Capital Gains Tax What It Is How It Works And Current Rates Updated

The Beginner S Guide To Capital Gains Tax Infographic Transform A capital gains tax is a tax imposed on the sale of an asset. the long term capital gains tax rates for the 2023 and 2024 tax years are 0%, 15%, or 20% of the profit, depending on the income of. Capital gains tax rate 2024. in 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income.

Current Us Long Term Capital Gains Tax Rate Tax Walls You also may be required to pay estimated taxes on capital gains. generally, you must pay 90% of your current year's taxes, or an amount equal to 100% of your taxes from the prior year (110% if. Long term capital gains are taxed at lower rates than ordinary income, while short term capital gains are taxed as ordinary income. we've got all the 2023 and 2024 capital gains tax rates in one. The capital gains tax is levied on any profit made from the sale of an asset in a given year, whether it’s a home, a car, stocks and bonds or cryptocurrency. not everyone pays capital gains tax. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. when you sell a capital asset like a mutual fund, exchange traded fund (etf), or stock, there’s a tax implication. but knowing what tax rate applies depends on several factors.

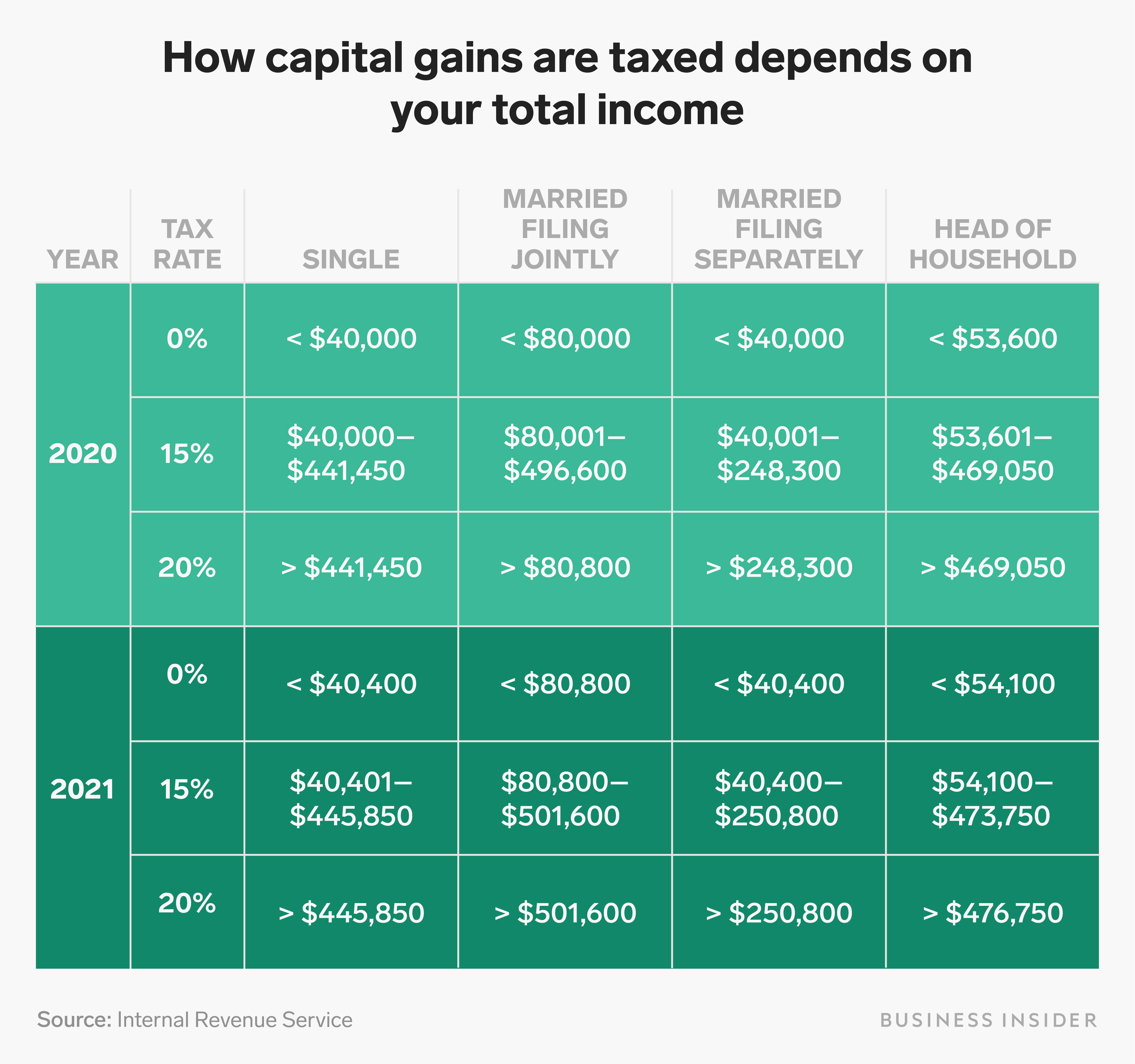

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns The capital gains tax is levied on any profit made from the sale of an asset in a given year, whether it’s a home, a car, stocks and bonds or cryptocurrency. not everyone pays capital gains tax. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. when you sell a capital asset like a mutual fund, exchange traded fund (etf), or stock, there’s a tax implication. but knowing what tax rate applies depends on several factors. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. the income thresholds for long term capital gains are adjusted annually. Learn how capital gains taxes work and strategies to minimize them. updated september 13, 2024. reviewed by. capital gains tax rates are the same in 2024 as they were in 2023: 0%, 15%, or.

Capital Gains Tax Rates How To Calculate Them And Tips On How To The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. the income thresholds for long term capital gains are adjusted annually. Learn how capital gains taxes work and strategies to minimize them. updated september 13, 2024. reviewed by. capital gains tax rates are the same in 2024 as they were in 2023: 0%, 15%, or.

State Capital Gains Tax Rates Navigating Zero High Low Tax States

Comments are closed.