Eric Affeltranger Cpa Charitable Remainder Trusts

Eric Affeltranger Cpa вђ What Is A Charitable Remainder Trust The internal revenue code defines a special class of charitable gift vehicles, known as “charitable remainder trusts.”. this class of trusts includes (1) unitrusts, (2) pooled income funds, and (3) annuity trusts, all of which are described more fully below. in addition, there is another form of deferred charitable gift which is fairly. Managing assets inside of a charitable remainder trust (crt) takes a good understanding of the workings of a crt. small errors have the potential to create big problems. i have the expertise to avoid these problems to ensure the highest quality result.

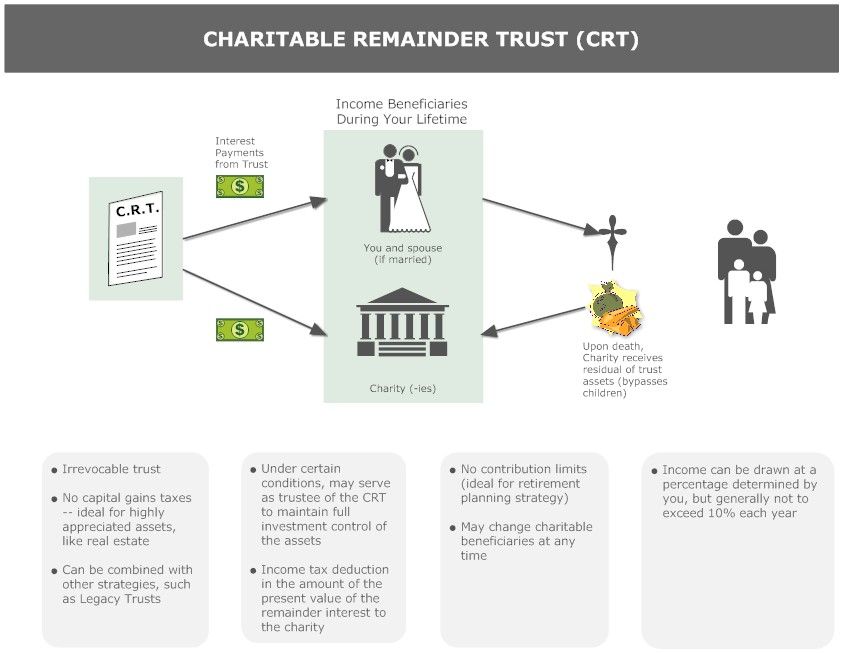

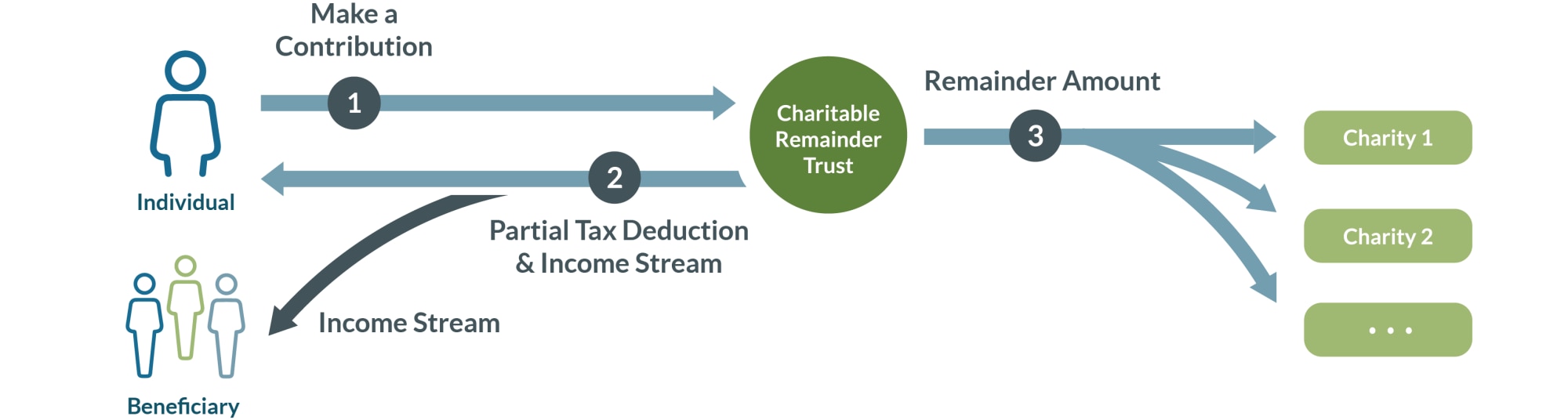

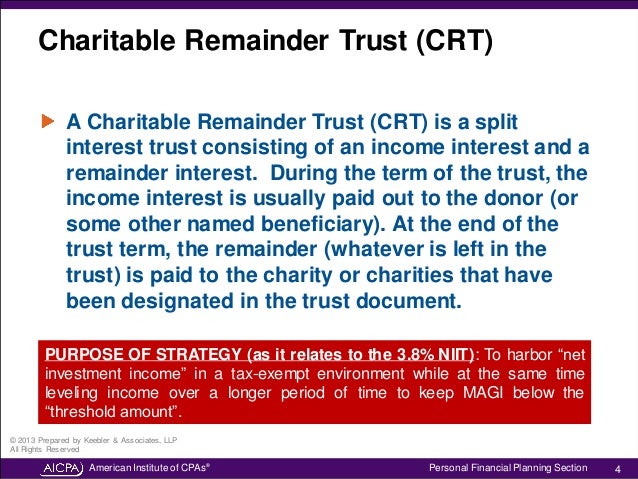

Eric Affeltranger Cpa вђ Charitable Remainder Trusts What is a charitable remainder trust? charitable remainder trusts are the classic planned gift. they enable the donor(s) to make an irrevocable gift to charity today, receive current income and gift tax deductions, remove the property from the donor’s taxable estate, and to continue to enjoy income from the gifted property for life, multiple lives, or a predetermined number of years. A charitable remainder trust (crt) is a form of irrevocable trust. you create a crt by transferring cash or other assets to an irrevocable trust. the trust agreement provides that you or a specified beneficiary will receive payments from the trust for a term of years or for the rest of your life. at the termination of this income interest, the. Charitable remainder trusts incentivize the combination of tax planning and philanthropy. while we will generally refer to these special trusts as crts during the podcast, there are several practical applications of the crt. crts can be used to create a tax deferred sale of business interests, appreciated securities or appreciated real estate. Policy statement. a charitable remainder trust involves transferring property into a trust whereby the donor retains a life interest in the property but makes an irrevocable gift of the residual interest to a registered charity. a registered charity can issue an official donation receipt for the fair market value of the residual interest in the.

