Consumer Debt Vs Business Debt

The Difference Between Consumer Debt And Business Debt Law Offic Regardless of the pros and cons, consumer debt in the united states is on the rise due to the ease of obtaining financing matched with the high level of interest rates. as of may 2024, consumer. Business debt and personal debt can be easily mixed up depending on how you run your business and how clean you keep your books. but when it comes to business debt, it’s any money you’ve borrowed in order to start your company (or keep it afloat). listen closely: unless your business is bringing in over a million dollars a year, most of.

Consumer Debt Vs Business Debt Smallbizclub Why consumer debt vs. business debt matters the chapter 7 means test only applies to debtors who are primarily dealing with “consumer debts.” if more than half of the bankruptcy petitioner’s debts are non consumer or “business debts,” then the debtor can qualify for chapter 7, and receive a bankruptcy discharge, without needing to. If at least half of your debt is consumer debt, you must take the means test. dollar amount standard. most courts find that if greater than half of the dollar amount of your debt is non consumer or business, the means test doesn't apply. number of debts. a few courts require that the business debt also be greater than half of your debts in number. In short, in order to file for chapter 7 bankruptcy in tampa, you will need to meet the “means test.”. and if you have quite a bit of business debt but only a relatively small portion of consumer debt, you may be eligible to have your debts discharged under chapter 7. to better understand how this works, we would like to take a closer look. Classifying debt matters because there are different rules that relate to how you can and cannot collect debt, depending on whether the debt is business related, or whether the debt is what is known as consumer debt. consumer debt is generally debt that is incurred for personal, family or household purposes. the things that most of us charge or.

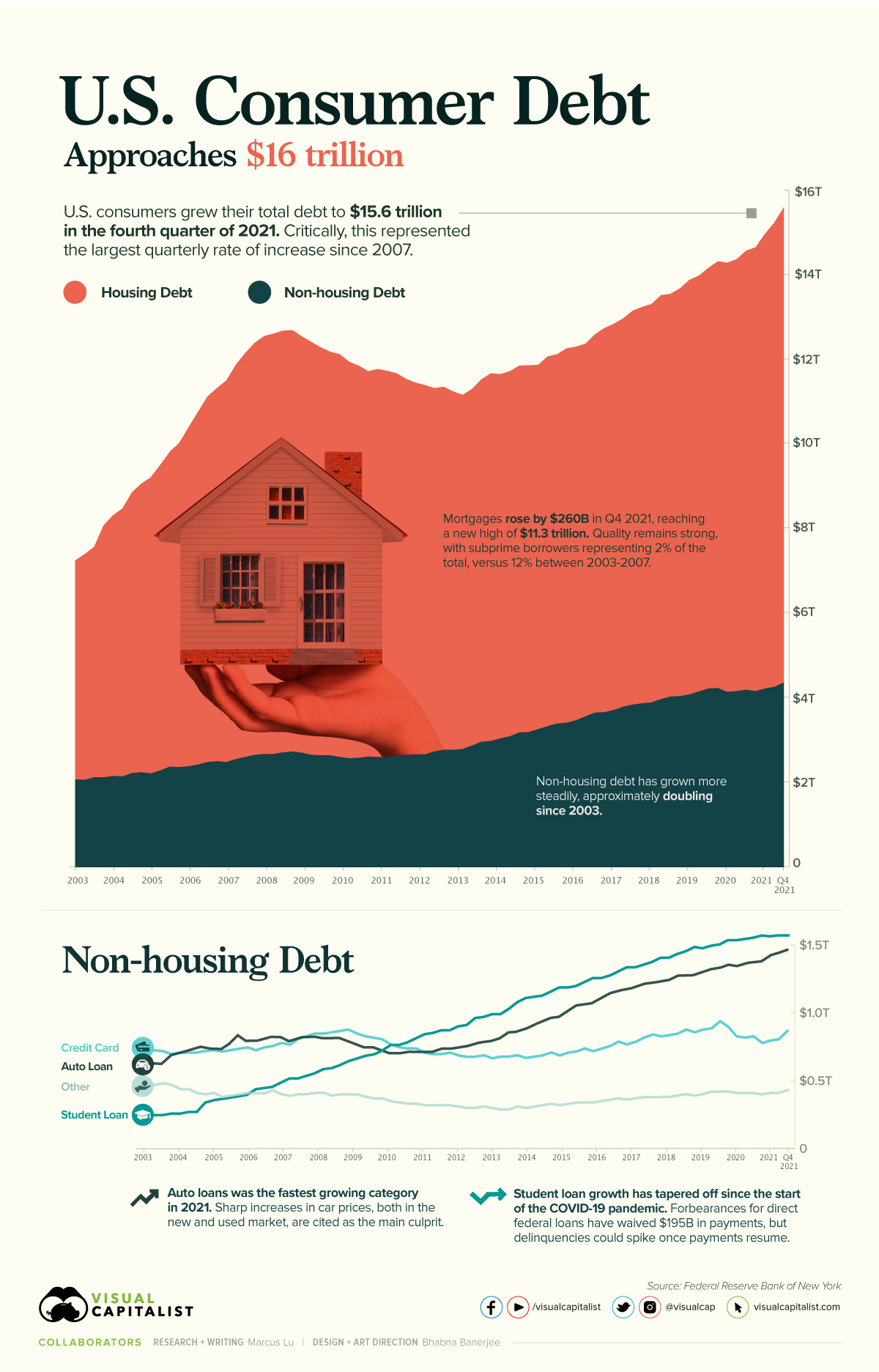

Charted U S Consumer Debt Approaches 16 Trillion In short, in order to file for chapter 7 bankruptcy in tampa, you will need to meet the “means test.”. and if you have quite a bit of business debt but only a relatively small portion of consumer debt, you may be eligible to have your debts discharged under chapter 7. to better understand how this works, we would like to take a closer look. Classifying debt matters because there are different rules that relate to how you can and cannot collect debt, depending on whether the debt is business related, or whether the debt is what is known as consumer debt. consumer debt is generally debt that is incurred for personal, family or household purposes. the things that most of us charge or. Consumer debt: definition and average balances in the u.s. consumer debt rose in the first quarter of 2023 to hit $17.05 trillion, as reported by the federal reserve bank of new york. while balances rose on mortgages and auto loans, credit card balances stayed relatively level. Consumer debt, as its name implies, is debt held by consumers, meaning private individuals as opposed to governments or businesses. it includes debts you may already have or might seek in the future — credit cards, student loans, auto loans, personal loans, and mortgages. it doesn’t include business loans or lines of credit or business.

Business Debt Vs Consumer Debt Things You Need To Know Consumer debt: definition and average balances in the u.s. consumer debt rose in the first quarter of 2023 to hit $17.05 trillion, as reported by the federal reserve bank of new york. while balances rose on mortgages and auto loans, credit card balances stayed relatively level. Consumer debt, as its name implies, is debt held by consumers, meaning private individuals as opposed to governments or businesses. it includes debts you may already have or might seek in the future — credit cards, student loans, auto loans, personal loans, and mortgages. it doesn’t include business loans or lines of credit or business.

Differences Between Consumer And Commercial Debt Collection

Comments are closed.