Debt Consolidation Loans For Bad Credit Pros And Cons Youtube

Debt Consolidation Loans For Bad Credit Pros And Cons Youtube People facing debt: you deserve a fair deal. compare debt consolidation quotes here: moneynerd.co.uk get debt consolidation quotes read more here: ht. 💵 create your free budget! sign up for everydollar ⮕ ter.li 6h2c45 📱download the ramsey network app ⮕ ter.li ajeshj 🛒 visit the ramsey sto.

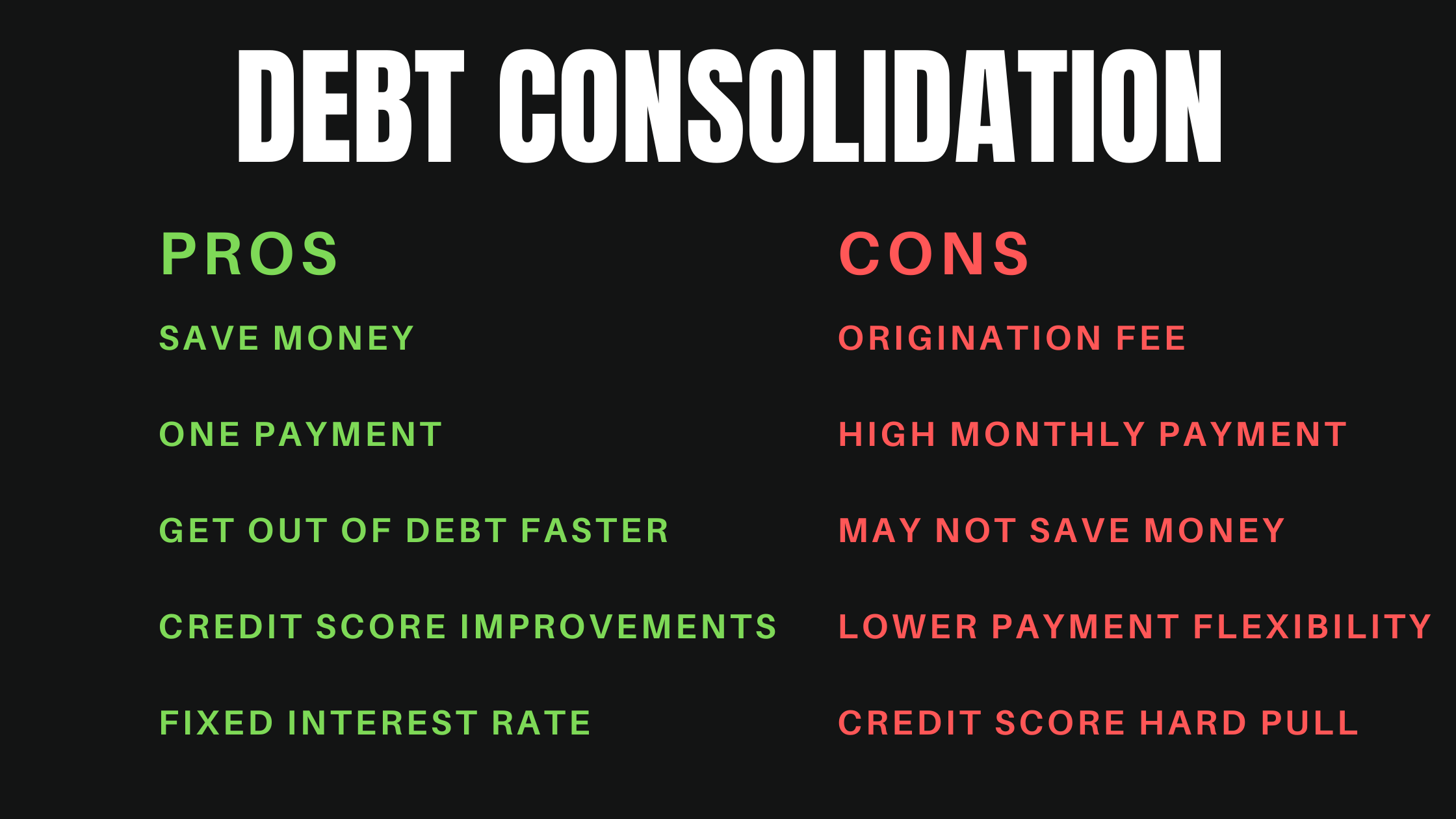

Pros And Cons Of Debt Consolidation Loans Man Vs Debt Whether you're drowning in credit card debt, medical bills, or various loans, this video offers valuable insights on how to effectively tackle and eliminate. You could receive a lower rate. the biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. for example, if you have $9,000 in total debt with. There are two main ways to consolidate your debt: enroll in a debt management plan or apply for a debt consolidation loan. there are many different types of debt consolidation loans, even if you have a rough credit history and bad credit score. Consolidating debt with a personal loan can be a good idea if you can get a new loan with favorable terms and a lower interest rate than current debt. whether you can qualify for a consolidation loan depends on your credit scores, income and other financial factors. if you qualify, make sure you understand the loan terms, have a plan to pay it.

Debt Consolidation Pros And Cons Review Counsel There are two main ways to consolidate your debt: enroll in a debt management plan or apply for a debt consolidation loan. there are many different types of debt consolidation loans, even if you have a rough credit history and bad credit score. Consolidating debt with a personal loan can be a good idea if you can get a new loan with favorable terms and a lower interest rate than current debt. whether you can qualify for a consolidation loan depends on your credit scores, income and other financial factors. if you qualify, make sure you understand the loan terms, have a plan to pay it. A debt consolidation loan may temporarily lower your credit score by a few points due to the hard credit inquiry. but, over time, consolidation could improve your score. you may find that it’s. Pros of debt consolidation. consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. streamlines finances. combining.

Comments are closed.