Capital Gains Tax 101 A Beginner S Guide For Stress Free Investing

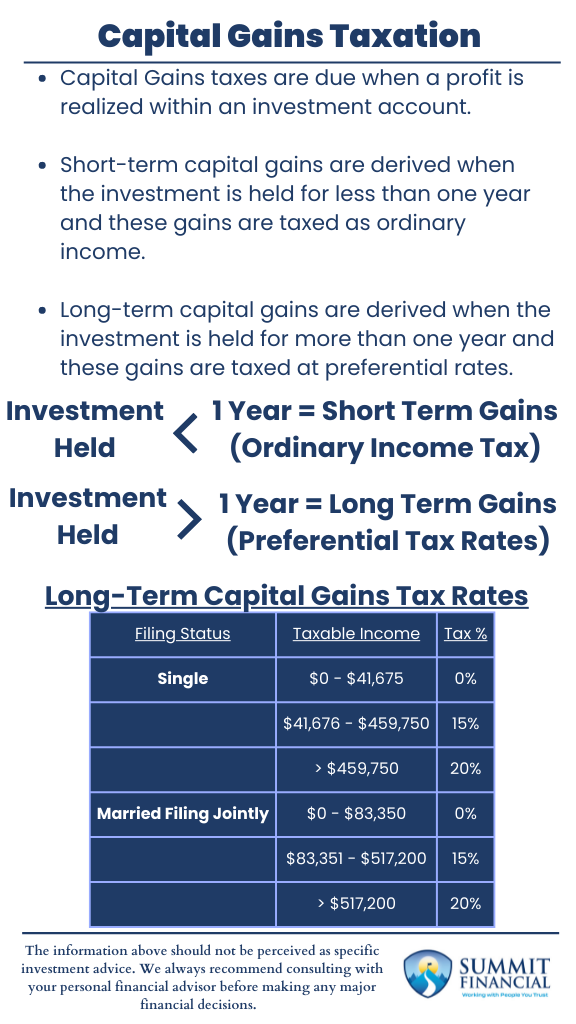

Capital Gains Tax 101 A Beginner S Guide To Understanding The Ba However, only $3,000 worth of losses can be deducted in a single year. any losses above $3,000 will be carried forward and can be applied to next year’s tax returns. summary: capital gains tax in summary, understanding how to calculate your capital gains tax rate is an essential step for most investors. there are a few key factors to consider:. The capital gains rates are 0%, 15%, and 20%, depending on your taxable income. here's a breakdown for tax years 2023 and 2024: although marginal tax brackets have changed over the years.

Capital Gains Tax 101 A Beginner S Guide For Stress Free Investing Welcome to our beginner’s guide to capital gains! if you’re new to investing or just starting to dip your toes into the world of finance, understanding capital gains is essential. don’t worry if terms like “capital gains tax” or “cost basis” sound like a foreign language right now – we’re here to break it all down for you in. You also may be required to pay estimated taxes on capital gains. generally, you must pay 90% of your current year's taxes, or an amount equal to 100% of your taxes from the prior year (110% if. Capital gains tax rate 2024. in 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income. Investment accounts. tax efficient investing involves choosing the right investments and accounts to hold those investments. there are two main types of investment accounts: taxable and tax.

Comments are closed.