Consumer Financial Literacy Survey

Key Findings From The Nfcc 2016 Consumer Financial Literacy Survey The 2021 financial literacy annual report details the cfpb’s financial literacy strategy and activities to improve the financial literacy of consumers. overall, this report describes the cfpb’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. it highlights our work including: response to the. Aug 09, 2024. the 2023 financial literacy annual report describes the cfpb’s financial literacy activities and strategy to improve the financial literacy of consumers. this year’s report includes information about the cfpb’s efforts to be a source of unbiased, objective information consumers can trust, as well as examples of effective.

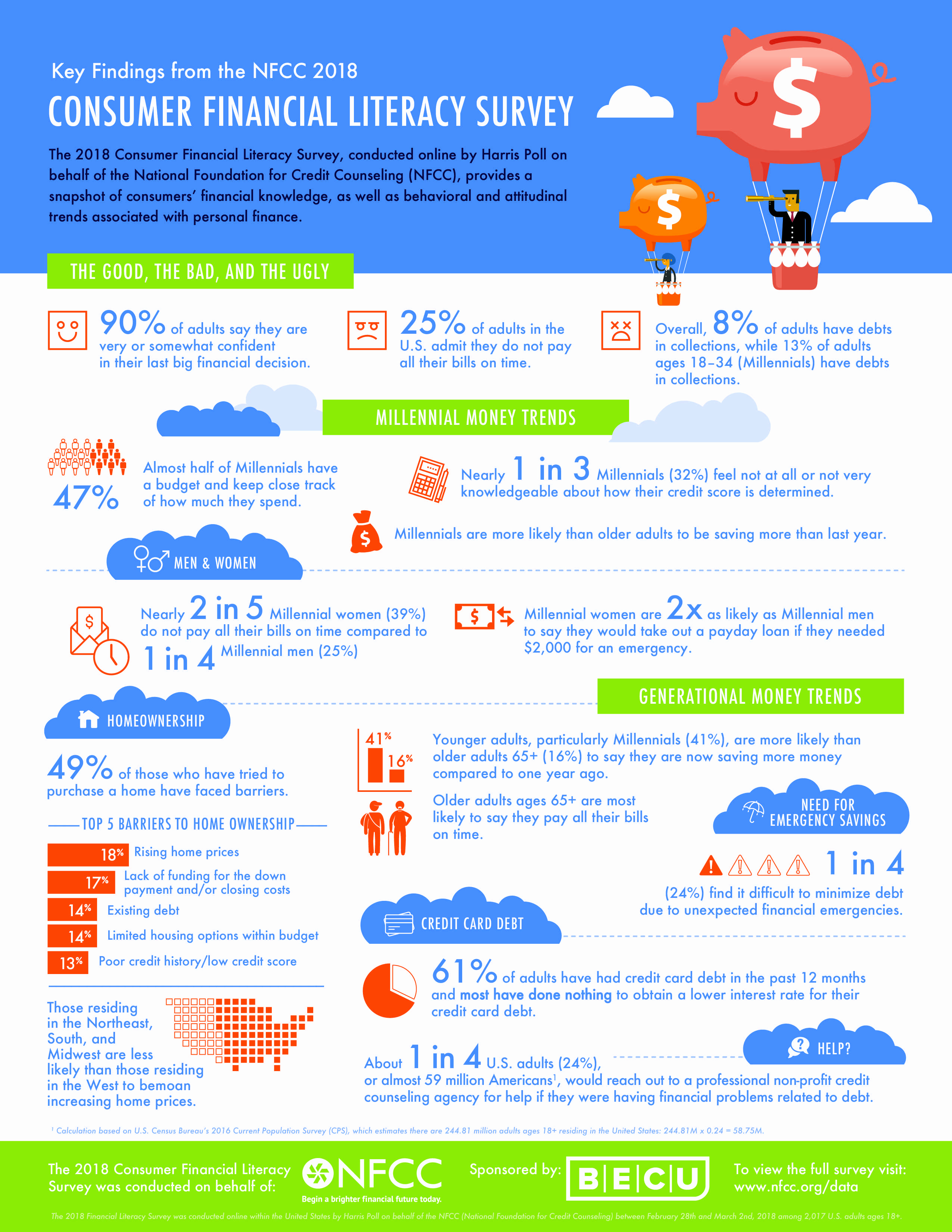

2018 Consumer Financial Literacy Survey вђ Ehl Ai Point Nfcc client impact. nfcc’s 2021 consumer financial literacy and preparedness survey. every year the nfcc provides a fresh look at the latest consumer financial health trends and statistics with our annual consumer financial literacy survey. The 2022 financial literacy annual report of the consumer financial protection bureau (cfpb) is required under section 1013 of the dodd frank wall street reform and consumer protection act. it details the cfpb’s financial literacy strategy and activities to improve the financial literacy of consumers. overall, this report describes the cfpb. The 2018 financial literacy survey was conducted online within the united states by harris poll on behalf of the nfcc (national foundation for credit counseling) between february 28th and march 2nd, 2018 among 2,017 u.s. adults ages 18 . figures for age, sex, race ethnicity, education, region and. If they were having financial problems related to debt, u.s. adults continue to say they would first turn to their friends and family for help (25 %). when asked why they would not reach out to a professional nonprofit credit counseling agency for help if they were having financial problems related to debt,.

