Earning Capitalization Method Business Valuation

How To Value A Business вђ Business Valuation Efinancialmodels The capitalization of earnings method is a widely used approach in business valuation techniques, particularly for small businesses. this method operates on the premise that a business's value is primarily derived from its ability to generate future earnings. the basic principle is to capitalize the expected earnings into a present value. The capitalized earnings method is an income oriented valuation technique that calculates the net present value of an infinite stream of normalized profits by capitalizing such annual income stream via a company’s discount rate, the weighted average cost of capital (wacc). when valuing a business, the capitalized earnings valuation method.

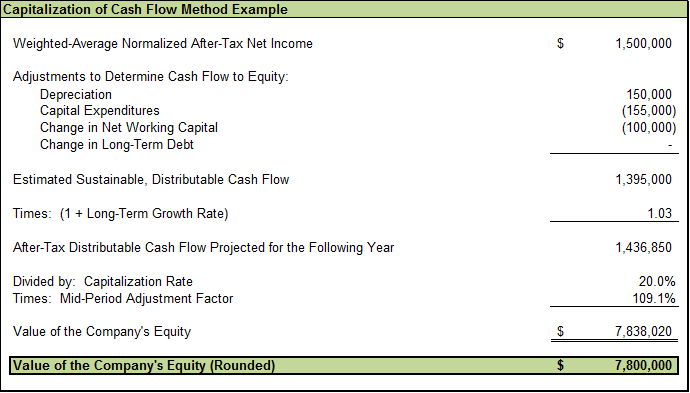

An Explanation Of Income Approach To Valuation вђ Capitalization Of Cash For example, a small business bringing in $500,000 annually and paying its owner a fair market value (fmv) of $200,000 annually uses $300,000 in income for valuation purposes. Difference between capitalized earnings & discounted cash flow (dcf) how does capitalized rate business valuation work. step 1 estimate the discount rate. step 2 historic profits analysis. step 3 – normalize earnings. step 4 – estimate sustainable earnings. step 5 determine sustainable profits after tax. The income approach is a general way of determining the value of a business by converting anticipated economic benefits into a present single amount. simply put, the value of a business is directly related to the present value of all future cash flows that the business is reasonably expected to produce. the income approach requires estimates of. The capitalization of earnings method is an income based valuation technique that estimates the value of a business by capitalizing its normalized earnings using a capitalization rate. the capitalization rate is derived from the required rate of return and the expected growth rate in earnings.

Ppt Property Division Powerpoint Presentation Id 434273 The income approach is a general way of determining the value of a business by converting anticipated economic benefits into a present single amount. simply put, the value of a business is directly related to the present value of all future cash flows that the business is reasonably expected to produce. the income approach requires estimates of. The capitalization of earnings method is an income based valuation technique that estimates the value of a business by capitalizing its normalized earnings using a capitalization rate. the capitalization rate is derived from the required rate of return and the expected growth rate in earnings. Earnings capitalization model (and buildup method) the earnings capitalization model faces the difficulty of weighting the cash flows attributable to the business and identifying an adequate discount rate (or cap rate) for the projected cash flows. while the concept of weighting more recent cash flows more heavily is a sound practice, there is. The capitalization of earnings method calculates business valuation by considering the current earnings of a business, its cash flows, and the annual rate of return for investors to determine future profits of the business. to calculate this valuation, an analyst requires good knowledge and insight into the working of the company and its.

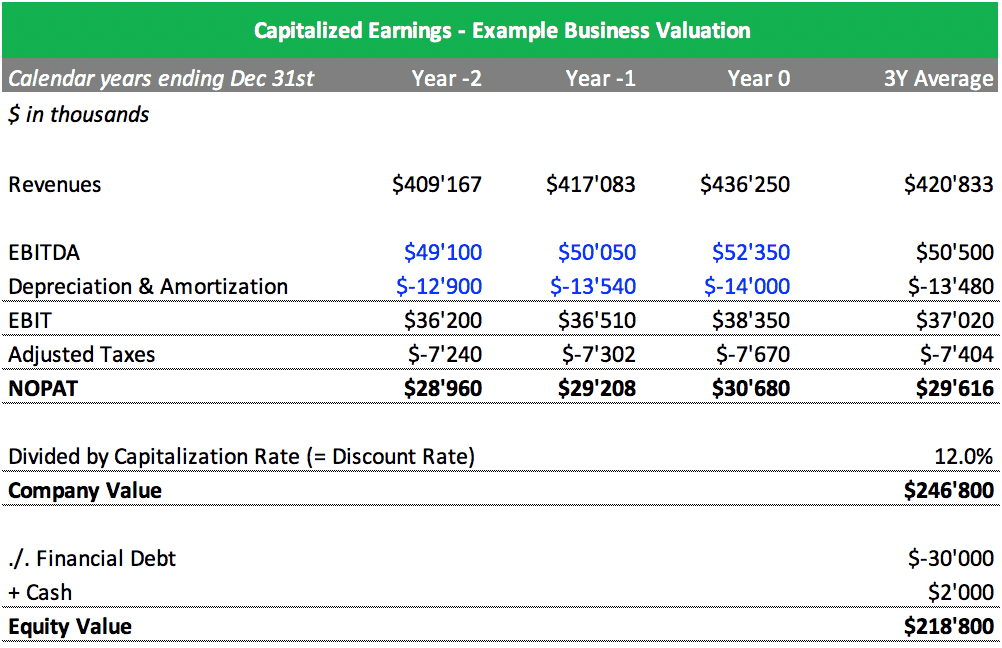

Simple Capitalized Earnings Business Valuation Model Efinancialmodels Earnings capitalization model (and buildup method) the earnings capitalization model faces the difficulty of weighting the cash flows attributable to the business and identifying an adequate discount rate (or cap rate) for the projected cash flows. while the concept of weighting more recent cash flows more heavily is a sound practice, there is. The capitalization of earnings method calculates business valuation by considering the current earnings of a business, its cash flows, and the annual rate of return for investors to determine future profits of the business. to calculate this valuation, an analyst requires good knowledge and insight into the working of the company and its.

Comments are closed.