Economic Correlation Cyclical And Non Cyclical Stocks Cpa Email

Economic Correlation Cyclical And Non Cyclical Stocks Cpa Email These are considered consumer staples, and the stocks of companies that produce these types of goods are defined as non cyclical stocks. that’s because those companies are expected to continue earning revenues regardless of economic cycles. non cyclical industries include food and beverage, tobacco, household and personal products. A rising tide might lift all boats, but the same cannot be said for the economy. when the u.s. experiences robust economic growth, certain sectors of the stock market tend to rise while others hold steady or even decline by comparison. the stocks of companies that experience higher revenues are typically categorized as cyclical. in … continue reading "economic correlation: cyclical and non.

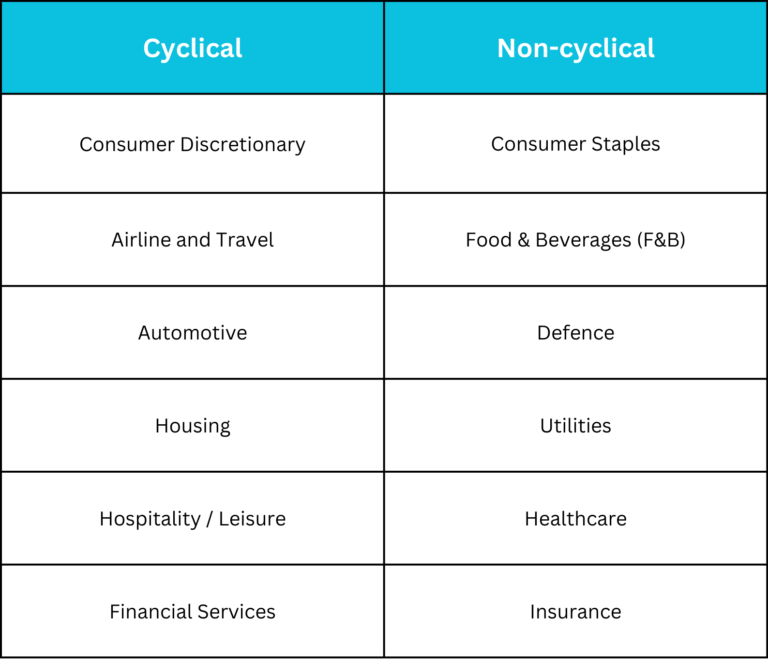

Cyclical Vs Non Cyclical Stocks What You Need To Know Mediafeed Cyclical stocks and their companies have a direct relationship to the economy, while non cyclical stocks repeatedly outperform the market when economic growth slows. investors cannot control the. The strong correlation between cyclical stocks and the economy presents challenges in predicting stock prices, posing difficulties for traders considering investments in these stocks. non cyclical stocks . non cyclical stocks consistently outperform the broader market even during periods of economic slowdown. Economic correlation: cyclical and non cyclical stocks. a rising tide might lift all boats, but the same cannot be said for the economy. when the u.s. experiences robust economic growth, certain sectors of the stock market tend to rise while others hold steady or even decline by comparison. This explains why defensive stocks are more desirable during an economic contraction than cyclical stocks. how to identify non cyclical stocks. in contrast to cyclical stocks, non cyclical stocks produce essential goods and services, goods and services which consumers need in all stages of the economic cycle. these goods and services have.

:max_bytes(150000):strip_icc()/dotdash_Final_Trendline_Nov_2020-01-26628d5ebc7044b7a221d471b45abb89.jpg)

Understanding Cyclical Vs Non Cyclical Stocks Economic correlation: cyclical and non cyclical stocks. a rising tide might lift all boats, but the same cannot be said for the economy. when the u.s. experiences robust economic growth, certain sectors of the stock market tend to rise while others hold steady or even decline by comparison. This explains why defensive stocks are more desirable during an economic contraction than cyclical stocks. how to identify non cyclical stocks. in contrast to cyclical stocks, non cyclical stocks produce essential goods and services, goods and services which consumers need in all stages of the economic cycle. these goods and services have. Here’s a breakdown of the differences: performance across economic cycles: cyclical stocks often perform well during economic upswings due to increased consumer spending. non cyclical stocks, while they may not see as high gains during these periods, generally deliver consistent, positive returns due to the steady demand for their products. Cyclical stocks, often integral to cyclical sectors in the market, are a subset of equities that strongly correlate with the overall economic cycle. in a cyclical market analysis, these stocks tend to rise and fall with broader economic trends. cyclical stocks belong to industries or sectors that experience fluctuations in demand depending on.

Understanding Cyclical Versus Non Cyclical Stocks Here’s a breakdown of the differences: performance across economic cycles: cyclical stocks often perform well during economic upswings due to increased consumer spending. non cyclical stocks, while they may not see as high gains during these periods, generally deliver consistent, positive returns due to the steady demand for their products. Cyclical stocks, often integral to cyclical sectors in the market, are a subset of equities that strongly correlate with the overall economic cycle. in a cyclical market analysis, these stocks tend to rise and fall with broader economic trends. cyclical stocks belong to industries or sectors that experience fluctuations in demand depending on.

Cyclical Non Cyclical Stocks Beginner S Guide Axehedge

Comments are closed.