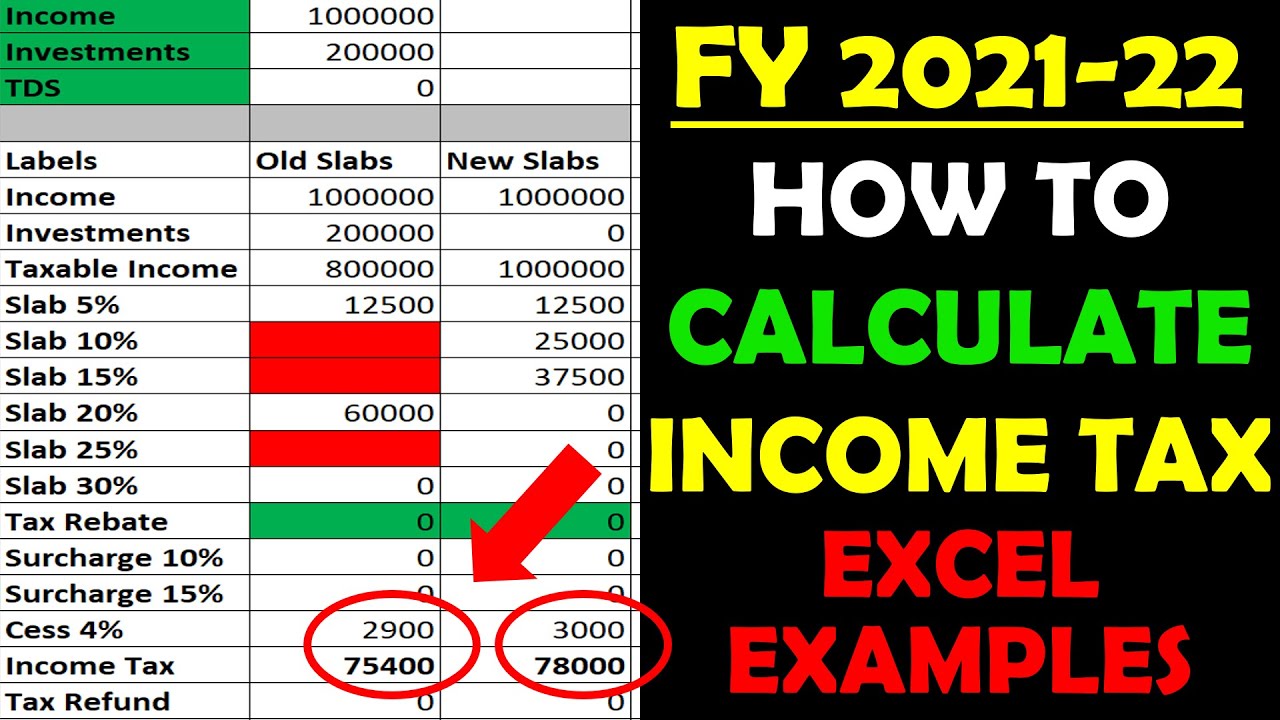

Taxable Income Formula Calculator Examples With Excel Template Rental property income. credits, deductions and income reported on other forms or schedules. use our tax bracket calculator to understand what tax bracket you're in for your 2023 2024 federal income taxes. based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. State taxes. marginal tax rate 5.85%. effective tax rate 4.88%. new york state tax $3,413. gross income $70,000. total income tax $11,074. after tax income $58,926. disclaimer: calculations are. Estimate your us federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using irs formulas. the calculator will calculate tax on your taxable income only. does not include income credits or additional taxes. does not include self employment tax for the self employed. also calculated is your net income, the amount you. Calculate your federal taxes with h&r block’s free income tax calculator tool. answer a few, quick questions to estimate your 2023 2024 tax refund.

Calculate Taxable Income 2023 Online Estimate your us federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using irs formulas. the calculator will calculate tax on your taxable income only. does not include income credits or additional taxes. does not include self employment tax for the self employed. also calculated is your net income, the amount you. Calculate your federal taxes with h&r block’s free income tax calculator tool. answer a few, quick questions to estimate your 2023 2024 tax refund. As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. for a single taxpayer, the rates are:. How to calculate federal tax based on your annual income. the 2023 tax calculator uses the 2023 federal tax tables and 2023 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here icalculator aims to make calculating your federal and state taxes and medicare as simple as.

How To Calculate Your Taxable Income 2023 As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. for a single taxpayer, the rates are:. How to calculate federal tax based on your annual income. the 2023 tax calculator uses the 2023 federal tax tables and 2023 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here icalculator aims to make calculating your federal and state taxes and medicare as simple as.

Calculate Taxable Income 2023 Online

Comments are closed.