Clues 1 Helps Consumers Who Are Having Difficulty Paying Their

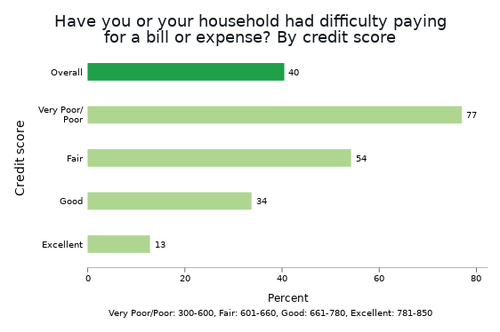

Clues 1 Helps Consumers Who Are Having Difficulty Paying Their 3 consumer insights on managing spending . 1. executive summary . having control over day to day, month to month finances is one of the four elements of financial well being. 1. to better help consumers make well informed financial decisions and achieve their financial goals, the cfpb sought to increase its understanding of the day to day. Because some consumers struggle to pay all their bills in a timely manner, the bureau focused on paying bills as an area for potential solutions. bureau research 3 found that empowering consumers to do something as simple as changing bill due dates to better line up with income could help some consumers better manage their cash flow .

Credit Card Debt Fell Even For Consumers Who Were Having Financial If you expect to have trouble paying off debts, there are several things you can do to keep your head above water. first, figure out how bad your situation is. get a handle on your how much cash. Bill calendar. this tool can help you keep track of when your bills are due and avoid late fees. for some bills, like credit cards, you may be able to adjust the bill’s due date by contacting your credit card company. for others, like rent, you may be able to split a large monthly payment into two smaller payments. download the bill calendar. Participants can often get a free or low cost budget review to help them identify areas where they may be able to cut spending and reduce their debt. consumers with more serious debt problems. Medical bills, 11 percent utility bills, 5.7 percent rent, and 4.8 percent mortgage. consumers with one difficulty tended to have others. three quarters of consumers with difficulty paying medical bills, rent, or mortgages also had an income drop. two thirds of consumers with difficulty paying the rent also had difficulty paying a utility bill.

Complete The Chart Which Of These Clues Help You Understand What Digest Participants can often get a free or low cost budget review to help them identify areas where they may be able to cut spending and reduce their debt. consumers with more serious debt problems. Medical bills, 11 percent utility bills, 5.7 percent rent, and 4.8 percent mortgage. consumers with one difficulty tended to have others. three quarters of consumers with difficulty paying medical bills, rent, or mortgages also had an income drop. two thirds of consumers with difficulty paying the rent also had difficulty paying a utility bill. Even if you don’t have a mortgage that’s eligible for a streamline refinance, you may still have options when it comes to refinancing after the pandemic. in april 2021, the federal housing finance agency announced a new program that allows low income families with fannie mae or freddie mac properties to reduce their payments by as much as $250 per month. The first quarter jump in severe delinquencies was the biggest since 2012. meanwhile total credit card debt rose to $1.12 trillion from just under $1 trillion a year ago. those in their 20s and 30s are having the most difficulty paying their credit card bills. those age groups typically have a mix of less earnings power and lower savings.

What Are Context Clues Inference Context Clues Examples Even if you don’t have a mortgage that’s eligible for a streamline refinance, you may still have options when it comes to refinancing after the pandemic. in april 2021, the federal housing finance agency announced a new program that allows low income families with fannie mae or freddie mac properties to reduce their payments by as much as $250 per month. The first quarter jump in severe delinquencies was the biggest since 2012. meanwhile total credit card debt rose to $1.12 trillion from just under $1 trillion a year ago. those in their 20s and 30s are having the most difficulty paying their credit card bills. those age groups typically have a mix of less earnings power and lower savings.

Iтащm юааhavingюаб юааdifficultyюаб юааpayingюаб For The Application Fee Is Anybody юааhavingюаб

Comments are closed.