Car Loan Calculators To Help You Shop Roadloans

Car Loan Calculators To Help You Shop Roadloans Adding a figure to the down payment field will increase the estimated amount you have to spend on a car. here’s an example. a car shopper enters a monthly payment of $450 with a 60 month loan term, six percent apr and a $4,000 down payment, which is the value of their trade in. the estimated amount they have to spend is $27,277. Once you’ve selected your vehicle and settled the price, the dealer will work with us to finalize the financing. our knowledgeable loan specialists are ready to help if you have any questions about the application or financing process. call (888) 276 7202 or use the online chat service.

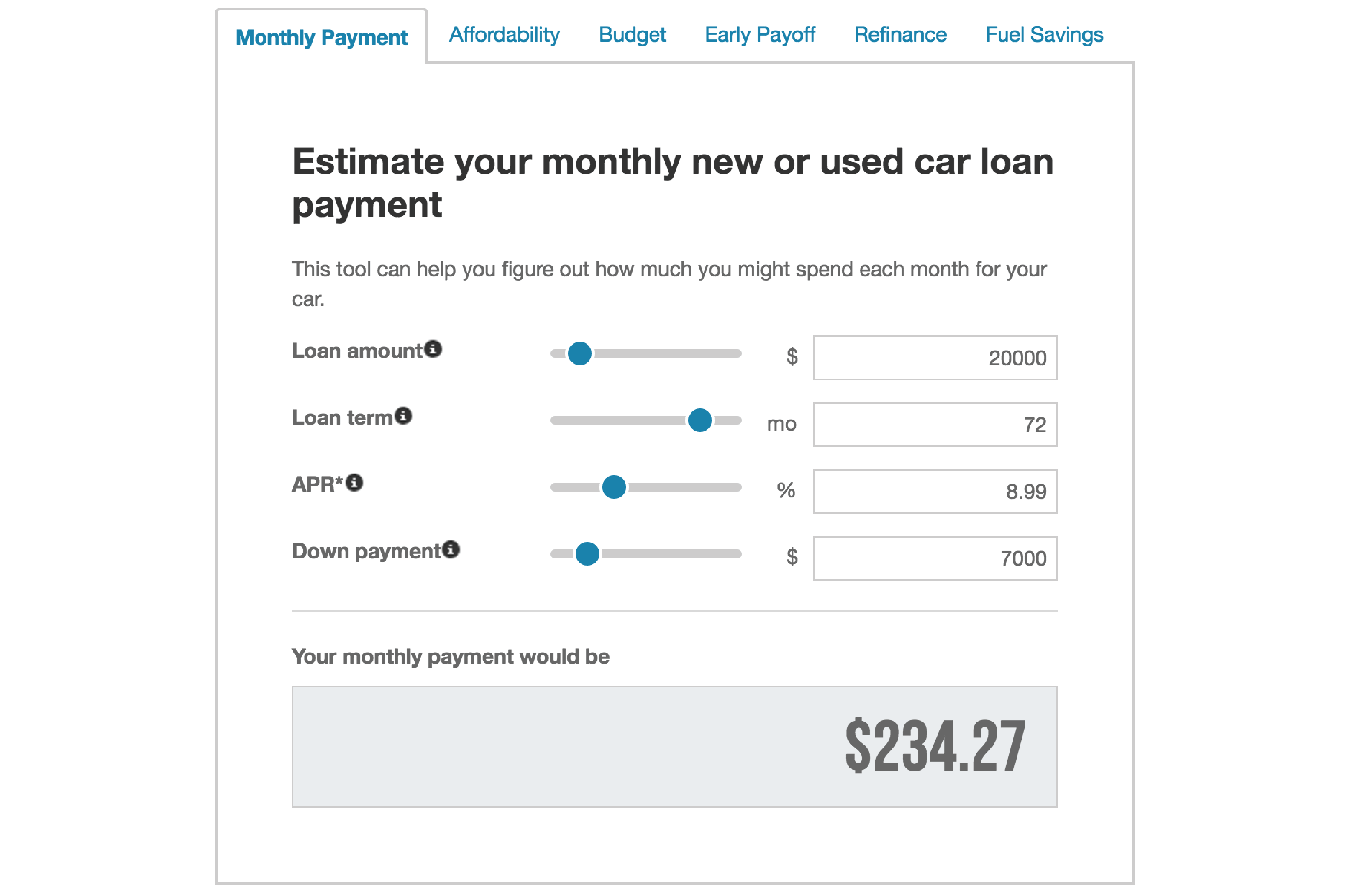

Car Loan Calculators To Help You Shop Roadloans Your car budget includes car payments, auto insurance, gas, maintenance, and repairs. learn about the 5 year cost to own evaluation to help calculate this budget. with an idea of budget in mind. The car loan calculator uses the following basic formula: monthly car loan payment = { rate rate [ (1 rate) months 1] } x principal car loan amount. where: rate (monthly interest rate) = decimal rate 12 , or rate = (annual interest rate 100) 12. car loan repayment calculator. Auto loan amortization calculator. see how much buying a new car will cost you with our easy auto loan calculator! whether you're looking to buy a new car, refinance your existing vehicle, or buy out a lease, this calculator will help you make the right decision. all you'll need is some necessary information, and you'll see the monthly payment. This auto loan calculator automatically adjusts the method used to calculate sales tax involving trade in value based on the state provided. using the values from the example above, if the new car was purchased in a state without a sales tax reduction for trade ins, the sales tax would be: $50,000 × 8% = $4,000.

Comments are closed.