Encore Financial S Hecm Reverse Mortgage Presentation Ppt

Encore Financial S Hecm Reverse Mortgage Presentation Ppt Encore financial's hecm reverse mortgage presentation. a home equity conversion mortgage (hecm) allows homeowners age 62 to access tax free cash from their home equity while continuing to live in their home. it provides monthly payments or a line of credit without requiring repayment until the home is sold or ownership is transferred. A home equity conversion mortgage (hecm), is a federal housing administration (fha) insured loan which enables you to access a portion of your home’s equity to obtain tax free1 funds without having to make monthly mortgage payments.2 if you are 62 years of age or older and have sufficient home equity, you may be able to get the cash you need.

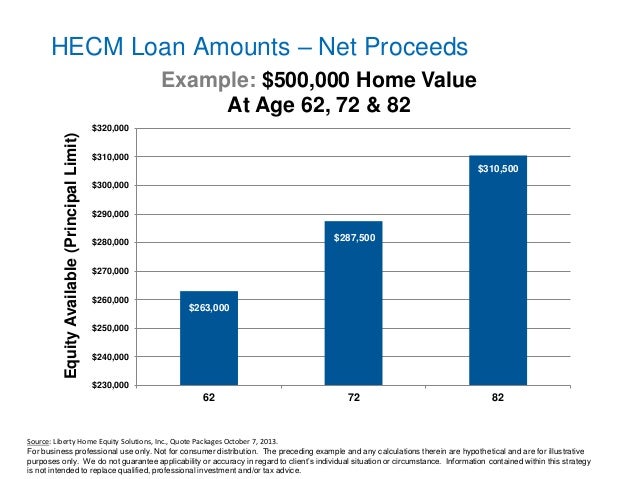

Encore Financial S Hecm Reverse Mortgage Presentation A reverse mortgage can help many seniors with their financial needs: • a loan that allows homeowners age 62 to tap into their home equity • you can use the proceeds for what you need • it is not advisable to use reverse mortgage proceeds to make a financial investment since the costs of the loan may exceed the investment return • you can even use a reverse mortgage to purchase a home 4. 1 reverse mortgages (hecm) presented by facility you need a room that has enough space for people to move around the room. this presentation should take approximately 1 hour. audience master financial education volunteers and public presentations. instructional objectives participants will: understand the basics of a reverse mortgage understand. Seniors age 62 own. $7 trillion. 1of home equity: the highest amount of housing wealth on record. and every day, more than. 10,000. 2 people reach retirement age. 1“seniors now have a collective $7 trillion in home equity”, housingwire , march 2019.2 baby boomers retire, pewresearch.org, december 2010. agenda. 800.288.5851. the traditional hecm. the home equity conversion mortgage (hecm) is commonly known as a “reverse mortgage.”. it is a government insured loan that allows homeowners who are 62 and older to convert some of their home equity into tax free cash. homeowners continue to live in and own their homes.

Encore Financial S Hecm Reverse Mortgage Presentation Seniors age 62 own. $7 trillion. 1of home equity: the highest amount of housing wealth on record. and every day, more than. 10,000. 2 people reach retirement age. 1“seniors now have a collective $7 trillion in home equity”, housingwire , march 2019.2 baby boomers retire, pewresearch.org, december 2010. agenda. 800.288.5851. the traditional hecm. the home equity conversion mortgage (hecm) is commonly known as a “reverse mortgage.”. it is a government insured loan that allows homeowners who are 62 and older to convert some of their home equity into tax free cash. homeowners continue to live in and own their homes. As of march 25, 2024, mortgage servicers can ofer enhanced incentives, known as cash for keys, to borrowers or heirs who pursue a deed in lieu of foreclosure, short sale, or a post foreclosure alternative to eviction. servicers may now ofer up to $7,500, plus an additional $5,000 for probate costs for deed in lieu of foreclosures and short. Hecm definition •a reverse mortgage is a type of loan for seniors that allow homeowners to convert to convert the equity in their homes into a monthly stream of income or a line of credit. •the only reverse mortgage insured by the u.s. federal government is called a home equity conversion mortgage (hecm).

Hecm Reverse Mortgage 5 Key Financial Metrics Youtube As of march 25, 2024, mortgage servicers can ofer enhanced incentives, known as cash for keys, to borrowers or heirs who pursue a deed in lieu of foreclosure, short sale, or a post foreclosure alternative to eviction. servicers may now ofer up to $7,500, plus an additional $5,000 for probate costs for deed in lieu of foreclosures and short. Hecm definition •a reverse mortgage is a type of loan for seniors that allow homeowners to convert to convert the equity in their homes into a monthly stream of income or a line of credit. •the only reverse mortgage insured by the u.s. federal government is called a home equity conversion mortgage (hecm).

Comments are closed.