Dividend Imputation System Franking Credits Explained Calculations

Dividend Imputation System Franking Credits Explained Calculations Calculating franking credits. this is the standard calculation for calculating franking credits: franking credit = (dividend amount (1 company tax rate)) dividend amount. if an investor. The formula for calculating the credits is: franking credit = (amount of dividend (1 – tax rate on company profits)) – amount of dividend. using the figures given above: franking credit = ($70 (1 – 30%)) – $70 = $30. in other words, apart from the dividend amount of $70, each shareholder is also entitled to $30 franking credits, which.

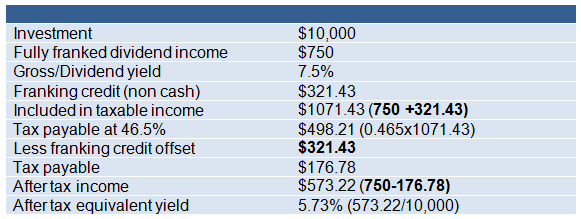

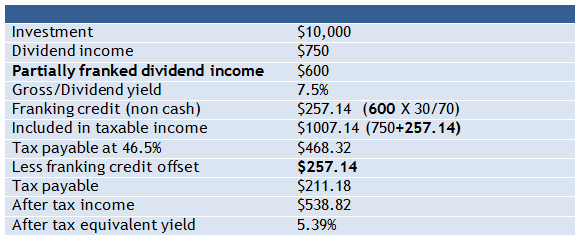

Dividend Imputation System Franking Credits Explained Calculations Franking credits formula. franking credits are calculated using the formula: dividend amount * company tax rate (1 company tax rate) * franking proportion. as australia's company tax for most asx listed companies is a flat 30%, the calculation is: dividend amount * 0.30 0.70 * franking proportion. example:. A franking credit, also known as an imputation credit, is a type of tax credit that allows the company's income tax to flow through to its shareholders. it is a system in place to avoid or eliminate doubling taxing dividends. double taxing is when tax is paid twice on the same income or profit. thus, when distributing dividends, the company and. Fully franked dividend income: 1.20 x 625 = $750. franking credit formula: total cash dividend x 30 70*. * assuming corporate tax rate of 30%. lets assume that your marginal tax rate is 45 percent plus a medicare levy (1.5%), total tax rate is 46.5%. with the franking calculation above we can see the benefits of the dividend imputation system. Dividend imputation is the process of eliminating double taxation on cash payouts from companies to their shareholders. corporations pay taxes on their income. a portion of that income is.

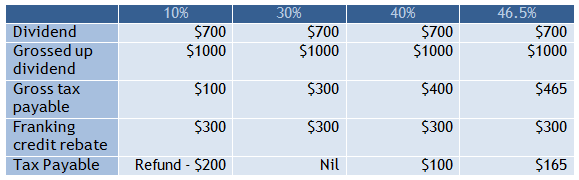

Dividend Imputation System Franking Credits Explained Calculations Fully franked dividend income: 1.20 x 625 = $750. franking credit formula: total cash dividend x 30 70*. * assuming corporate tax rate of 30%. lets assume that your marginal tax rate is 45 percent plus a medicare levy (1.5%), total tax rate is 46.5%. with the franking calculation above we can see the benefits of the dividend imputation system. Dividend imputation is the process of eliminating double taxation on cash payouts from companies to their shareholders. corporations pay taxes on their income. a portion of that income is. The flows of franking credits are shown by the gold arrows. figure 1 – flows of tax and franking credits. in the example, the shareholder receives $100,000 of income, being $70,000 of cash dividends and $30,000 of tax credits paid by the company on the shareholder’s behalf, at the company tax rate of 30%. On a marginal tax rate greater than 30%: the franking credit is credited against your marginal rate, with tax paid on the difference. on a marginal tax rate of 30%: the dividend is not taxed. on a marginal tax rate less than 30%: the ato refunds the franking credit value to the investor. for example, telstra’s dividends are 100% franked.

Comments are closed.