Consumer Financial Protection Bureau Overdraft Fees

Consumer Financial Protection Bureau Taking Action Against Bank – today, the consumer financial protection bureau (cfpb) published guidance to help federal and state consumer protection enforcers stop banks from charging overdraft fees based on phantom opt in agreements. phantom opt ins occur when banks claim they have customers’ consent to charge overdraft fees but there is no proof they actually. The cfpb wants to close a loophole that exempts overdraft lending services from consumer protection laws and save americans billions in junk fees. the rule would apply to large banks and require them to disclose interest rates or charge fees based on costs.

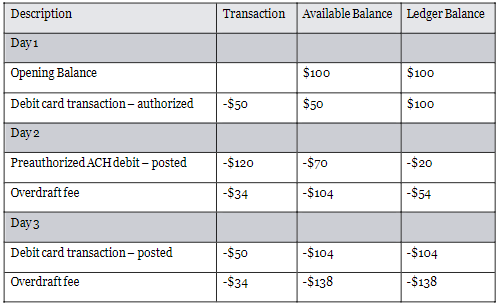

Consumer Financial Protection Circular 2022 06 Unanticipated Overdraft The cfpb warns banks against charging surprise overdraft and depositor fees that are likely unfair and unlawful under existing law. the agency provides examples of potentially unlawful practices and highlights its enforcement actions and research on junk fees. Consumer financial protection bureau (cfpb) analysis of banks and credit unions with over $10 billion in assets, for example, found that nearly two thirds of banks and one quarter of credit unions have eliminated nsf fees.4 additionally, an analysis of banks’ overdraft fee. 1 . fact sheet: the cfpb’s proposed rule to curb excessive fees on overdraft loans by very large banks and close a decades old loophole . in january 2024, the consumer financial protection bureau (cfpb) proposed a rule addressing overdraft loans. The consumer financial protection bureau is proposing to cap overdraft fees at as low as $3, potentially saving consumers billions of dollars a year and stepping up us president joe biden’s war.

Overdraft Fees Can Price People Out Of Banking Consumer Financial 1 . fact sheet: the cfpb’s proposed rule to curb excessive fees on overdraft loans by very large banks and close a decades old loophole . in january 2024, the consumer financial protection bureau (cfpb) proposed a rule addressing overdraft loans. The consumer financial protection bureau is proposing to cap overdraft fees at as low as $3, potentially saving consumers billions of dollars a year and stepping up us president joe biden’s war. Jan. 17, 2024. the consumer financial protection bureau on wednesday proposed a rule that would sharply limit overdraft charges at the largest banks and credit unions in the united states, a. Time. in a 2014 study using data from 2011 2012, the consumer financial protection bureau’s (“cfpb” or “the bureau”) office of research found that, at a collection of large banks , overdraft and nsf fees made up over half of all checking account fees. 1.

Bank Overdraft Fees Costing Consumers Billions Target Of Cfpb Bloomberg Jan. 17, 2024. the consumer financial protection bureau on wednesday proposed a rule that would sharply limit overdraft charges at the largest banks and credit unions in the united states, a. Time. in a 2014 study using data from 2011 2012, the consumer financial protection bureau’s (“cfpb” or “the bureau”) office of research found that, at a collection of large banks , overdraft and nsf fees made up over half of all checking account fees. 1.

Comments are closed.