Changes Of Interest Rate Over Business Cycle

Changes Of Interest Rate Over Business Cycle Since the 1950s, a u.s. economic cycle, on average, lasted about five and a half years. however, there is wide variation in the length of cycles, ranging from just 18 months during the peak to. To interpret the typical spectral shape of growth rates, it is useful to briefly review some key elements of time series analysis in the frequency domain. a covariance stationary variable xt can be decomposed into an integral of periodic components: π π. xt = z xt(ω)dω = z [a(ω) cos(ωt) b(ω) sin(ωt)]dω (1) 0 0.

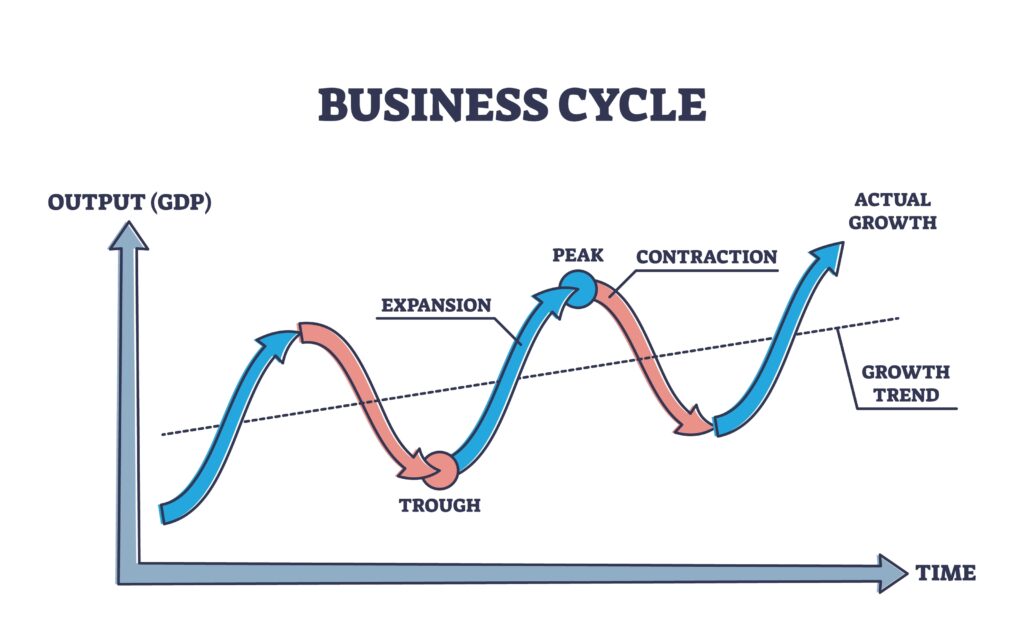

4 Stages Of The Economic Cycle Britannica Money Moreover, the forces that shape the business cycle change over time. for example, for about 20 years starting in the mid 1960s, inflation was a huge concern. it was over 4 percent throughout much of that period, even soaring above 10 percent at times. however, that changed as the federal reserve began more aggressively fighting inflation. In the short term, the business cycle is primarily driven by fluctuations in consumer spending and business investment. over the business cycle, the rate at which the economy is expanding or contracting can be significantly different. for example, during the 2009 2020 expansion, real gdp grew at an average pace of about 2.3% per year, whereas real. Four phases of an economic cycle. although there are numerous theories explaining what causes economic cycles, most generally agree on the four phases: expansion, peak, contraction, and recovery. phase 1: expansion. during the expansion phase, interest rates are often on the low side, making it easier for consumers and businesses to borrow money. Business cycle, periodic fluctuations in the general rate of economic activity, as measured by the levels of employment, prices, and production. figure 1, for example, shows changes in wholesale prices in four western industrialized countries over the period from 1790 to 1940. as can be seen, the movements are not, strictly speaking, cyclic.

Understanding Stock Market And Economic Cycles Four phases of an economic cycle. although there are numerous theories explaining what causes economic cycles, most generally agree on the four phases: expansion, peak, contraction, and recovery. phase 1: expansion. during the expansion phase, interest rates are often on the low side, making it easier for consumers and businesses to borrow money. Business cycle, periodic fluctuations in the general rate of economic activity, as measured by the levels of employment, prices, and production. figure 1, for example, shows changes in wholesale prices in four western industrialized countries over the period from 1790 to 1940. as can be seen, the movements are not, strictly speaking, cyclic. Key economic variables change through the business cycle. the level of business investment shows significant changes over the cycle. employment levels follow the cycle with a delay as companies initially use overtime before hiring after the onset of recovery and then reduce overtime before reducing employment as the economy passes its peak and. America’s bout of painfully high inflation — and the period of high interest rates meant to cure it — is finally drawing toward a close. price increases are nearly back to a normal pace, so.

Comments are closed.