Factors That Are Increasing Your Personal Loan Interest Rate

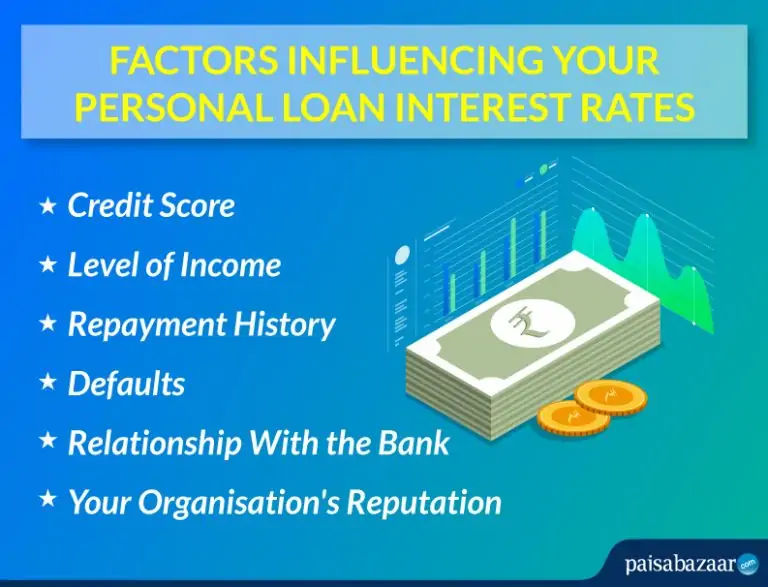

Factors That Are Increasing Your Personal Loan Interest Rate The average interest rate on a two year personal loan reached 10.16% for the third quarter of 2022, according to the federal reserve. that's up from a pandemic era low of 8.73% in the previous. These are among the most consequential factors. 1. credit score & lender. your creditworthiness, as represented by your credit score, is the most important factor in determining your personal loan rate. much of the variation from one lender to the next is attributable to the types of borrowers these lenders pursue.

6 Factors That Can Affect Your Personal Loan Interest Rates The average personal loan interest rate for consumers with good credit (690 to 719 credit score) is currently 14.32%, according to aggregate, anonymized offer data from users who pre qualified for. For borrowers with a credit score of 720 or higher who pre qualified on credible ’s online marketplace, the average interest rate on a personal loan with a three year term was 15.36% from. The average personal loan interest rate was 10.28 percent at the beginning of 2022 and has risen steadily since. the average personal loan interest rate as of september is 12.42 percent. however. With the recent fed announcement, the federal funds target rate range now sits at 0.75% to 1%. accordingly, u.s. banks have announced prime rate increases to 4% from 3.5% before the hike, which could directly impact interest rates for new loans. if the fed continues to raise rates, personal loan borrowers will likely see rates rise higher.

Factors Affecting Personal Loan Interest Rates вђў Leverageswift The average personal loan interest rate was 10.28 percent at the beginning of 2022 and has risen steadily since. the average personal loan interest rate as of september is 12.42 percent. however. With the recent fed announcement, the federal funds target rate range now sits at 0.75% to 1%. accordingly, u.s. banks have announced prime rate increases to 4% from 3.5% before the hike, which could directly impact interest rates for new loans. if the fed continues to raise rates, personal loan borrowers will likely see rates rise higher. The average interest rate for a two year personal loan was 12.49% in the first quarter of 2024, according to the federal reserve. but personal loan interest rates vary based on several factors. Fixed rates from 8.99% apr to 29.99% apr reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. sofi rate ranges are current as of 02 06 2024 and are.

5 Factors That Affect Your Personal Loan Interest Rate Axis Bank The average interest rate for a two year personal loan was 12.49% in the first quarter of 2024, according to the federal reserve. but personal loan interest rates vary based on several factors. Fixed rates from 8.99% apr to 29.99% apr reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. sofi rate ranges are current as of 02 06 2024 and are.

Comments are closed.