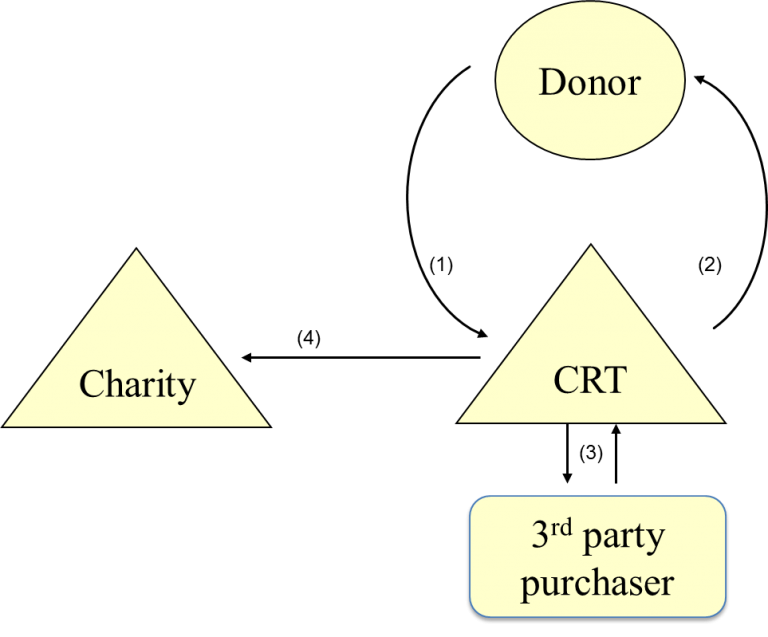

Charitable Remainder Trust Crt Explained

Charitable Remainder Trusts Crt Charitable Tools Explained Donor Reversing Course People with high incomes or ample assets— as well as those likely to be there in the future —should stop contributing to pre-tax 401 (k)s and IRAs The tax deductions offered by such To avoid that tax trap, it’s time for un-required distributions Start trimming IRA and other retirement account balances now in order to use today’s historically low tax rates Take full advantage of

Charitable Remainder Trusts Crt Charitable Tools Explained Donorstrust

Comments are closed.