Customer Financing A Guide For Businesses Quickbooks

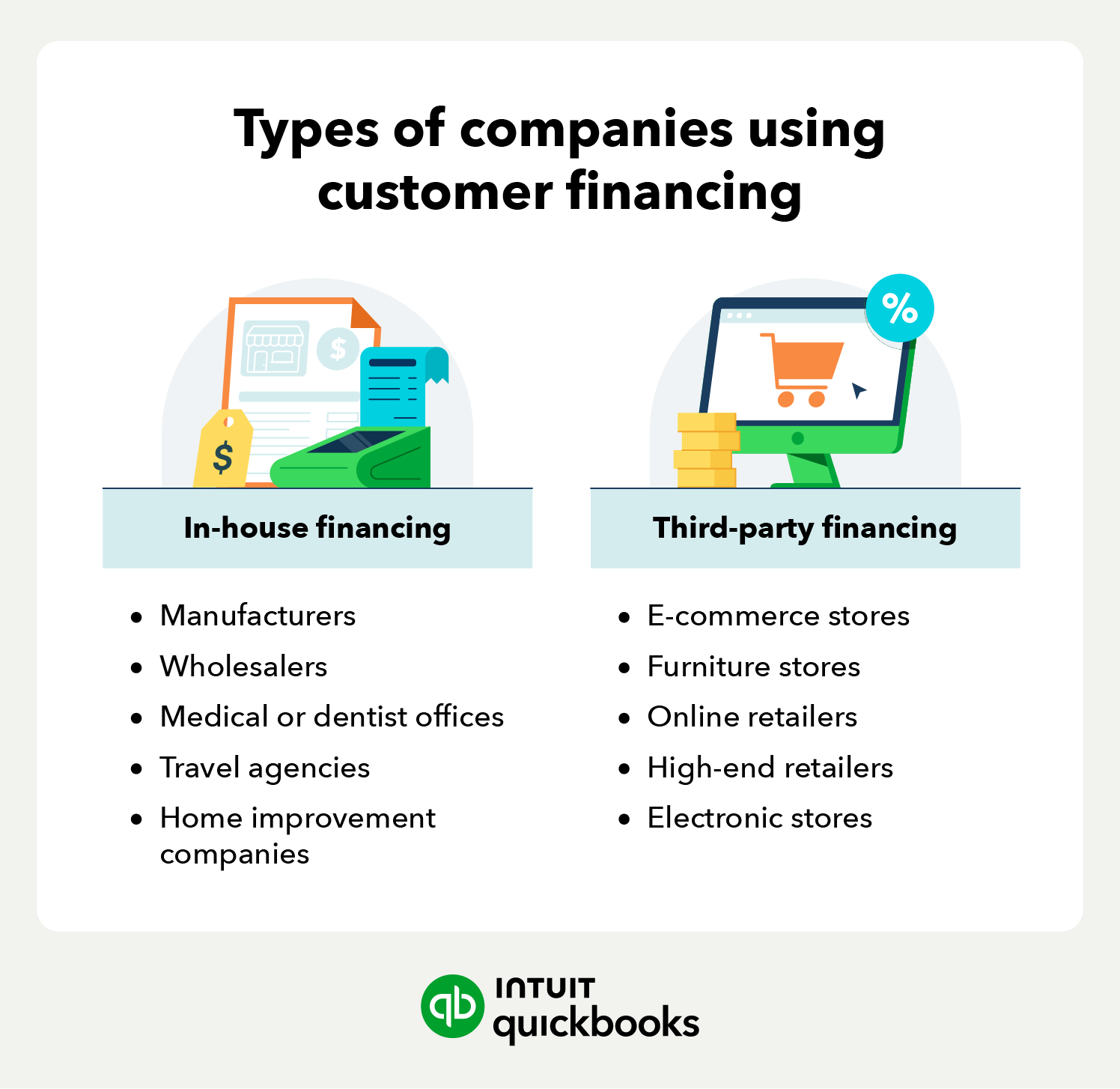

Customer Financing A Guide For Businesses Quickbooks Customer financing is a program or service offered by a business to help customers pay for products, goods, or services over time. usually, financing involves an application process and spreads payments over a period, such as six weeks or 24 months. if you are a small business owner, the financial resources of your customers can play a key. If you plan to offer credit to your customers, consider these best practices. 1. check the customer’s credit. when you allow customers to pay with a credit card, the credit card company assumes most of the risk if the cardholder fails to pay their bill. but when small business owners allow customers to pay on credit via check or invoice, the.

Customer Financing A Guide For Businesses Quickbooks Pros and cons of offering customer financing. small business owners should evaluate both the benefits and drawbacks of offering consumer financing. we’ve summarized some of the pros and cons below. benefits of consumer financing. increase order values: on average, order size increases by 15% when businesses offer customer financing. Customer financing is any type of buy now pay later arrangement. typically, the customer will have to pay a portion of the total cost before the goods services are released. this sort of financing is usually a business to customer (b2c) arrangement instead of a business to business (b2b) arrangement. if you want to offer customer financing, you. Step 4: advertise your financing options to customers. after all of the leg work is done, it’s time to share your new financing options with your customers. prominently advertise financing in your store, on your website, and across social media so that customers know about the options upfront. Viabill. viabill offers buy now, pay later customer financing for purchases up to $1,500 to be repaid over four to 24 months. you receive payment upfront regardless of the repayment schedule. viabill is currently integrated with a few ecommerce platforms and is available in three countries (usa, denmark and spain.).

Customer Financing A Guide For Businesses Quickbooks Step 4: advertise your financing options to customers. after all of the leg work is done, it’s time to share your new financing options with your customers. prominently advertise financing in your store, on your website, and across social media so that customers know about the options upfront. Viabill. viabill offers buy now, pay later customer financing for purchases up to $1,500 to be repaid over four to 24 months. you receive payment upfront regardless of the repayment schedule. viabill is currently integrated with a few ecommerce platforms and is available in three countries (usa, denmark and spain.). 2. paypal. there are many popular paypal small business solutions, but one that you might not be familiar with is paypal credit. paypal credit is a great way for online businesses, particularly those that already accept paypal as a form of payment, to offer customer financing. Quickbooks capital is a loan product for small businesses. here’s how it works:. 1. make sure all records in your quickbooks account are up to date. once all your records are up to date, quickbooks will share your data (with your consent) with its wide range of online lender partners to explore potential business loan options tailored to your needs.

Comments are closed.