Calculating Future Value On Excel

How To Calculate Future Value In Excel With Different Payments Youtube To calculate the future value of this investment: step 1) write the fv function as follows. xxxxxxxxxx. = fv [b4, b5, b3, b2] rate is referred (cell b4) to as the first argument. no of periods (cell b5) referred to as the second argument. cell b3 is referred to as the pmt argument. Future value in excel. the future value (fv) is one of the key metrics in financial planning that defines the value of a current asset in the future. in other words, fv measures how much a given amount of money will be worth at a specific time in the future. normally, the fv calculation is based on an anticipated growth rate, or rate of return.

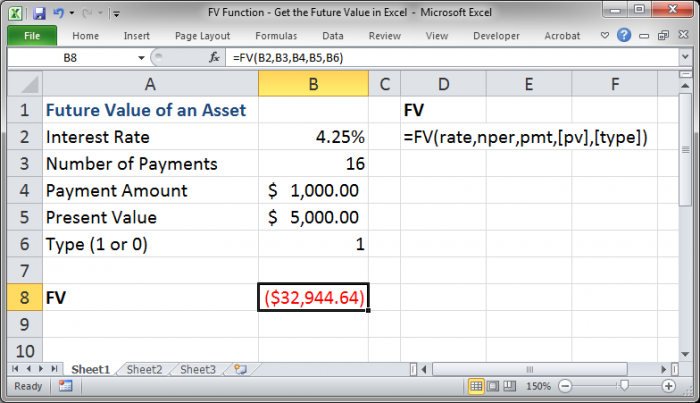

Fv Function Get The Future Value In Excel Teachexcel 5. 4. future value: =10000* (1 4%)^5. for example, if an investment of $10,000 earns an annual interest rate of 4%, the investment's future value after 5 years can be calculated by typing the following formula into any excel cell: =10000* (1 4%)^5. which gives the result 12166.52902. Fv, one of the financial functions, calculates the future value of an investment based on a constant interest rate. you can use fv with either periodic, constant payments, or a single lump sum payment. use the excel formula coach to find the future value of a series of payments. at the same time, you'll learn how to use the fv function in a. What is the excel fv function? the fv function excel formula is categorized under financial functions. this function helps calculate the future value of an investment. as a financial analyst, the fv function helps calculate the future value of investments made by a business, assuming periodic, constant payments with a constant interest rate. it. Fv is one of the core financial functions in excel. it calculates the future value of an investment or a loan based on constant payments and a constant interest rate. the syntax is as follows: =fv(rate, nper, pmt, [pv], [type]) where: rate is the interest rate for each period, expressed as a decimal in percentage format (e.g., 5% as 0.05).

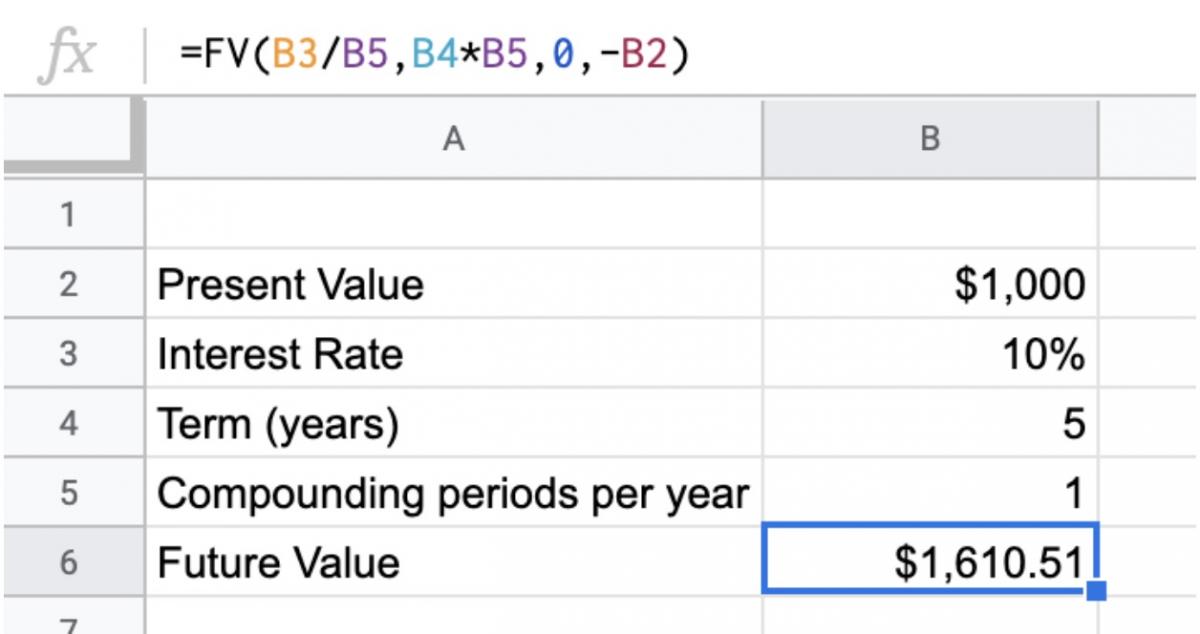

How To Calculate The Future Value In Excel On An Annual Or Monthly What is the excel fv function? the fv function excel formula is categorized under financial functions. this function helps calculate the future value of an investment. as a financial analyst, the fv function helps calculate the future value of investments made by a business, assuming periodic, constant payments with a constant interest rate. it. Fv is one of the core financial functions in excel. it calculates the future value of an investment or a loan based on constant payments and a constant interest rate. the syntax is as follows: =fv(rate, nper, pmt, [pv], [type]) where: rate is the interest rate for each period, expressed as a decimal in percentage format (e.g., 5% as 0.05). The future value (fv) function calculates the future value of an investment assuming periodic, constant payments with a constant interest rate. notes: 1. units for rate and nper must be consistent. for example, if you make monthly payments on a four year loan at 12 percent annual interest, use 12% 12 (annual rate 12 = monthly interest rate) for. And the number of payments per period is converted into the monthly number of payments as. nper – 5 (years) * 12 (months per year) = 60. no regular payments are being made, so the value of pmt argument is. pmt = 0. the formula used for the calculation is: =fv(d7,d8,d9,d10,d11) the future value of the investment is. fv = $1,492.81.

Fv Function In Excel To Calculate Future Value The future value (fv) function calculates the future value of an investment assuming periodic, constant payments with a constant interest rate. notes: 1. units for rate and nper must be consistent. for example, if you make monthly payments on a four year loan at 12 percent annual interest, use 12% 12 (annual rate 12 = monthly interest rate) for. And the number of payments per period is converted into the monthly number of payments as. nper – 5 (years) * 12 (months per year) = 60. no regular payments are being made, so the value of pmt argument is. pmt = 0. the formula used for the calculation is: =fv(d7,d8,d9,d10,d11) the future value of the investment is. fv = $1,492.81.

Future Value Fv Definition Examples Investinganswers

Comments are closed.