How A Charitable Remainder Trust Works Strategic Wealth Partners Charitable remainder trusts incentivize the combination of tax planning and philanthropy. while we will generally refer to these special trusts as crts during the podcast, there are several practical applications of the crt. crts can be used to create a tax deferred sale of business interests, appreciated securities or appreciated real estate. Policy statement. a charitable remainder trust involves transferring property into a trust whereby the donor retains a life interest in the property but makes an irrevocable gift of the residual interest to a registered charity. a registered charity can issue an official donation receipt for the fair market value of the residual interest in the. Cpa financial advisers should note three developments affecting charitable remainder trusts (crts) that occurred in the latter part of 2008. first, the irs and the treasury department issued final regulations modifying the service’s stance on the consequences of receipt of unrelated business taxable income (ubti) by a crt. Generally, the charitable deduction for contributions to a crt with a public charity as its remainder beneficiary is limited to 50% of adjusted gross income (agi). however, if the donor contributes capital gain property to the crt, the special 30% of agi limitation applies. in addition, if the trustee, donor, or income beneficiary has the power.

Charitable Remainder Trusts Fidelity Charitable Cpa financial advisers should note three developments affecting charitable remainder trusts (crts) that occurred in the latter part of 2008. first, the irs and the treasury department issued final regulations modifying the service’s stance on the consequences of receipt of unrelated business taxable income (ubti) by a crt. Generally, the charitable deduction for contributions to a crt with a public charity as its remainder beneficiary is limited to 50% of adjusted gross income (agi). however, if the donor contributes capital gain property to the crt, the special 30% of agi limitation applies. in addition, if the trustee, donor, or income beneficiary has the power.

Charitable Remainder Trusts

Comments are closed.