Calculating Federal Income Taxes Using Excel 2023 Tax Brackets

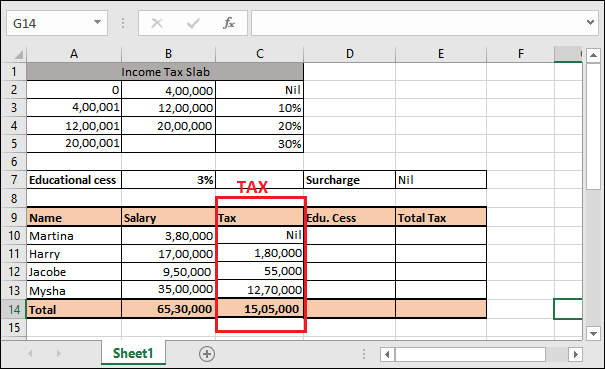

Calculating Federal Income Taxes Using Excel 2023 Tax Brackets Youtube In this video, i use a simple excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket. in the proce. Summary. = index (tax table,0, match (c4, status list,0) * 2 1) to calculate the total income tax owed in a progressive tax system with multiple tax brackets, you can use a simple, elegant approach that leverages excel's new dynamic array engine. in the worksheet shown, the main challenge is to split the income in cell i4 into the correct tax.

Calculating Federal Income Taxes Using Excel 2023 Taxођ Step 5 – calculate federal tax rate. we will compute the effective tax rate by applying the following formula: effective federal tax rate = total tax expenses total taxable income. the total tax expense is $15,738.75 (cell g8), and the total taxable income is $80,000 (cell f8). download the practice workbook. calculating federal tax.xlsx. Irs tax tip 2023 21, february 16, 2023. a few minutes spent reviewing income tax withholding early in the year helps set a taxpayer up for success all year long. the tax withholding estimator on irs.gov makes it easy to figure out how much to withhold. this online tool helps employees withhold the correct amount of tax from their wages. You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Your effective tax rate is different. it averages the amount of taxes you paid on all of your income. to calculate this rate, take the sum of all your lost income and divide that number by your.

Calculating Federal Income Taxes Using Excel 2023 Taxођ You pay tax as a percentage of your income in layers called tax brackets. as your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a. Your effective tax rate is different. it averages the amount of taxes you paid on all of your income. to calculate this rate, take the sum of all your lost income and divide that number by your. Rental property income. credits, deductions and income reported on other forms or schedules. use our tax bracket calculator to understand what tax bracket you're in for your 2023 2024 federal income taxes. based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). there are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Example Of Income Tax Calculation 2023 24 Rental property income. credits, deductions and income reported on other forms or schedules. use our tax bracket calculator to understand what tax bracket you're in for your 2023 2024 federal income taxes. based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). there are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Calculating Federal Income Taxes Using Excel 2023 Taxођ

Comments are closed.