Dailydatacard Consumer Price Index April 2022 Dataphyte

Dailydatacard Consumer Price Index April 2022 Dataphyte #dailydatacard: despite the increasing prices of goods in the market, the consumer price index known as cpi for april 2022 decreased by 1.3%. #dailydatacard: consumer price index may 2022. i.78% inflation rate 0.02% increase from april. rivers, abia, and ogun are the states with.

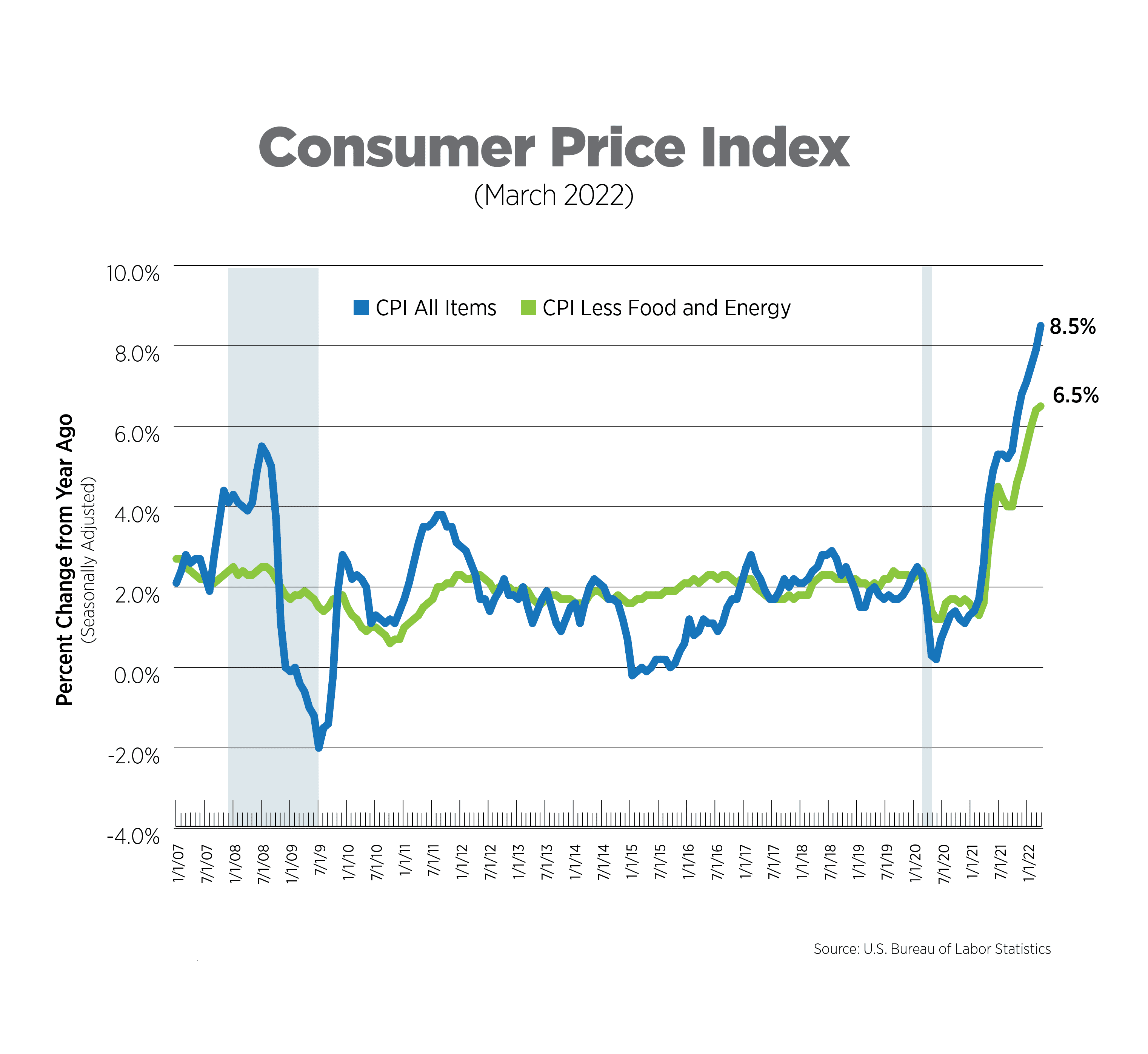

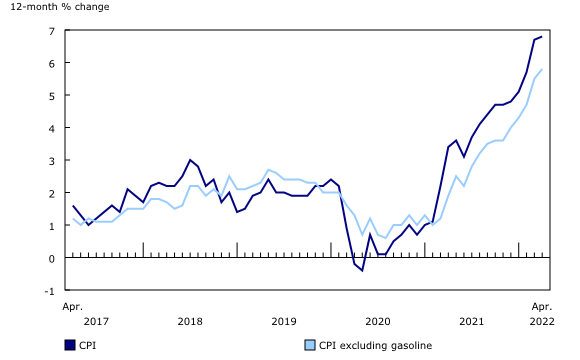

Dailydatacard Consumer Price Index April 2022 Dataphyte Consumer price index. april 2022. 6.8%. (12 month change) source (s): table 18 10 0004 01. in april, canadian consumer prices rose 6.8% year over year, a slight increase from march ( 6.7%). the year over year increase in april was largely driven by food and shelter prices. gas prices increased at a slower pace in april compared with march. #dailydatacard: consumer price index and inflation report (september 2022). do you reside in any of the top 3 states with high food inflation? wednesday, september 11, 2024. The consumer price index (cpi) represents changes in prices as experienced by canadian consumers. it measures price change by comparing, through time, the cost of a fixed basket of goods and services. the goods and services in the cpi basket are divided into 8 major components: food; shelter; household operations, furnishings and equipment. The consumer price index (cpi) rose 6.8% on an annual average basis in 2022, following gains of 3.4% in 2021 and of 0.7% in 2020. the increase in 2022 was a 40 year high, the largest increase since 1982 ( 10.9%). excluding energy, the annual average cpi rose 5.7% in 2022 compared with 2.4% in 2021. price increases were broad based in 2022, with.

