Calculation Of Present Value Youtube

Calculation Of Present Value Youtube What’s better than watching videos from alanis business academy? doing so with a delicious cup of freshly brewed premium coffee. visit lannacoffe. This video explains the concept of net present value and illustrates how to calculate the net present value of a project via an example.— edspira is the crea.

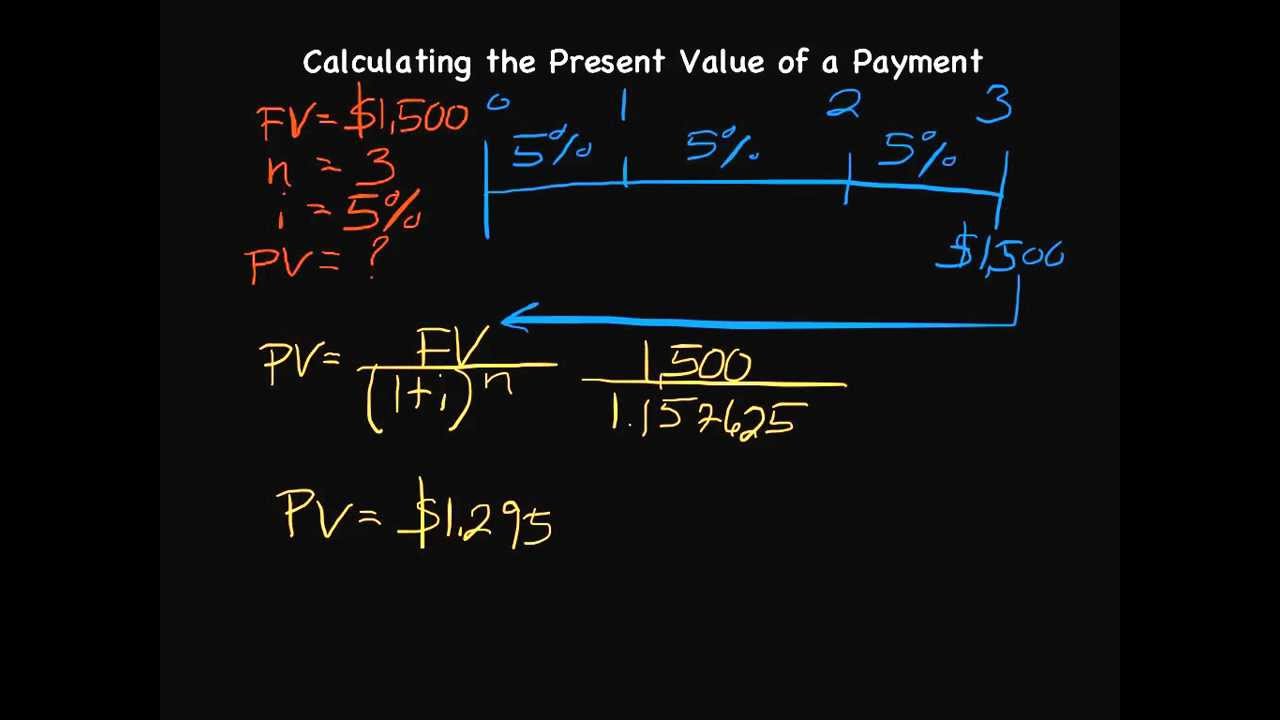

How To Calculate Present Value Youtube Net present value explained in a clear and simple way, in just a few minutes! two steps: first understanding the idea of present value and future value, and. Npv formula. in practice, the xnpv excel function is used to calculate the net present value (npv). =xnpv (rate, values, dates) where: rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows. values → the array of cash flows, with all cash outflows and inflows accounted for. Calculate npv discount each cash flow to its present value using the formula: pv = cash flow (1 discount rate)^year. sum the discounted cash flows add all present values. example: for a project with a cash inflow of $1,000 in year 1 and a discount rate of 10%, npv = $1,000 (1 0.10)^1 = $909.09. Formula to calculate present value (pv) present value, a concept based on time value of money, states that a sum of money today is worth much more than the same sum of money in the future and is calculated by dividing the future cash flow by one plus the discount rate raised to the number of periods.

Comments are closed.