Compound Interest Future Value

What Is Future Value Formula Compound Interest Examples Typically, cash in a savings account or a hold in a bond purchase earns compound interest and so has a different value in the future. a good example of this kind of calculation is a savings account because the future value of it tells how much will be in the account at a given point in the future. it is possible to use the calculator to learn. The basic formula for compound interest is: fv = pv (1 r) n. finds the future value, where: fv = future value, pv = present value, r = interest rate (as a decimal value), and; n = number of periods; and by rearranging that formula (see compound interest formula derivation) we can find any value when we know the other three:.

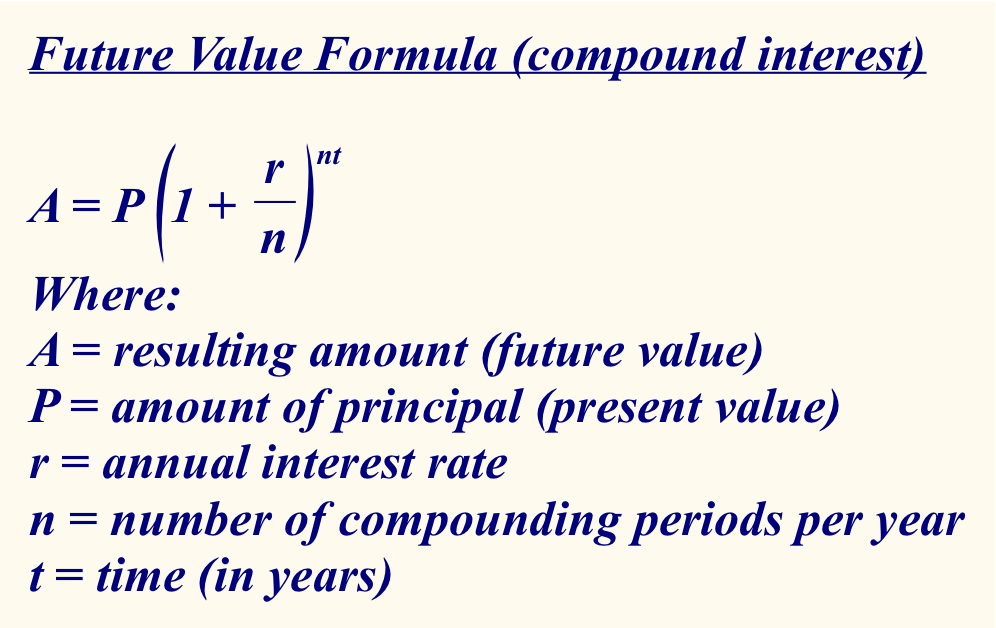

The Mind Blowing Math Of Money The Solver Blog Rimwe Educational Solution: to find: fututre value for an investment after 10 years. the present value (investment), pv = $1000. the rate of interest, r = 5% =5 100 = 0.05. the time in years, t = 10. since the amount is compounded daily, n = 365. using the future value formula of compound interest: fv = pv (1 r n) n t. Step 3: interest rate. estimated interest rate. your estimated annual interest rate. interest rate variance range. range of interest rates (above and below the rate set above) that you desire to see results for. The compound interest formula is: a = p (1 r n)nt. the compound interest formula solves for the future value of your investment (a). the variables are: p – the principal (the amount of money you start with); r – the annual nominal interest rate before compounding; t – time, in years; and n – the number of compounding periods in each. With a compounding interest rate, it takes 17 years and 8 months to double (considering an annual compounding frequency and a 4% interest rate). to calculate this: use the compound interest formula: fv = p × (1 (r m)) (m × t) substitute the values. the future value fv is twice the initial balance p, the interest rate r = 4%, and the.

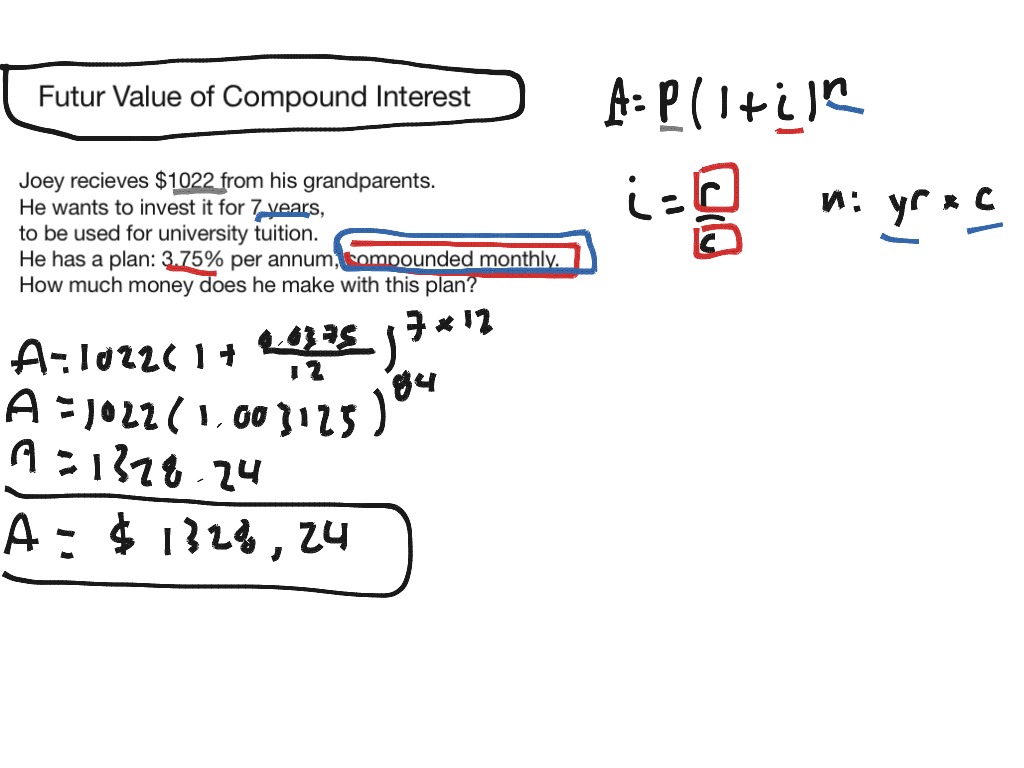

Future Value Of Compound Interest Math Compound Interest Showme The compound interest formula is: a = p (1 r n)nt. the compound interest formula solves for the future value of your investment (a). the variables are: p – the principal (the amount of money you start with); r – the annual nominal interest rate before compounding; t – time, in years; and n – the number of compounding periods in each. With a compounding interest rate, it takes 17 years and 8 months to double (considering an annual compounding frequency and a 4% interest rate). to calculate this: use the compound interest formula: fv = p × (1 (r m)) (m × t) substitute the values. the future value fv is twice the initial balance p, the interest rate r = 4%, and the. The future value formula using compounded annual interest is: fv = pv⋅(1 r) n. where: fv — future value; pv — present value; r — annual interest rate; and; n — years the money is invested. when the interest is compounded at other frequencies (quarterly or monthly), the formula to determine the future value results in: fv = pv⋅(1. Future value is the value of an investment at a future date based on an assumed growth rate. it's useful to know to estimate the profit an investment may offer. to compound interest, the 10%.

Comments are closed.