Consumer Banking Statistics

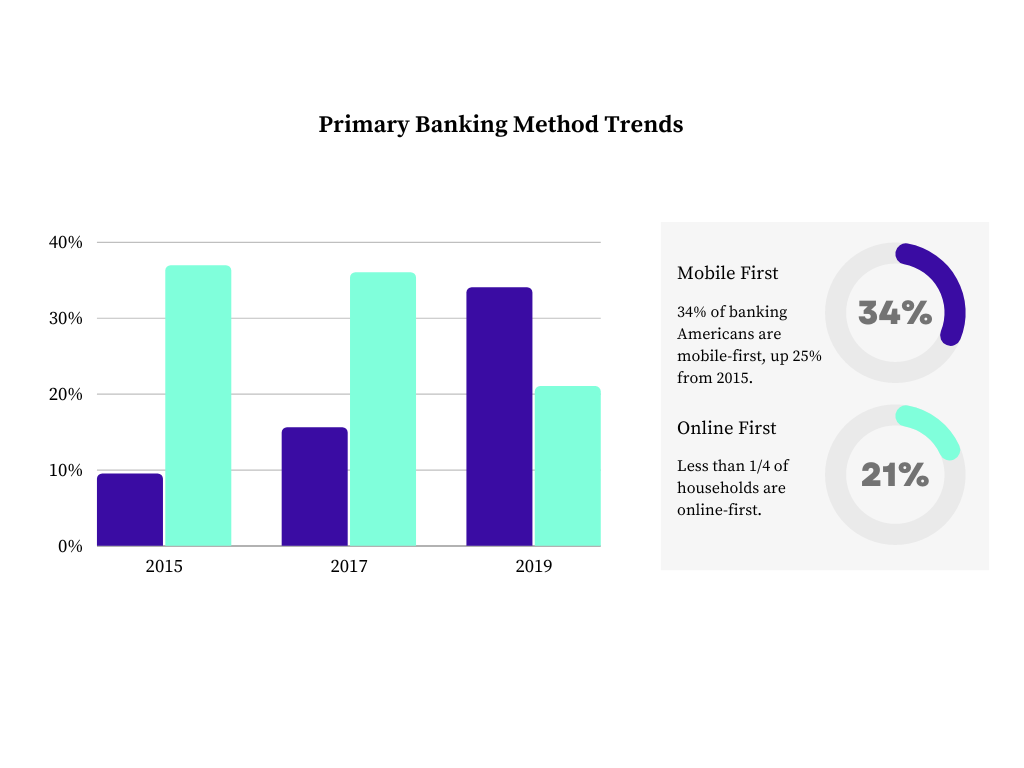

Consumer Banking Statistics And Trends In 2019 Valuepenguin The use of bank tellers was down to 21%, and telephone banking use was at just 2.4%. mobile banking access rose steadily from 9.5% in 2015 to 34% in 2019. the use of online banking remained. Consumer banking statistics 2024. consumer banking is a changing industry. decades of consolidation have reduced the total number of banks available to consumers, although the number of bank.

Consumer Banking Statistics And Trends In 2019 Valuepenguin Learn about the current state of consumer banking in the u.s., including account balances, rates, fees, preferences and trends. compare the top 10 largest banks and see how mobile banking is changing the industry. As of 2023, mobile banking is the primary choice of account access for 48 percent of u.s. consumers, making it the most prevalent banking method. (aba) digital wallets, such as paypal and apple. Compare consumer banking statistics for all insured institutions and commercial savings banks as of december 31, 2021. see changes in total assets, loans, deposits, net income, and other indicators from the previous quarter. National unbanked rate. an estimated 4.5 percent of u.s. households (approximately 5.9 million) were “unbanked” in 2021, meaning that no one in the household had a checking or savings account at a bank or credit union. the unbanked rate in 2021—4.5 percent—was the lowest since the survey began in 2009.

Consumer Banking Statistics And Trends In 2019 Valuepenguin Compare consumer banking statistics for all insured institutions and commercial savings banks as of december 31, 2021. see changes in total assets, loans, deposits, net income, and other indicators from the previous quarter. National unbanked rate. an estimated 4.5 percent of u.s. households (approximately 5.9 million) were “unbanked” in 2021, meaning that no one in the household had a checking or savings account at a bank or credit union. the unbanked rate in 2021—4.5 percent—was the lowest since the survey began in 2009. Find the most up to date statistics and facts on banking industry in the united states. premium statistic quarterly delinquency on consumer loans at commercial banks in the u.s. 2007 2024. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation's financial system. the fdic insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions.

Consumer Banking Statistics Trends Bankbonus Find the most up to date statistics and facts on banking industry in the united states. premium statistic quarterly delinquency on consumer loans at commercial banks in the u.s. 2007 2024. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation's financial system. the fdic insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions.

Consumer Banking Statistics Trends Bankbonus

Comments are closed.