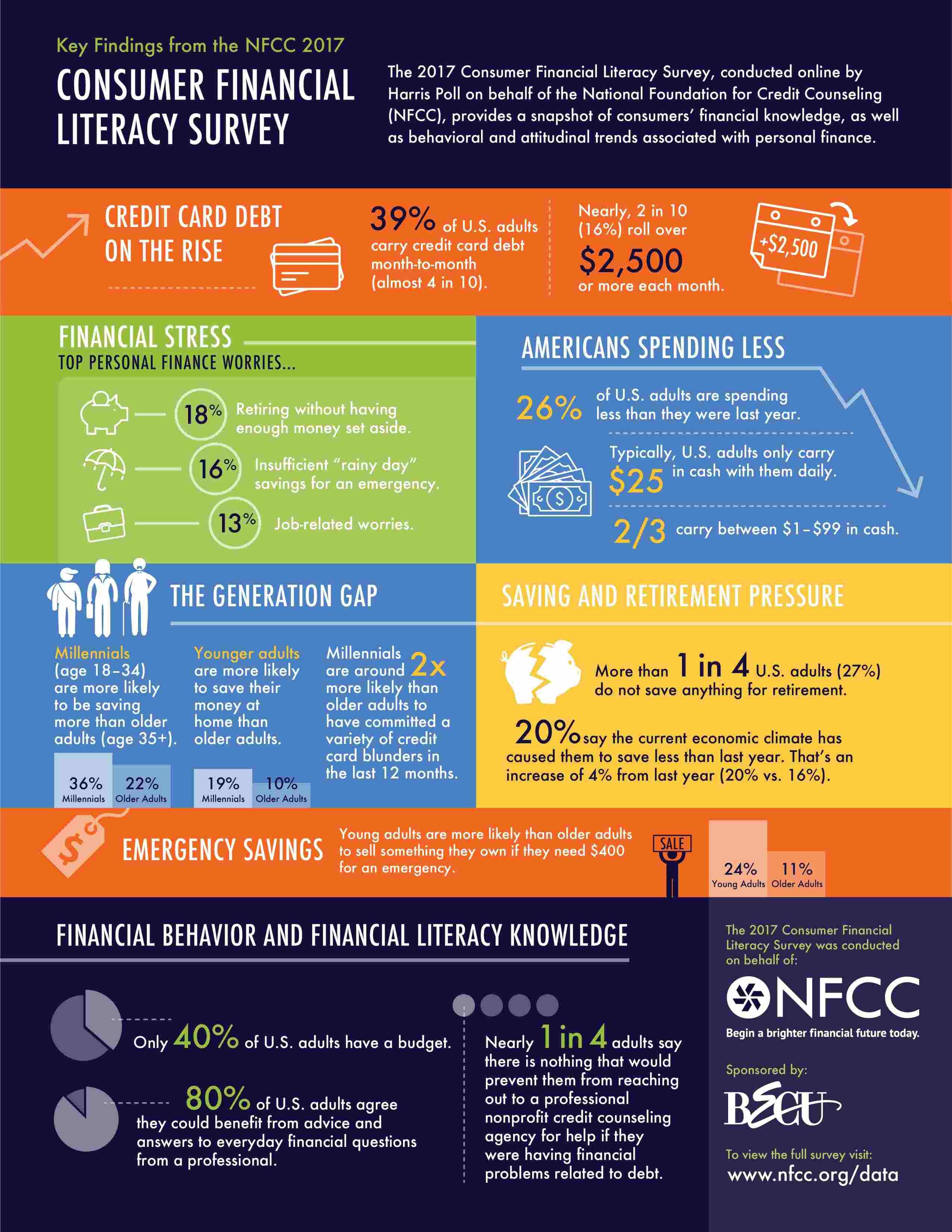

2017 Consumer Financial Literacy Survey Nfcc The 2018 financial literacy survey was conducted online within the united states by harris poll on behalf of the nfcc (national foundation for credit counseling) between february 28th and march 2nd, 2018 among 2,017 u.s. adults ages 18 . figures for age, sex, race ethnicity, education, region and. If they were having financial problems related to debt, u.s. adults continue to say they would first turn to their friends and family for help (25 %). when asked why they would not reach out to a professional nonprofit credit counseling agency for help if they were having financial problems related to debt,. The 2019 financial literacy survey was conducted online within the united states by harris poll on behalf of the nfcc (national foundation for credit counseling) between march 8th and march 13th, 2019 among 2,086 u.s. adults ages 18 . figures for age, sex, race ethnicity, education, region and household. The 2022 investopedia financial literacy survey was fielded via an online self administered questionnaire from jan. 27 to feb. 7, 2022, to 4,000 u.s. adults. annual consumer financial literacy.

Global Survey On Consumer Protection And Financial Literacy Oversight The 2019 financial literacy survey was conducted online within the united states by harris poll on behalf of the nfcc (national foundation for credit counseling) between march 8th and march 13th, 2019 among 2,086 u.s. adults ages 18 . figures for age, sex, race ethnicity, education, region and household. The 2022 investopedia financial literacy survey was fielded via an online self administered questionnaire from jan. 27 to feb. 7, 2022, to 4,000 u.s. adults. annual consumer financial literacy.

Comments are closed.