Consumer Price Index 2022 The consumer price index (cpi) represents changes in prices as experienced by canadian consumers. it measures price change by comparing, through time, the cost of a fixed basket of goods and services. the goods and services in the cpi basket are divided into 8 major components: food; shelter; household operations, furnishings and equipment. The consumer price index (cpi) rose 6.8% on an annual average basis in 2022, following gains of 3.4% in 2021 and of 0.7% in 2020. the increase in 2022 was a 40 year high, the largest increase since 1982 ( 10.9%). excluding energy, the annual average cpi rose 5.7% in 2022 compared with 2.4% in 2021. price increases were broad based in 2022, with. The consumer price index (cpi) is an indicator of changes in consumer prices experienced by canadians. it is obtained by comparing, over time, the cost of a fixed basket of goods and services purchased by consumers. the cpi is widely used as an indicator of the change in the general level of consumer prices or the rate of inflation. Consumer price index. april 2023. 4.4%. (12 month change) source (s): table 18 10 0004 01. the consumer price index (cpi) rose 4.4% year over year in april, following a 4.3% increase in march. this was the first acceleration in headline consumer inflation since june 2022. on a year over year basis, higher rent prices and mortgage interest costs.

The Daily вђ Consumer Price Index April 2022 The consumer price index (cpi) is an indicator of changes in consumer prices experienced by canadians. it is obtained by comparing, over time, the cost of a fixed basket of goods and services purchased by consumers. the cpi is widely used as an indicator of the change in the general level of consumer prices or the rate of inflation. Consumer price index. april 2023. 4.4%. (12 month change) source (s): table 18 10 0004 01. the consumer price index (cpi) rose 4.4% year over year in april, following a 4.3% increase in march. this was the first acceleration in headline consumer inflation since june 2022. on a year over year basis, higher rent prices and mortgage interest costs.

Comments are closed.