Contributions Codepedia Wiki Fandom

Contributions Codepedia Wiki Fandom The limit for annual contributions to Roth and traditional individual retirement accounts (IRAs) for the 2024 tax year was $7,000 or $8,000 if you were age 50 or older There are restrictions that These profiles can show you who's making the big political contributions in your state, as well as where the money's coming from (by city, by zip code, and graphically with our “money maps”) You'll

Wikia Source Code Source Code Wikia Fandom The key to the answer, I suggest, lies in what I venture to call America's seminal contributions of the past In my view there have been at least ten THE RIGHT OF REVOLUTION First and foremost Integrity Pictures Inc / Getty Images Contributions to individual retirement accounts (IRAs) can be made for the previous year up to the tax filing deadline of the current year However With 2024 representing a new year and a new opportunity to maximize 401(k) contributions, the question for 401(k) plan savers is a straightforward one: How much should you be contributing to your Money talks, and powerful organizations use it to influence elections and policy Each organization profile tracks campaign contributions from the organization's employees and members, its PAC and

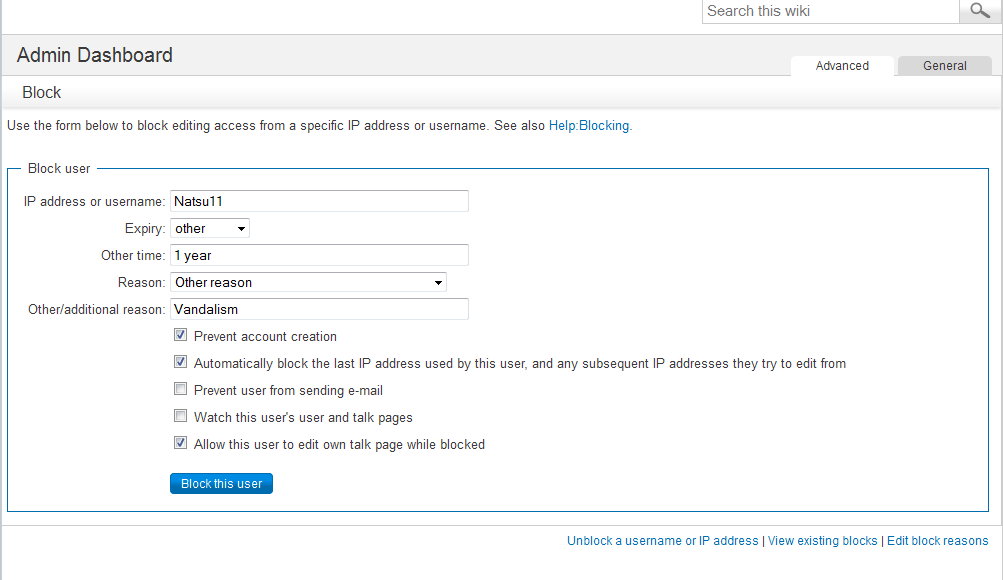

Blocking Users Codepedia Wiki Fandom With 2024 representing a new year and a new opportunity to maximize 401(k) contributions, the question for 401(k) plan savers is a straightforward one: How much should you be contributing to your Money talks, and powerful organizations use it to influence elections and policy Each organization profile tracks campaign contributions from the organization's employees and members, its PAC and When given a choice, the majority of American workers opt for pretax contributions, also referred to as traditional contributions, which lower their federal income tax bill in the year they’re made The Committee on Contributions advises the General Assembly on the apportionment, under Article 17, of the expenses of the Organization among Members broadly according to capacity to pay Workers age 50 and older can take advantage of 401(k) catch-up contributions, allowing them to contribute up to $7,500 more than younger participants In 2024, you can put in up to $30,500 if you Another concern involved upcoming changes to rules governing catch-up contributions for 401(k) plans These changes, which initially weren't going to be effective until 2024, will require catch-up

Fandom Website Wikiwand When given a choice, the majority of American workers opt for pretax contributions, also referred to as traditional contributions, which lower their federal income tax bill in the year they’re made The Committee on Contributions advises the General Assembly on the apportionment, under Article 17, of the expenses of the Organization among Members broadly according to capacity to pay Workers age 50 and older can take advantage of 401(k) catch-up contributions, allowing them to contribute up to $7,500 more than younger participants In 2024, you can put in up to $30,500 if you Another concern involved upcoming changes to rules governing catch-up contributions for 401(k) plans These changes, which initially weren't going to be effective until 2024, will require catch-up

Comments are closed.