Credit Card Debt Relief Everything You Need To Know

Credit Card Debt Relief Everything You Need To Know Debt forgiveness has consequences. for example, you may have to pay taxes on the amount forgiven. contact your credit card issuer to learn about your options if you're about to miss a payment. you. In fact, credit karma member data pulled on jan. 4, 2024, reveals that members with at least one credit card carry an average of $7,288 in card debt, with some generations and geographic groups holding much higher average debt (see methodology). many factors could turn your credit cards into a source of financial stress, including economic.

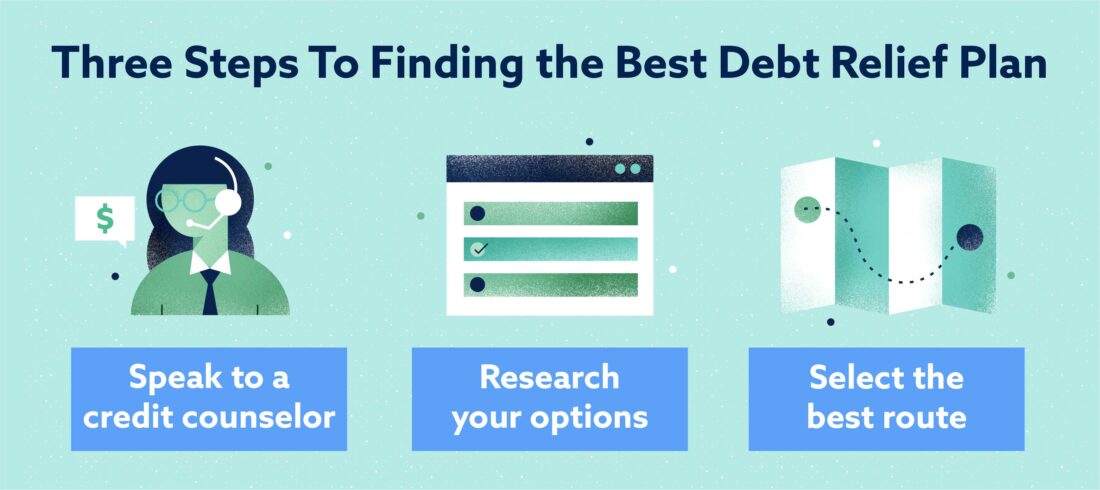

Credit Card Debt Relief Everything You Need To Know How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses. Credit card debt relief could help you manage debt, but you'll need to be careful when choosing a program. credit card debt hit a record breaking $1.12 trillion in 2024. as credit card users. In most cases, the only way that credit card companies will forgive 100% of your debt is if you file for bankruptcy. with credit card debt forgiveness, the debt relief provider negotiates. The average credit card balance in the u.s. was $6,501 as of the third quarter of 2023, a 10 percent year over year increase. the national average credit utilization ratio stands at 29 percent.

Credit Card Debt Relief Everything You Need To Know In most cases, the only way that credit card companies will forgive 100% of your debt is if you file for bankruptcy. with credit card debt forgiveness, the debt relief provider negotiates. The average credit card balance in the u.s. was $6,501 as of the third quarter of 2023, a 10 percent year over year increase. the national average credit utilization ratio stands at 29 percent. When you reduce a credit card balance, you only pay interest on the remaining amount due. as a result, debt forgiveness may help you save hundreds or even thousands of dollars, depending on how much you owe and how long it takes to pay the account in full. if a creditor forgives your entire debt, you can use the minimum monthly payment to catch. 4. always pay the statement balance in full. the most surefire way to avoid credit card debt is to pay the statement balance (not the minimum balance) when the regular purchase apr is applied. if your financial situation allows, set up credit card auto payments and select to automatically pay the statement balance.

Credit Card Debt Relief Everything You Need To Know When you reduce a credit card balance, you only pay interest on the remaining amount due. as a result, debt forgiveness may help you save hundreds or even thousands of dollars, depending on how much you owe and how long it takes to pay the account in full. if a creditor forgives your entire debt, you can use the minimum monthly payment to catch. 4. always pay the statement balance in full. the most surefire way to avoid credit card debt is to pay the statement balance (not the minimum balance) when the regular purchase apr is applied. if your financial situation allows, set up credit card auto payments and select to automatically pay the statement balance.

Comments are closed.