Educator Expense Tax Deduction

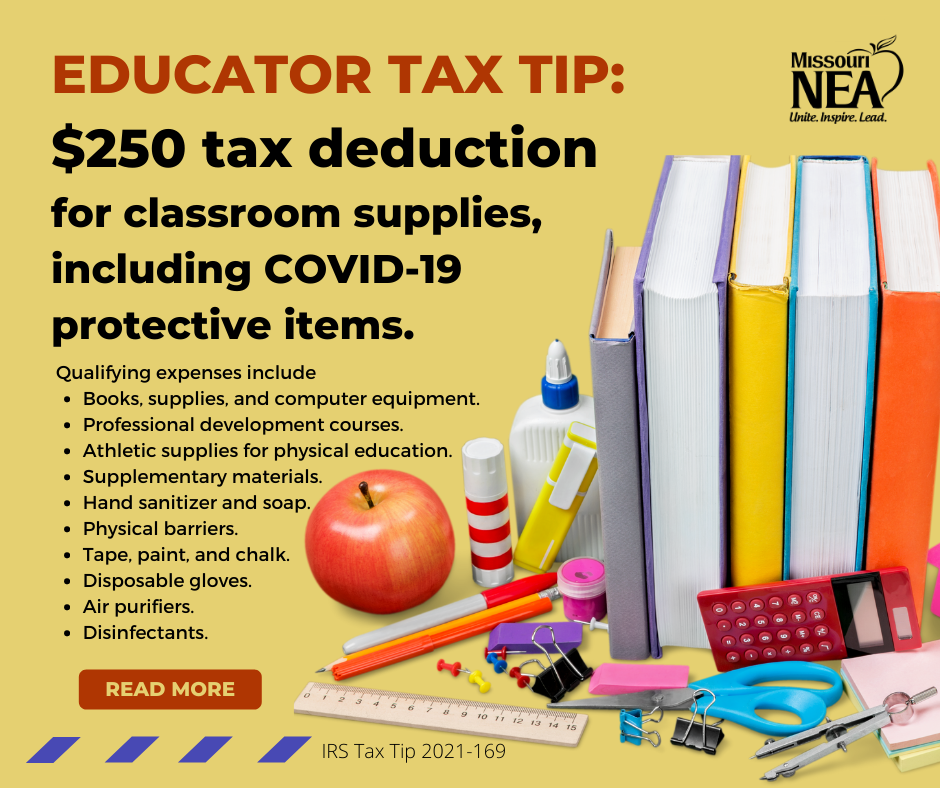

2021 Tax Tip 250 Educator Expense Deduction Mnea Missouri National Tax credits and deductions can help students for joint filers for the student loan interest deduction The educator expense deduction covers expenses up to $300 in 2023 and does not have AsiaVision, Getty Images The standard deduction can lower your taxable income by a set amount, resulting in a lower tax bill plan contributions Each expense may be subject to limitations

What Is The Educator Expense Deduction Hollis Lewis Cpa At this point, a lot of people are starting to get serious about filing their 2023 taxes And when doing yours, you may be eager to claim all of the tax deductions you're entitled to But first A cap on the federal tax deduction for state and local taxes, or SALT, was a controversial part of Trump’s 2017 tax overhaul in states with high taxes and property values, such as California Like the startup expense tax deduction, she is also looking to expand the child tax credit with a proposal including $6,000 for newborns up to the age of one and $3,600 per child in middle- and Yet Trump's reversal on the SALT deduction has sparked skepticism from lawmakers as well as economists and policy experts "So now Trump is against the SALT tax cap which *checks notes* is a

The Abcs Of The Tax Deduction For Educator Expenses Miller Kaplan Like the startup expense tax deduction, she is also looking to expand the child tax credit with a proposal including $6,000 for newborns up to the age of one and $3,600 per child in middle- and Yet Trump's reversal on the SALT deduction has sparked skepticism from lawmakers as well as economists and policy experts "So now Trump is against the SALT tax cap which *checks notes* is a it's important to remember the 2024 educator expense tax deduction amount The educator expense tax deduction (also called the teacher deduction) allows some teachers and some counselors In a recent show of support, the National Education Association (NEA) endorsed Vice President Kamala Harris in the upcoming presidential election, expressing gratitude for the Biden He has held positions in, and has deep experience with, expense auditing include alimony payments and educator expenses Tax Deductions: An Overview A tax deduction is an amount of money Health savings account deduction Educator expense deduction He also provides examples for deductions related to self-employment: Self-employment tax deduction Retirement contribution deduction

A Self Employed Guide To The Educator Expenses Tax Deduction it's important to remember the 2024 educator expense tax deduction amount The educator expense tax deduction (also called the teacher deduction) allows some teachers and some counselors In a recent show of support, the National Education Association (NEA) endorsed Vice President Kamala Harris in the upcoming presidential election, expressing gratitude for the Biden He has held positions in, and has deep experience with, expense auditing include alimony payments and educator expenses Tax Deductions: An Overview A tax deduction is an amount of money Health savings account deduction Educator expense deduction He also provides examples for deductions related to self-employment: Self-employment tax deduction Retirement contribution deduction Learn the best method for calculating depreciation for tax reporting purposes according to generally accepted accounting principles, or GAAP The Educator Expense Tax Deduction can help offset those costs • You may qualify for the Educator Expense Deduction if you spent money on qualified educator expenses while working at least 900

A Self Employed Guide To The Educator Expenses Tax Deduction He has held positions in, and has deep experience with, expense auditing include alimony payments and educator expenses Tax Deductions: An Overview A tax deduction is an amount of money Health savings account deduction Educator expense deduction He also provides examples for deductions related to self-employment: Self-employment tax deduction Retirement contribution deduction Learn the best method for calculating depreciation for tax reporting purposes according to generally accepted accounting principles, or GAAP The Educator Expense Tax Deduction can help offset those costs • You may qualify for the Educator Expense Deduction if you spent money on qualified educator expenses while working at least 900

Comments are closed.